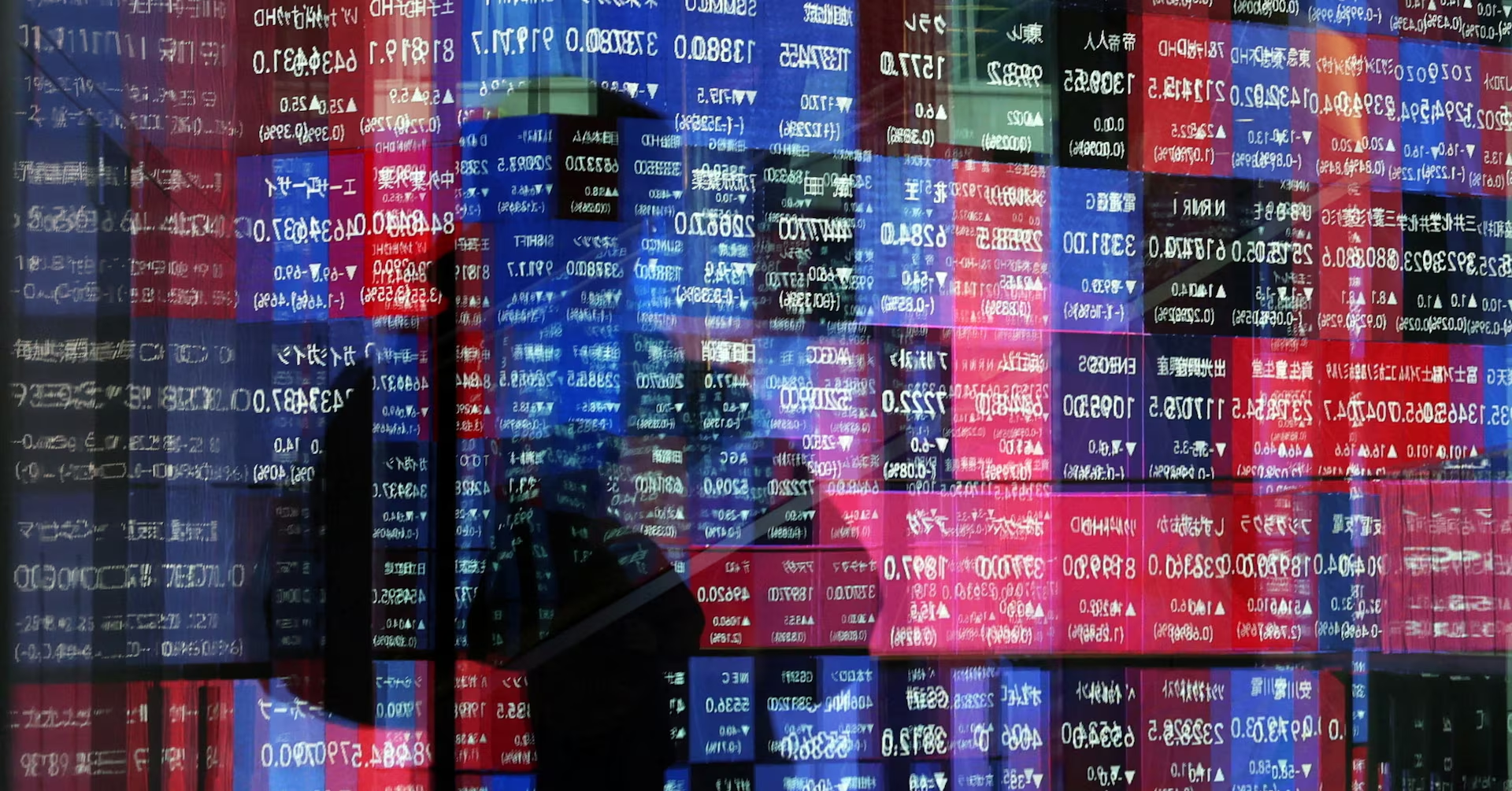

Japan's Rate Hike and Yen Decline Signal Economic Shifts

Asian stock markets rose driven by Wall Street's tech gains, while the yen hit all-time lows against the euro and Swiss franc amid rising interest rates and speculative selling. The US economy is expected to show strong growth in Q3, but investor sentiment is extremely bullish, raising caution of a potential reversal. The yen's decline prompted warnings of intervention, and commodities like silver and oil saw notable gains.