Advances in Targeted Therapies and Data Redefine Breast Cancer Treatment

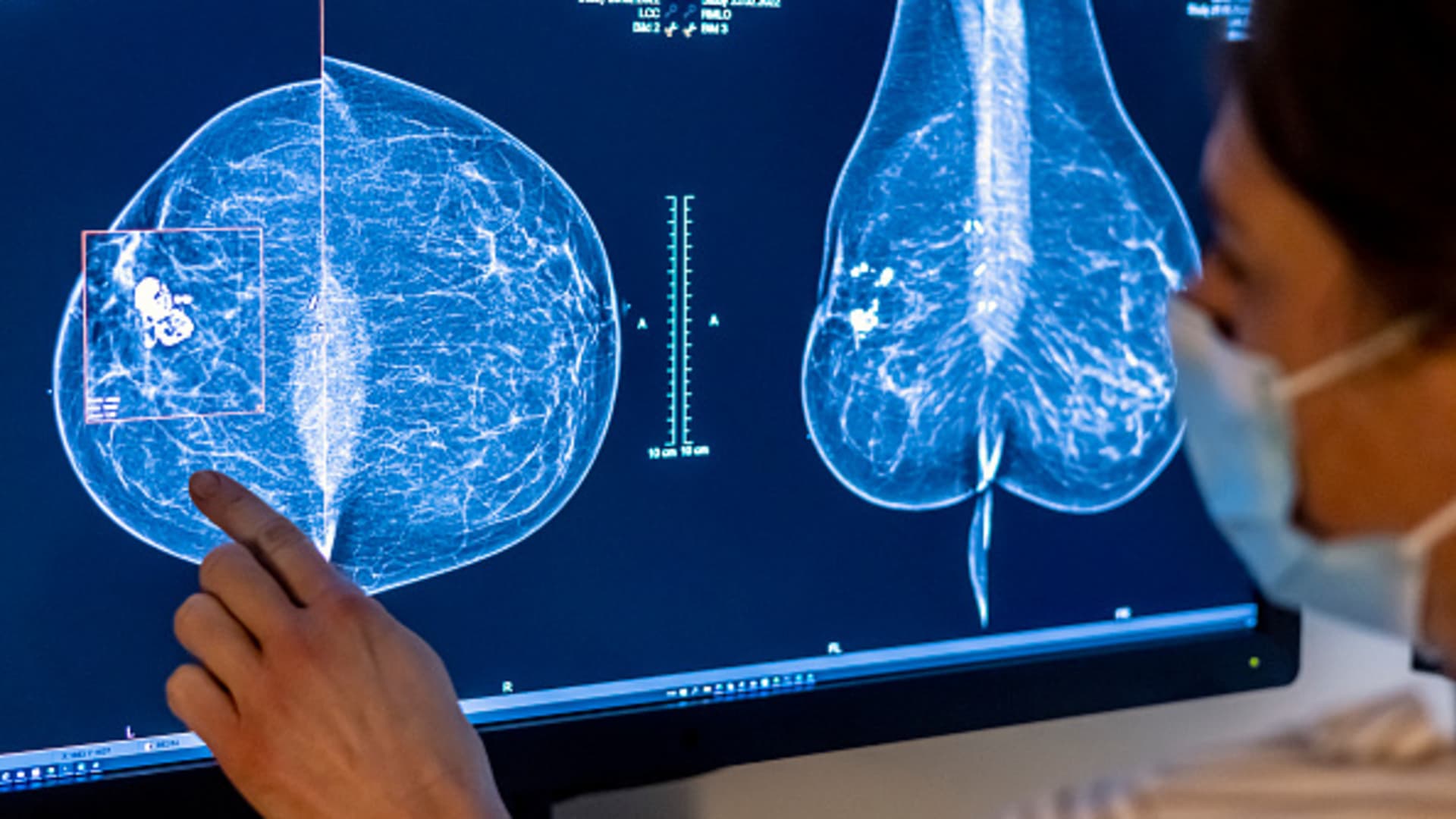

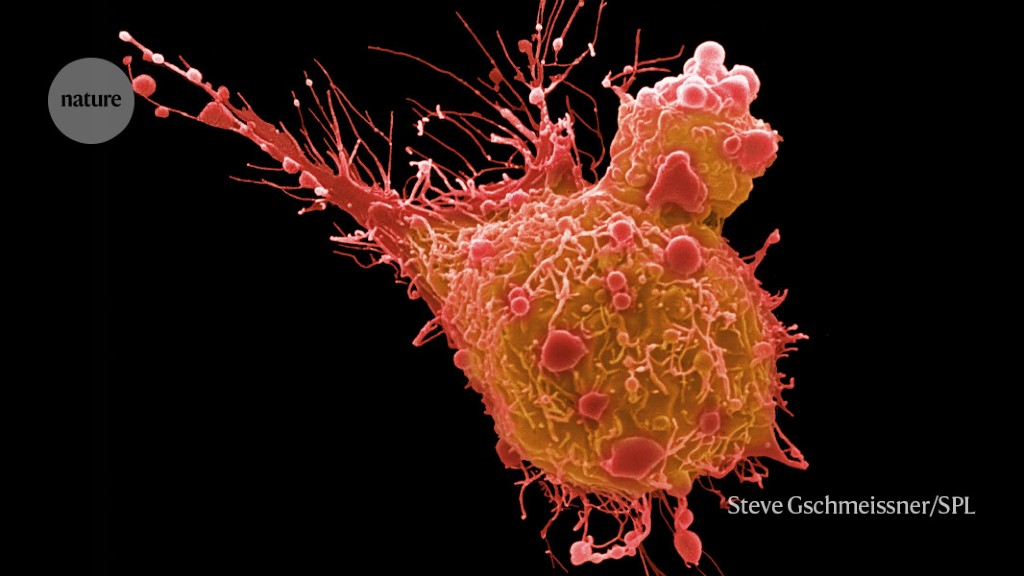

New research presented at the European Society for Medical Oncology Congress highlights the promising potential of antibody-drug conjugates (ADCs) as targeted cancer treatments, especially for breast cancer, showing improved survival rates and earlier intervention possibilities, though challenges like toxicity and patient selection remain.