First Brands Bankruptcy Sparks Industry Restructuring Concerns

First Brands has filed for bankruptcy, risking multibillion-dollar losses, though specific details and implications are not provided in the article.

All articles tagged with #financial losses

First Brands has filed for bankruptcy, risking multibillion-dollar losses, though specific details and implications are not provided in the article.

A class action lawsuit was filed against Lockheed Martin alleging that the company and its officers misled investors by omitting critical information about internal control failures and program risks, which led to significant financial losses and a drop in stock price after disclosure of $1.6 billion in losses on classified programs.

Stephen Colbert addressed the cancellation of The Late Show, joking about CBS's financial losses and the $16 million settlement with Trump, suggesting the decision was influenced by financial reasons despite the show's high ratings.

Plug Power's stock has risen nearly 90% this year amid hopes for a short squeeze due to high short interest, but concerns remain over potential share dilution, ongoing losses, and financial distress signals like a reverse split proposal, making it a risky investment despite Wall Street's optimistic target price.

Donald Trump is considering privatizing the US Postal Service (USPS) during his second term, citing its financial losses. Discussions have taken place with Howard Lutnick, Trump's commerce secretary pick, and other officials. Privatization could disrupt shipping and affect federal workers, but Trump argues the USPS should not be government-subsidized. The USPS, a self-sustaining agency since 1970, reported a $9.5 billion loss in the last fiscal year. Trump's specific plans remain unclear, but he has previously clashed with the USPS over its operations and funding.

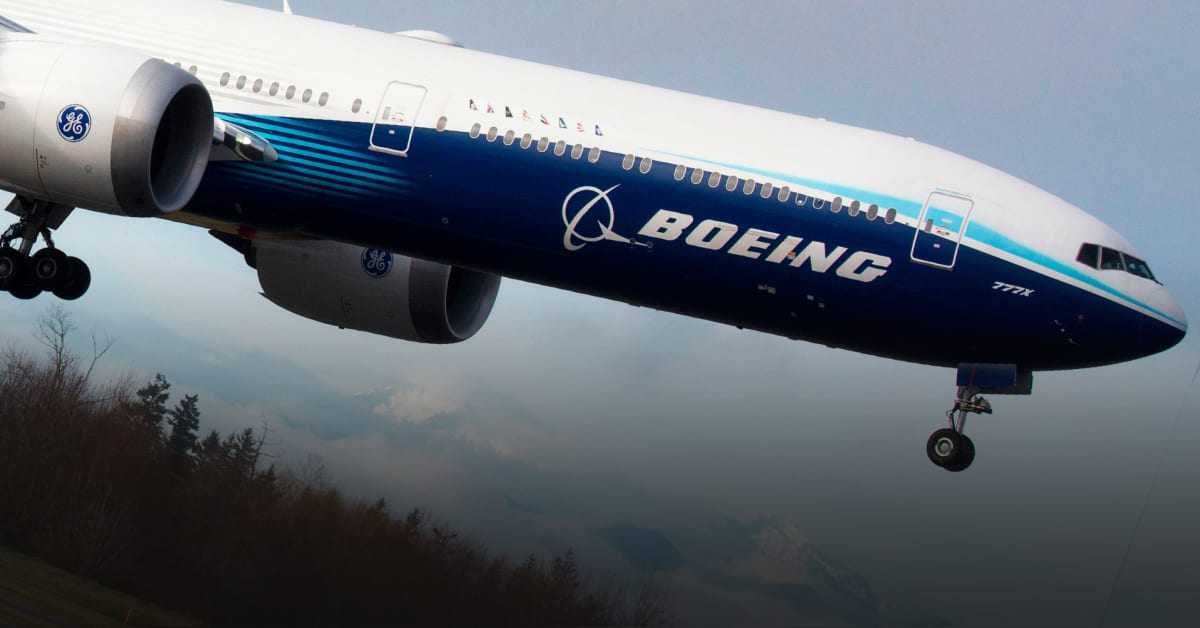

Boeing plans to lay off over 2,500 employees on December 20 as part of a strategy to cut 10% of its global workforce, affecting engineers, technicians, and nonunion workers in several states. This decision follows a costly seven-week strike by 33,000 unionized workers, which significantly impacted Boeing's finances, contributing to a $5.7 billion operational loss in the third quarter. The layoffs are part of Boeing's efforts to recover financially and remain competitive amid ongoing challenges, including safety issues and whistleblower allegations.

Boeing is proceeding with plans to lay off 10% of its global workforce despite the end of a machinist strike, as it faces significant financial losses and delivered its fewest planes in years. The company issued 60-day layoff notices to engineering union members and is focusing on cost-cutting measures to recover from a $6 billion loss last quarter. Production challenges, including issues with the 737 Max model, continue to impact Boeing's operations.

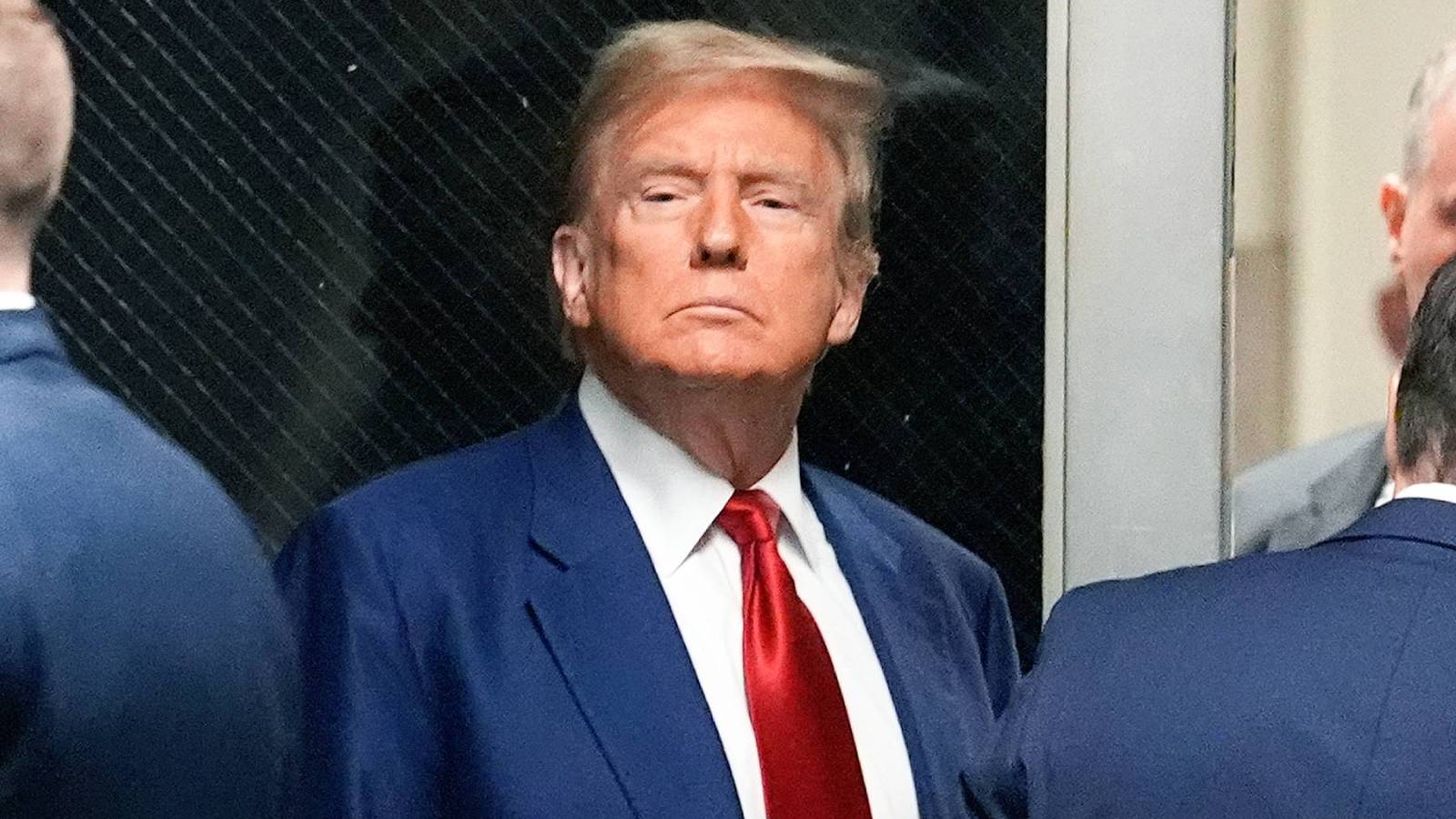

Shares of Trump Media & Technology Group (DJT) dropped 5% following former President Donald Trump's conviction on 34 counts of falsifying business records. The company, which owns Truth Social, has faced significant financial challenges, reporting substantial losses and a decline in stock value since its public debut. Trump, who holds a 60% stake in the company, is expected to appeal the verdict and faces potential prison time.

Luciano Benetton announced he is stepping down as chairman of the family-run apparel brand after discovering losses of over $100 million, blaming the current management team. Benetton, who returned as chairman in 2018, will leave his position in June, coinciding with the board's term at the family holding company, Edizione SpA. The brand has struggled against fast-fashion competition and has seen significant losses since 2013.

Red Lobster is considering filing for Chapter 11 bankruptcy to restructure its debts after suffering $11 million in losses from its "Ultimate Endless Shrimp" promotion, which backfired when it attracted too many customers. The seafood restaurant chain's new CEO, Jonathan Tibus, has experience in restructuring businesses through the Chapter 11 process. The chain's key lender, Fortress Investment Group, is involved in current debt negotiations, and its Thailand-based investor, Thai Union Group, has announced it is divesting from the restaurant.

Donald Trump's company, Trump Media & Technology Group, has filed a lawsuit against two co-founders of Truth Social, accusing them of mismanagement and seeking to eliminate their stake in the company. This comes after the co-founders filed their own suit against Trump's company, alleging an attempt to dilute their shares. Truth Social's stock prices plummeted after the company's financial losses were made public, with reported losses of over $100 million in two years. The outcome of these legal battles could have significant financial implications for Trump as he grapples with mounting legal expenses.

Trump Media & Technology Group, the parent company of Donald Trump's social media platform Truth Social, saw its stock plummet over 22% following an updated regulatory filing revealing heavy financial losses and increased risks associated with the former president's ties to the platform. The filing disclosed sales of just over $4 million and net losses of nearly $60 million for the full-year ending Dec. 31, with expectations of continued losses. The success of Truth Social is heavily reliant on the reputation and popularity of Donald Trump, and stakeholders are subject to a six-month lockup period before selling or transferring shares, potentially impacting Trump's ability to address financial challenges.

Ryan Reynolds and Rob McElhenney's ownership of Wrexham soccer club has resulted in the club owing the celebrity owners over $11 million, with reported losses increasing to $6.4 million. Despite this, the club's turnover has risen, and it is currently bidding for back-to-back promotions. Wrexham plans to continue investing in capital expenditure projects, including expanding its stadium, and is optimistic about future financial prospects due to increased income from sources such as a documentary and participation in the English Football League.

JetBlue Airways is ending service in several cities, including Kansas City, Bogota, Quito, and Lima, and reducing flights out of Los Angeles to focus on stronger markets after years of financial losses. The airline is also dealing with the grounding of some of its planes for engine inspections. These changes come after unsuccessful partnership and merger attempts, as well as courtroom defeats, leading to a shift in strategy under new CEO Joanna Geraghty.

Ethiopia's largest bank, the Commercial Bank of Ethiopia, is facing a financial crisis after a technical glitch allowed customers to withdraw more money than they had in their accounts, resulting in reported losses of over $40 million. The glitch, attributed to a routine system update gone wrong, led to long lines at ATMs and temporary closure of banking operations. Ethiopian officials have ruled out a cyberattack, and the bank is now attempting to recover the substantial sums withdrawn during the incident.