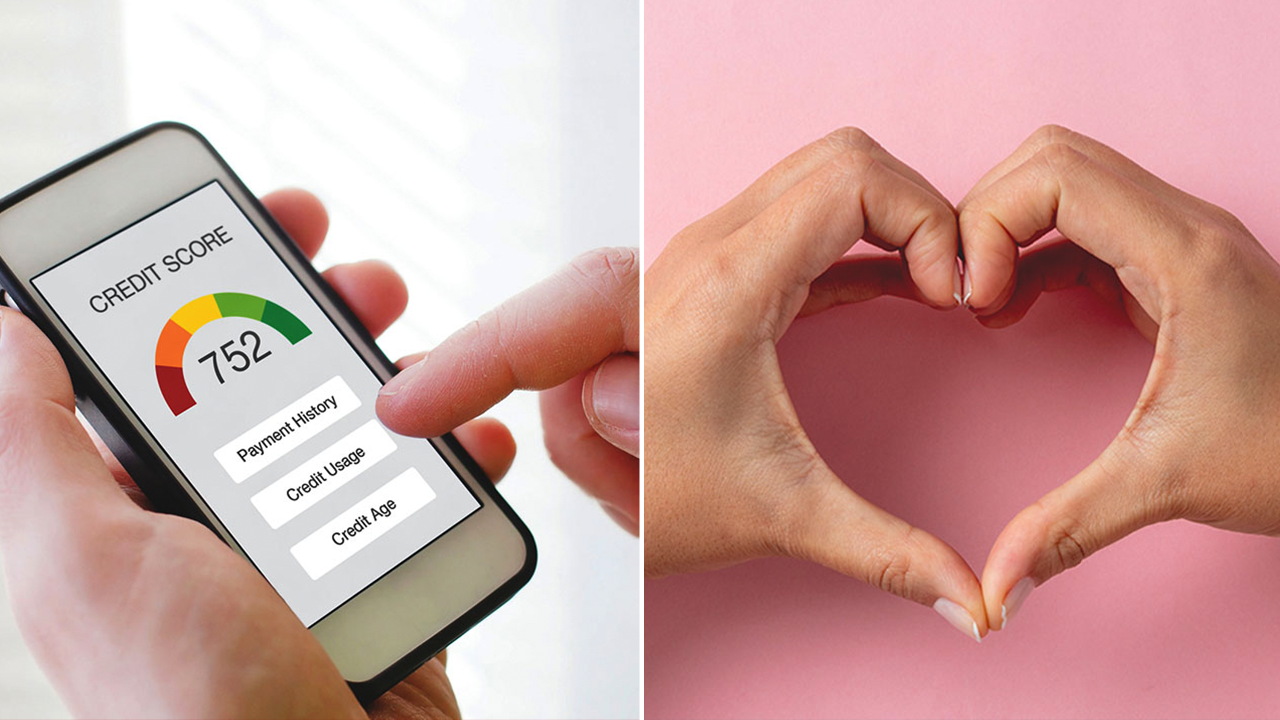

Love by the Numbers: A Dating App Bets on Credit Scores

Score is relaunching a dating app that requires a 675+ credit score for membership and offers a paid, credit-verified tier with features like video intros, using Equifax for verification; the founder argues credit reflects reliability in dating, but privacy concerns and a potential bias toward financially vetted matches loom as younger users face a credit crunch.