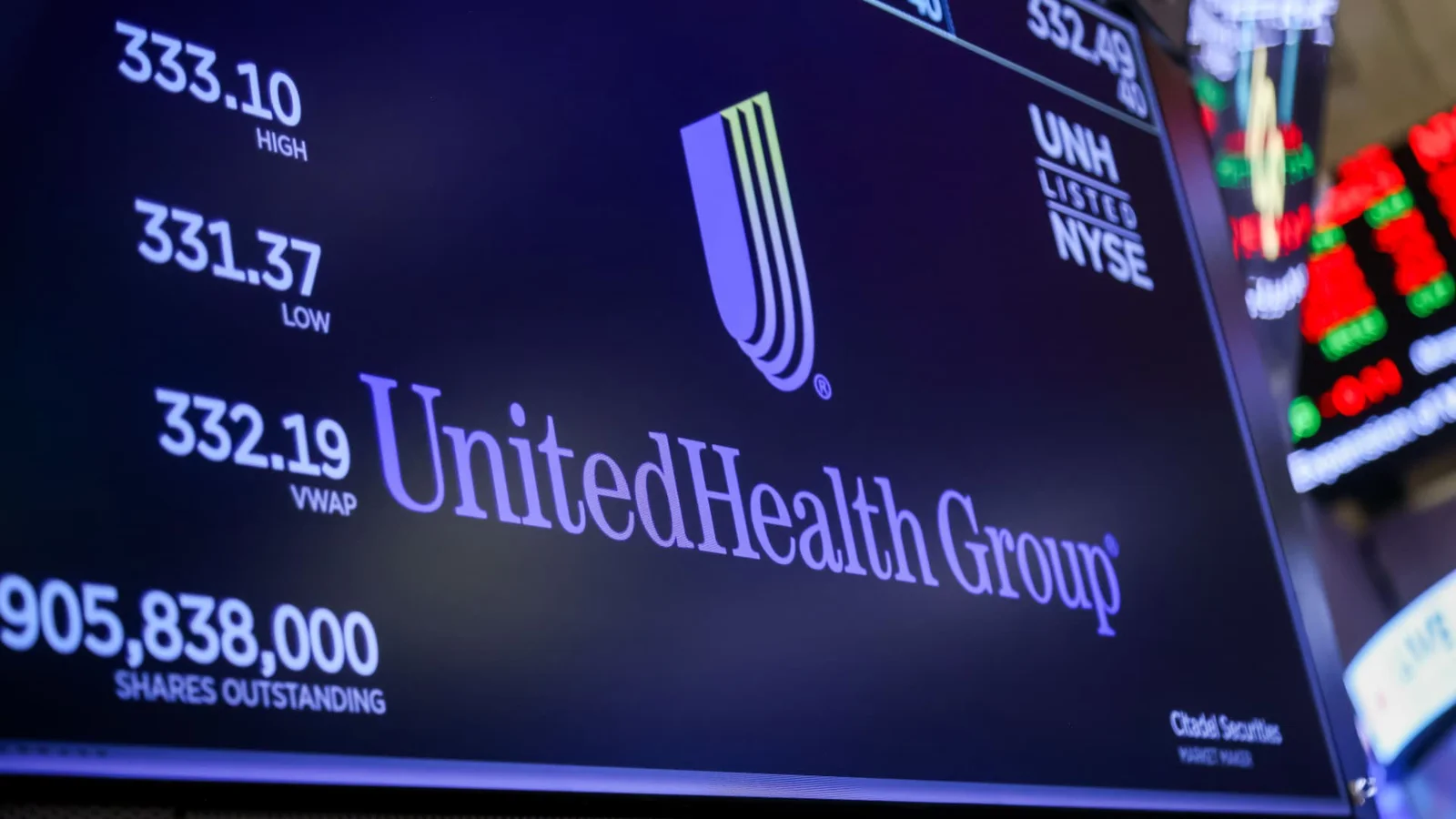

UnitedHealth Stock Dips as Goldman Sees 2026 EPS Path On Track

Despite a Q4 EBIT shortfall driven by weaker Optum Health margins and higher opex, Goldman Sachs maintains a Buy rating on UnitedHealth with a $421 target and says the 2026 EPS guidance of $17.75+ is on track with Street expectations. The analyst notes margin improvements in Optum (about 5.1%) and a company-wide operating margin guide of ~3.2%, amid Medicare funding pressure. The stock has fallen roughly 20% to around $282 and sits near a 52-week low, though the note emphasizes the path to margin recovery and long-term upside.