"The Optimal Retirement Age for Americans: Are You On Track?"

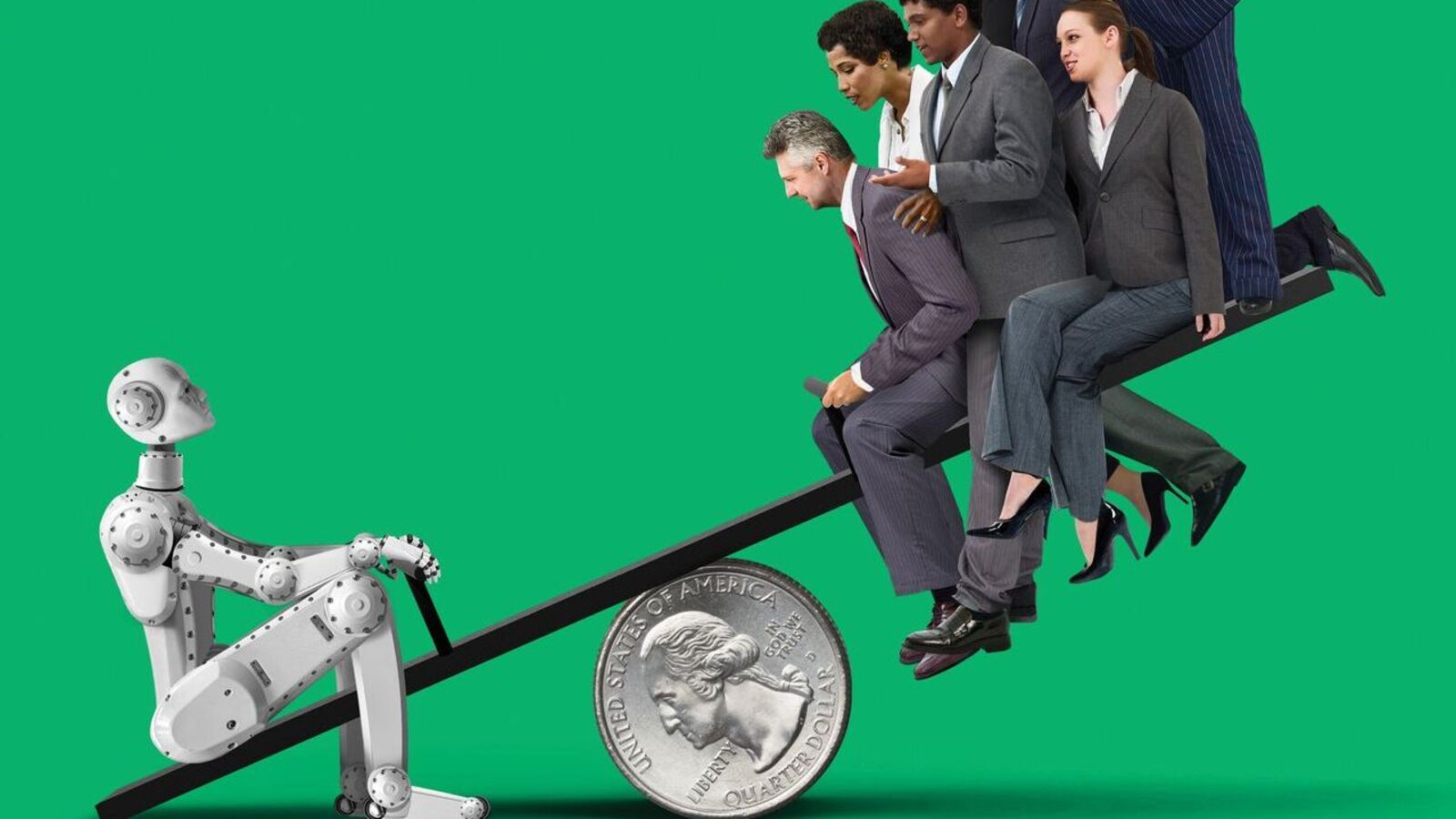

The average retirement age in the United States is 64, with workers expecting to retire at 66, and the full retirement age is 67 for those born in 1960 or later. Women have saved 30% less than men by retirement, and racial disparities show that Black and Hispanic families have lower retirement savings compared to white families. Social Security plays a pivotal role in retirement planning, and effective retirement planning should include maximizing contributions to retirement savings plans and considering catch-up contributions for people 50 or older. It's important to assess your retirement readiness by evaluating savings, maximizing retirement contributions, estimating retirement expenses, understanding Social Security benefits, diversifying investments, planning for longevity, considering working in retirement, and regularly reviewing your retirement plan. Consulting a financial adviser can provide valuable guidance tailored to your specific situation.