Biden Administration Caps Overdraft Fees at $5 Nationwide

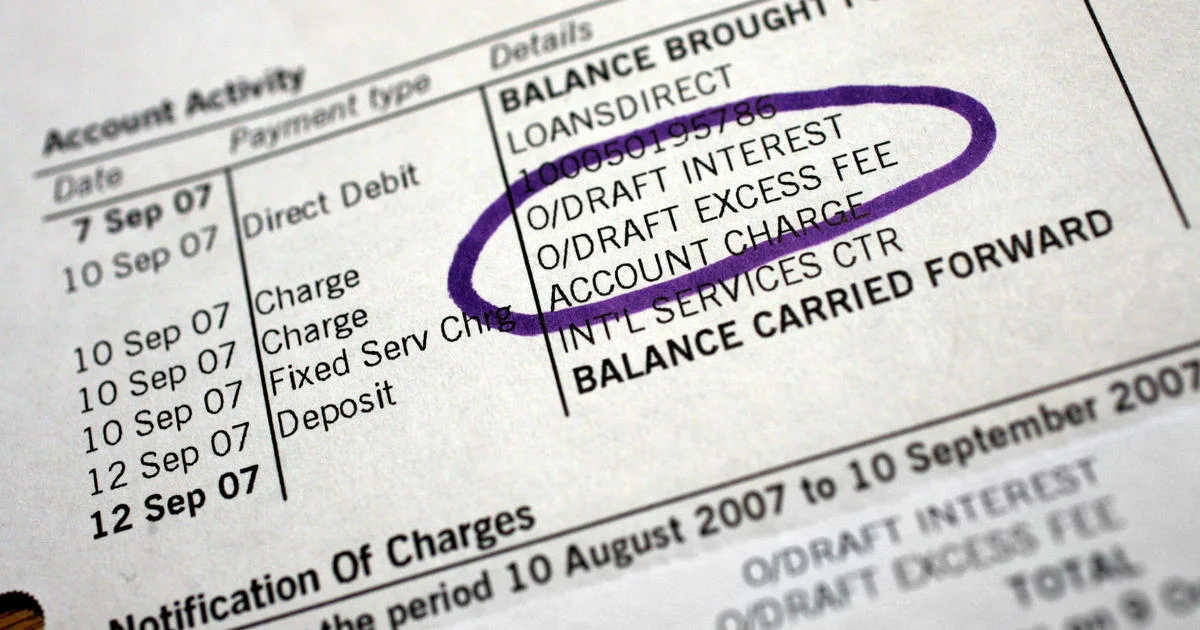

The Consumer Financial Protection Bureau (CFPB) has issued a rule capping overdraft fees at $5 for banks and credit unions with over $10 billion in assets, potentially saving consumers $5 billion annually. This move aims to close a legal loophole that allowed excessive fees, which have disproportionately affected minorities and low-income consumers. The rule, part of the Biden Administration's effort to reduce 'junk fees,' is expected to face legal challenges from the banking industry, which argues it could limit their ability to offer overdraft services.