Marvell Stock Surges on Data Center Growth and Celestial AI Acquisition

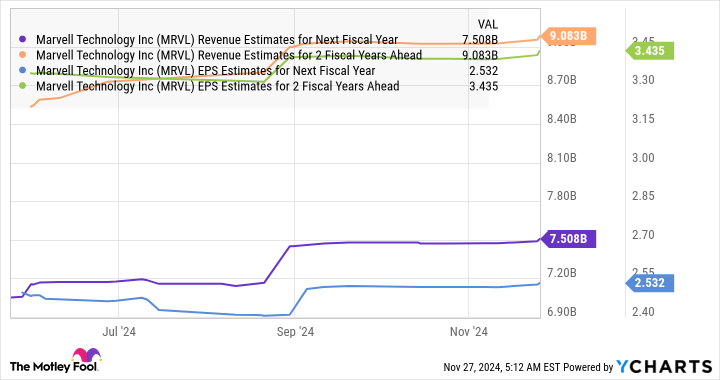

Marvell Technology's stock surged after reporting strong Q3 earnings and providing optimistic guidance for data center revenue growth, driven by demand for its custom AI chips, notably from Amazon, and announcing the acquisition of Celestial AI to bolster its AI capabilities.