"Nvidia's Cyclical Nature and AI Dominance: Stock Outlook and Potential for $1,000 Share Price"

TL;DR Summary

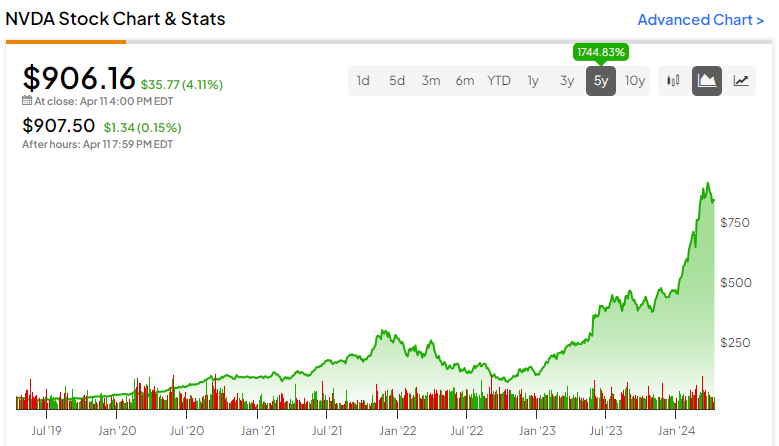

Nvidia's stock is trading at high multiples despite potential cyclical risks, with the company's rapid profit growth and high margins possibly nearing a peak. Increased competition and potential economic weakness could impact Nvidia's future earnings, while the semiconductor industry's surge in investment and competition pose additional challenges. Analysts remain bullish on the stock, but some caution that Nvidia's position may resemble Intel's during the dot-com bubble, with potential for a similar downturn in the future.

- Nvidia Stock (NASDAQ:NVDA): More Cyclical Than You'd Think Yahoo Finance

- Nvidia doesn’t have a monopoly in AI — though it sure seems that way MarketWatch

- Nasdaq Leads Nifty Rebound; Why Morgan Stanley Got Hammered Investor's Business Daily

- Why Nvidia Stock Could Top $1,000 A Share After May Earnings Report Forbes

- Nvidia Stock Has Pulled Back: Time to Buy the Dip? The Motley Fool

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

4 min

vs 5 min read

Condensed

92%

885 → 75 words

Want the full story? Read the original article

Read on Yahoo Finance