"Former DWAC CEO Sues Successor for Hacking in Truth Social Lawsuit"

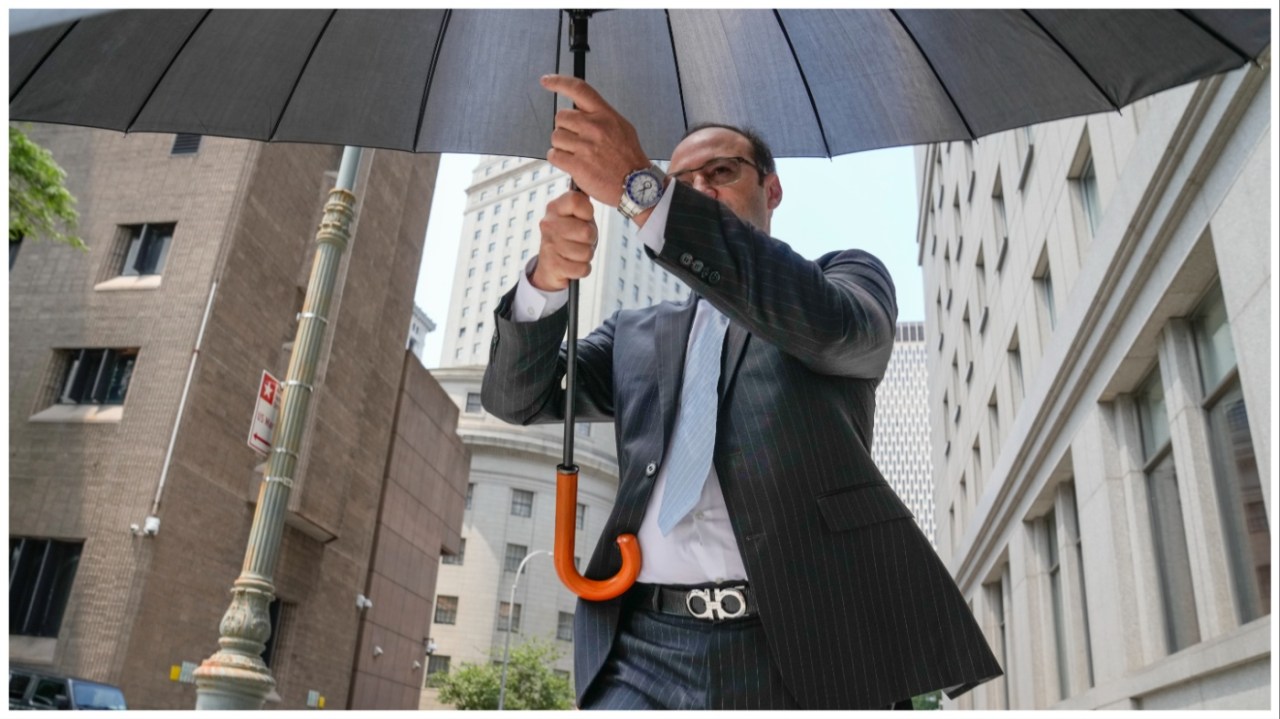

The former CEO of Digital World Acquisition (DWAC) is suing his replacement for allegedly orchestrating a "coup d'état" to seize control of the company, claiming that his files were hacked and confidential information was used to discredit him. The lawsuit also alleges that the new CEO offered "outsized compensation" to other directors for support in removing the former CEO. This legal battle comes after the merger of DWAC with Trump Media & Technology Group, which has seen significant declines in stock performance following its public debut on the Nasdaq.