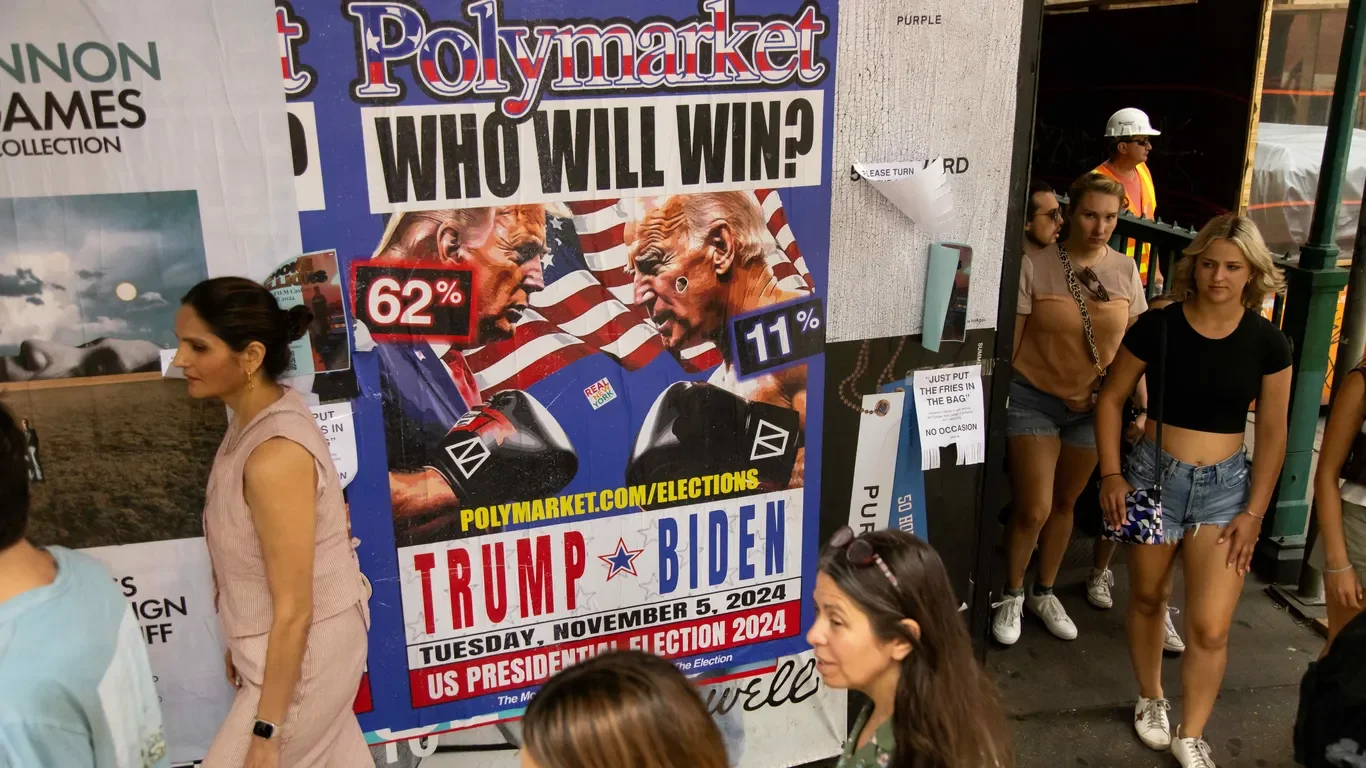

Polymarket tests onion-ban rules with offshore bets on Golden Globes

FT Alphaville explains how Polymarket’s Golden Globes bets sit in a regulatory grey area: the 1958 Onion Futures Act bans onion futures and a 2010 amendment blocks cinema box-office futures, pushing such bets offshore. Polymarket runs a US-restricted site for compliant markets while offering non-US bets (including box-office-ish wagers) on its main offshore platform, a setup Kalshi does not replicate. The piece notes regulatory scrutiny and a $1.4 million penalty in 2022 for non-compliant activities, highlighting how offshore platforms navigate jurisdictional rules while hosting high-profile event bets.