Wall Street's Post-Christmas Rally Sparks Optimism for 2026

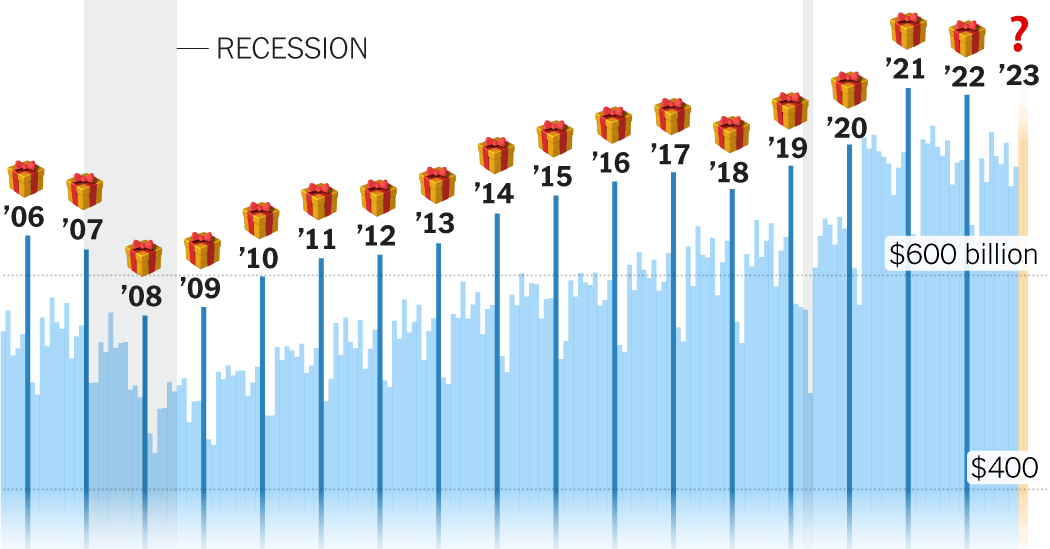

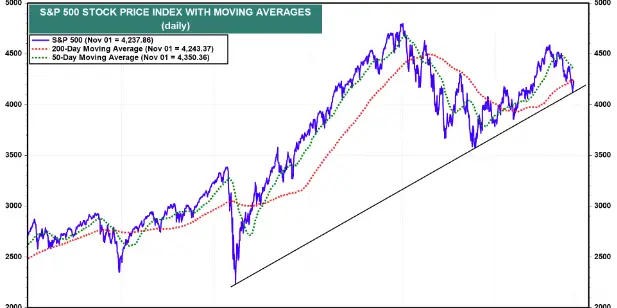

Historically, December 26 is the most reliably positive trading day of the year for the S&P 500, with gains occurring in 33 of the past 39 years since 1953, making it a significant day for investors following Christmas. This year, the market has been strong, and the upcoming session marks the second day of the Santa Claus rally, which has been notably positive despite recent years of negative returns.