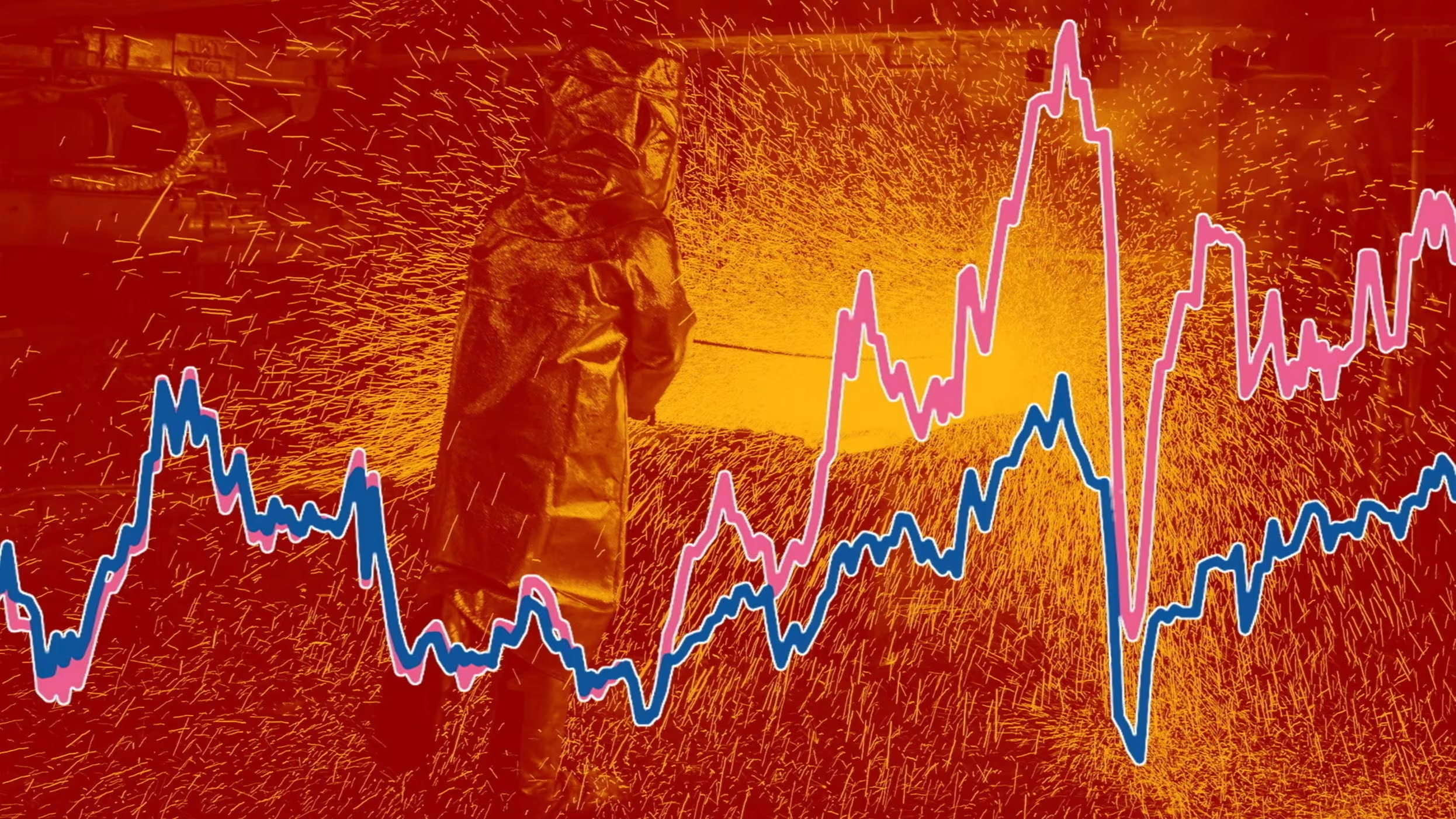

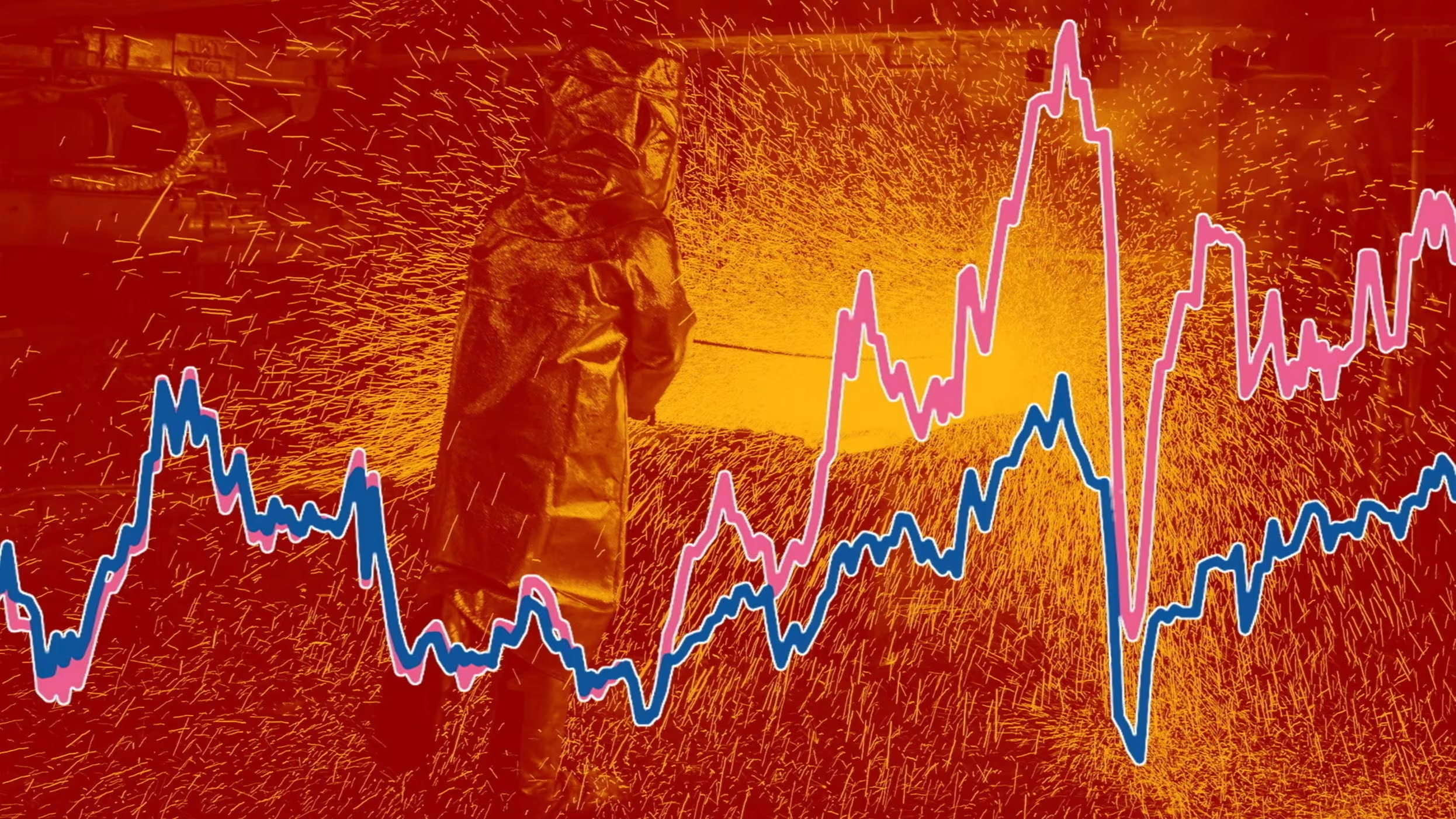

US Copper Tariffs to Boost Commodity Firms with $300M Windfall

Commodity firms are expected to gain approximately $300 million from new US copper tariffs, which could significantly impact the metal industry and trade dynamics.

All articles tagged with #windfall

Commodity firms are expected to gain approximately $300 million from new US copper tariffs, which could significantly impact the metal industry and trade dynamics.

Shares of Trump Media, the social media company owned by former President Donald J. Trump, have surged on the Nasdaq, reaching a market value of nearly $9 billion, resulting in a windfall for insiders and executives, including Mr. Trump whose stake is worth over $5 billion on paper. Other beneficiaries include former Republican congressman Devin Nunes, who holds a stake worth more than $7 million, and Phillip Juhan, an executive whose net worth has swelled by more than $30 million.

Former President Donald Trump's media company, Trump Media & Technology Group, has entered into a deal to merge with a special purpose acquisition company (SPAC), which could potentially result in a windfall of $3 billion. This move is expected to provide Trump's company with the necessary capital to expand its digital media presence and compete with established social media platforms.

A potential $3.5 billion windfall for Donald Trump is at stake as a legal battle looms over a Special Purpose Acquisition Company (SPAC) deal. The deal involves Digital World Acquisition Corp's merger with Trump Media & Technology Group, which could result in Trump receiving a significant payout. However, the Securities and Exchange Commission (SEC) has raised concerns about the deal, leading to uncertainty and potential legal challenges.

JPMorgan Chase has reported record annual profits, largely attributed to a windfall from rising interest rates. The bank's net income for 2021 reached $53.7 billion, marking a significant increase from the previous year. JPMorgan's performance reflects the impact of higher interest rates on its lending and investment businesses, contributing to its strong financial results.

Jessica Vincent purchased a colorful vase for $3.99 at a Goodwill store in Virginia. After researching its origins, she discovered it was a rare Murano glass piece designed by Carlo Scarpa and produced by Venini in 1942. The vase, part of a limited collection called Pennellate, was sold at auction for $107,100. Vincent, who had always dreamed of finding a valuable item, plans to use the money to improve her farmhouse and hopes the vase will eventually be displayed in a museum.

A woman purchased a vase for $3.99 at a Goodwill store, only to discover it was an antique designed by Italian architect Carlo Scarpa in the 1940s. She sold the vase for $107,100, making a profit of around $83,500. The vase's high value was attributed to its pristine condition, and the auctioneer described the find as a "winning lottery ticket."

A woman in Virginia purchased a glass vase for $3.99 from a thrift store and later discovered it was a rare piece of Murano glass designed by Carlo Scarpa for Venini. The vase, part of the "Pennellate" series, was sold at an auction for over $107,000, more than doubling its estimated value. The buyer remains anonymous, but the seller considers the windfall a blessing and continues to enjoy thrifting for unique finds.

A glass vase purchased for $3.99 from a Goodwill store in Virginia turned out to be a rare piece of Murano glass designed by architect Carlo Scarpa in 1942. The vase, part of Scarpa's "Pennellate" series, was sold at an art and design auction for over $107,000, more than doubling its top estimate. The buyer remains anonymous, but the seller, Jessica Vincent, expressed her excitement and gratitude for the unexpected windfall, stating that she needed the money more than the vase. Vincent, an avid thrifter, plans to continue her treasure hunting adventures.

Tech billionaire Michael Dell has donated $350 million worth of Dell Technologies stock to his family foundation and other charitable funds he advises. This is his first donation of Dell shares since 2006 and his largest gift of the company's stock ever. Dell is set to receive over $20 billion in stock and cash when Broadcom acquires VMware later this month. Despite the size of the donation, Dell and his wife are still among the biggest philanthropists in America, having donated an estimated $2.4 billion in their lifetime.

Cannabis company Curaleaf is targeting a potential windfall in Germany as it expands its operations in the country. The company, one of the largest cannabis operators in the US, is looking to tap into the growing medical cannabis market in Germany, which is expected to reach €7.7 billion ($9.2 billion) by 2028. Curaleaf plans to establish a presence in Germany through acquisitions and partnerships, aiming to capitalize on the country's favorable regulatory environment for medical cannabis.