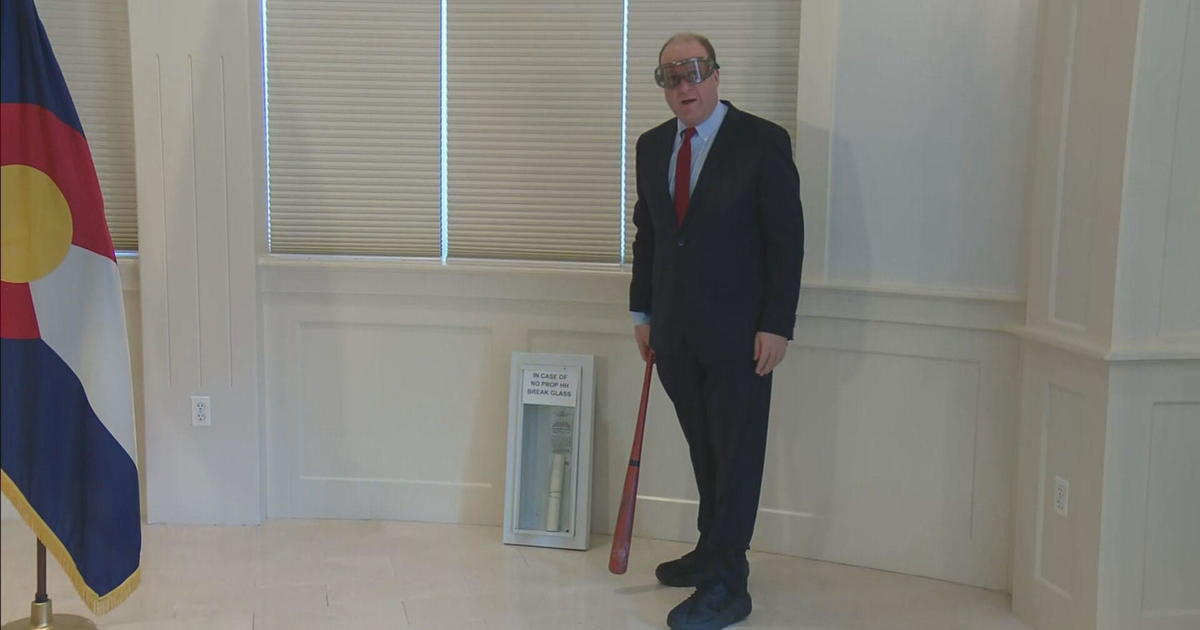

TABOR Refunds: Controversy, Partisanship, and Repackaging

Colorado lawmakers have approved equal Taxpayer's Bill of Rights (TABOR) refunds for taxpayers in the next round of refunds, following the rejection of Proposition HH. The refunds, estimated to be around $847 for single filers and $1,694 for joint filers, will be distributed equally regardless of income levels. However, the passage of a bill to expand the earned income tax credit may lower the amount paid in TABOR refunds to around $800. This is a departure from the normal system, where refunds were based on income levels, with higher earners receiving more.