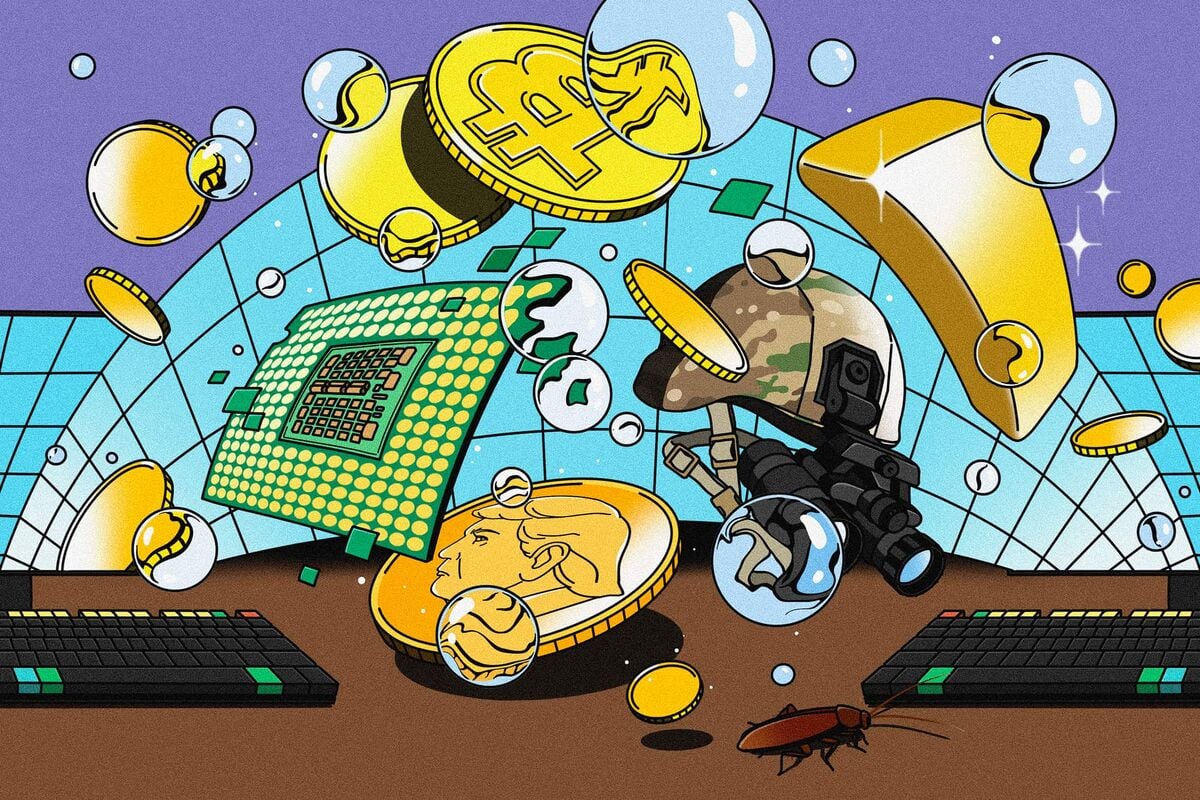

Pentagon's SHIELD Vendor List Ignites Defense Stock Watch

Pentagon's SHIELD program—a $151 billion defense canopy—pushes a fast-track, 2,400+ vendor marketplace via the Missile Defense Agency; being named on the SHIELD list signals opportunity, not guaranteed funding, with participation from stocks like KTOS, LHX, LMT, HII, PLTR and ORCL as awards unfold in staggered tranches in 2025–26.