Politicseconomics News

The latest politicseconomics stories, summarized by AI

Featured Politicseconomics Stories

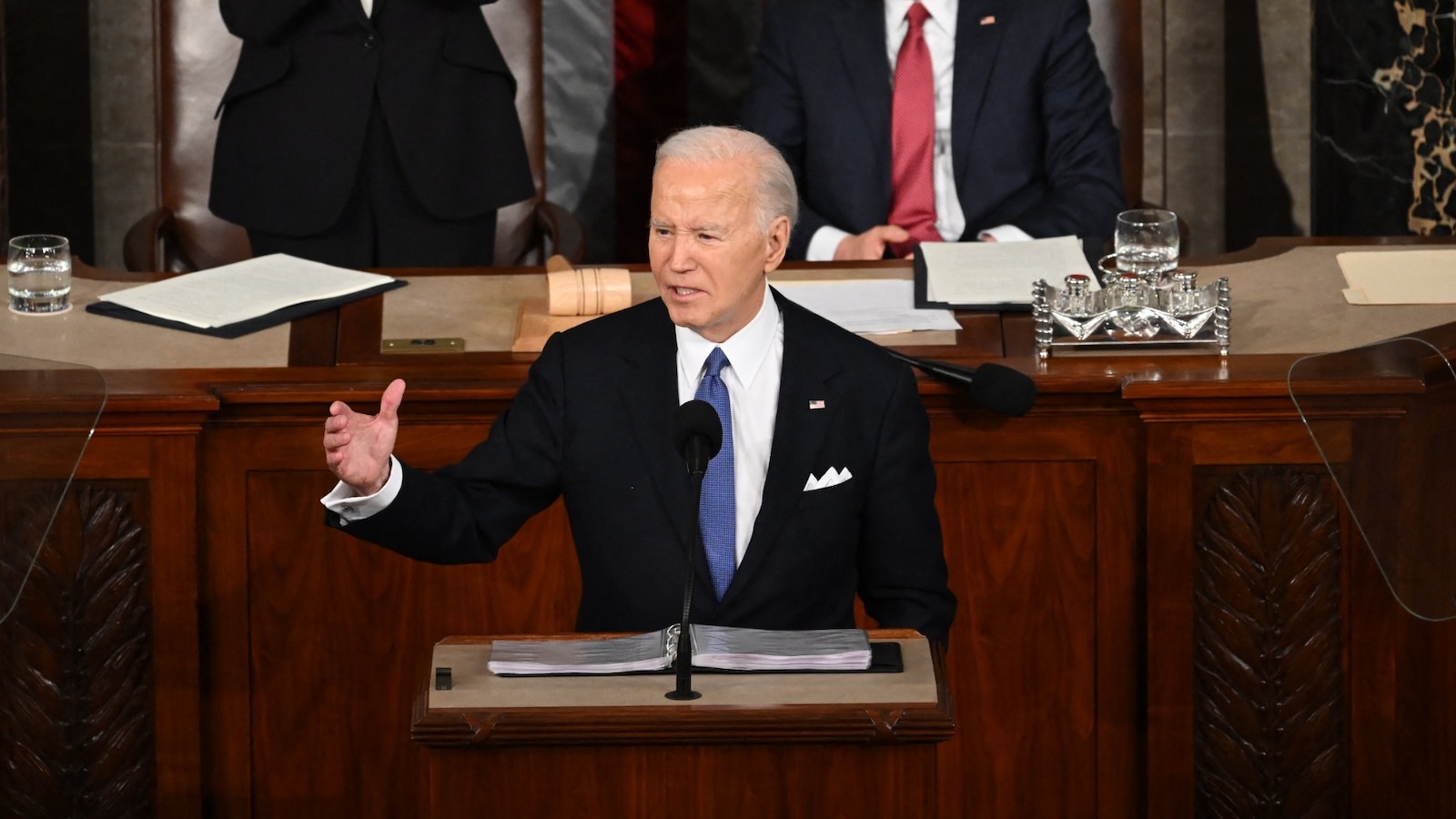

"Biden Administration's $7.4 Billion Student Loan Relief Impact on Taxpayers"

President Biden's student loan handouts have reached 4.3 million borrowers, totaling $153 billion in debt relief, with the Wharton School estimating the cost to taxpayers at over half a trillion dollars. The relief includes waiving interest and eliminating debt for long-term borrowers, with the majority of the cost attributed to interest waivers. Despite legal challenges, Biden remains committed to student debt cancellation, arguing that it will stimulate the economy.

More Top Stories

"Biden's Inflation Battle: Navigating the Economic Impact"

Fox Business•1 year ago

Spain to End 'Golden Visa' Program for Wealthy Non-EU Real Estate Buyers

The Associated Press•1 year ago

More Politicseconomics Stories

"Rethinking Tax Fairness: Experts Weigh In on Biden's Billionaire Tax Proposal"

President Biden's proposed billionaire tax, aiming to impose a minimum 25% tax on Americans with assets over $100 million, has been met with skepticism from experts who question its practicality and potential impact on the US tax code. The proposal would require taxing unrealized gains, which raises concerns about handling losses and the potential for driving away ultra-wealthy individuals. Critics argue that the top 1% already pays a significant share of federal taxes, and suggest updating the existing alternative minimum tax instead. The debate highlights the complexities of taxing wealth in a rapidly evolving economic landscape.

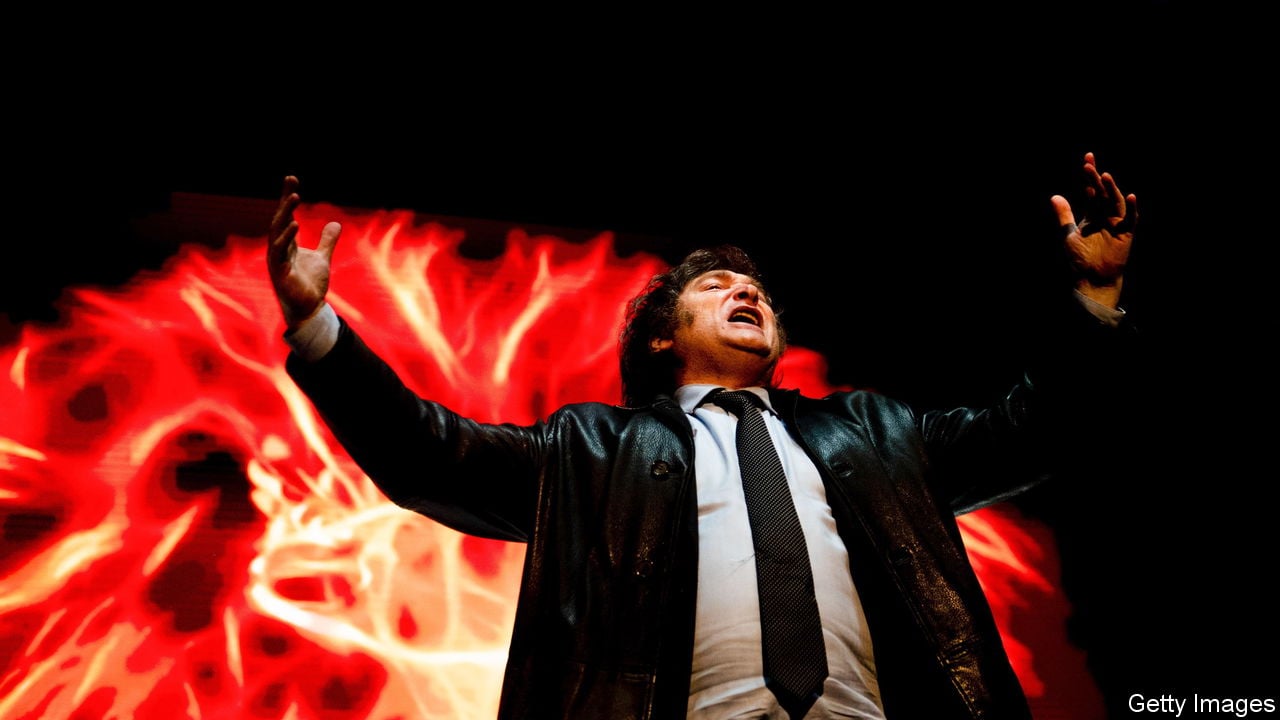

"Javier Milei's 100 Days: A Rollercoaster Ride for Argentina's Economy"

After 100 days in office, Argentine President Javier Milei has made significant economic strides by achieving monthly fiscal surpluses, reducing inflation, and stabilizing the country's currency. However, these successes have come at a high cost, with an estimated 50% of Argentines living in poverty and the economy expected to shrink by 4% this year. Milei's popularity remains high, but his lack of support in Congress poses a challenge to enacting deep reforms. The next 100 days will be crucial as he seeks to navigate the intertwined challenges of economic recovery and political support.

"Argentina's Economic Experiment: Milei's First 100 Days in Office"

Argentinian President Javier Milei, known for his far-right libertarian views and promises of shock therapy to revive the country's struggling economy, has faced challenges in implementing his radical reforms during his first 100 days in office. Despite initial successes such as devaluing the peso and slashing state subsidies, Milei has encountered resistance from lawmakers and protests from workers and unions. His emergency decree aimed at deregulation was suspended by a court, and his reform bill faced opposition in Congress. Milei now faces the daunting task of delivering results to gain public support, as skyrocketing inflation and poverty rates continue to plague the country.

"Trump Vows 100% Tariffs on Chinese-Made Cars Crossing Mexican Border"

Donald Trump proposed imposing a 100-percent tariff on vehicles made in Mexico by Chinese companies, in addition to other tariffs on Mexican and Chinese-made products, during a rally in Ohio. These tariffs could have devastating effects on the economies of China, Mexico, and the U.S., potentially leading to inflation and job losses. The proposed tariffs would also conflict with the U.S.-Mexico-Canada Agreement, which Trump signed. Instead of protectionist policies, the focus should be on fostering innovation and competition in the U.S. auto industry.

"Assessing Biden's Bold Budget: Tax Cuts, Wealth Tax, and Woke Items"

President Joe Biden has proposed a "billionaire tax" targeting the super-rich, aiming to impose a 25% tax on Americans with wealth over $100 million. The debate over wealth taxes has reignited, with global finance ministers exploring a global minimum tax on billionaires. While some argue that wealth taxes could help combat wealth inequality, others question their effectiveness and potential for a mass exodus of the super-rich. Proponents believe the revenues generated could address wealth inequality, but critics raise concerns about the costs and redistribution of wealth.

"Biden's Plan to Address America's Housing Crisis: Will It Work?"

President Joe Biden is proposing a one-year $10,000 tax credit for middle-class, starter-home residents to incentivize them to move to bigger homes, aiming to open up 3 million starter homes for those struggling to enter the housing market. However, experts are skeptical about the effectiveness of this proposal, as it may not be enough to address the housing affordability crisis and could potentially drive up prices due to increased demand for starter homes. The housing market's lock-in effect, historically low inventory levels, and high home prices have disproportionately affected younger generations, making it difficult for them to afford homes. Whether Biden's proposal will be successful in Congress during an election year remains uncertain.

"Trump Considers Tax Cuts to Offset Tariffs, Defends Trade Stance"

Former President Donald Trump defended his proposed 10% tariffs, suggesting that tax cuts could offset any resulting price increases for families and calling for an extension of his 2017 tax cuts. He also expressed interest in addressing entitlement programs, including potential cuts, and indicated a lack of concern about the use of cryptocurrencies. Trump's comments come as he emerges as the likely Republican nominee for the 2024 presidential election, with his tariff plan drawing attention and concerns about inflation.

"Trump's Potential Return: Tariffs, Tax Cuts, and Market Impact"

Former President Donald Trump expressed his intention to reinstate tariffs on foreign goods if re-elected, citing economic and political benefits. He highlighted the impact of tariffs on China and the steel industry, and proposed targeting the Chinese automobile industry. Trump emphasized the potential for tariffs to bring back companies and jobs to the U.S., while critics argue that tariffs make imported goods more expensive.

"Biden's 'Junk Fee' Crackdown: Consumer Relief or Political Distraction?"

President Biden's crackdown on "junk fees" is criticized by experts who argue that it is a distraction from larger economic issues such as high inflation and government spending. The administration's focus on junk fees is seen as an attempt to deflect responsibility for the economic turmoil caused by policies like the American Rescue Plan and the Inflation Reduction Act. Critics argue that the crackdown on junk fees may not ultimately save Americans money and could lead to increased costs in an inflationary environment.

"Biden's Plan to Address Housing Affordability: What You Need to Know"

President Biden proposed tax credits for first-time homebuyers and families selling their starter homes to ease affordability and stimulate the housing market, aiming to counter high home prices and soaring mortgage rates. Economists have expressed mixed opinions, with some praising the effort to thaw the frozen housing market while others cautioning that the tax incentives may not be sufficient to overcome the challenges posed by high home prices and mortgage rates.