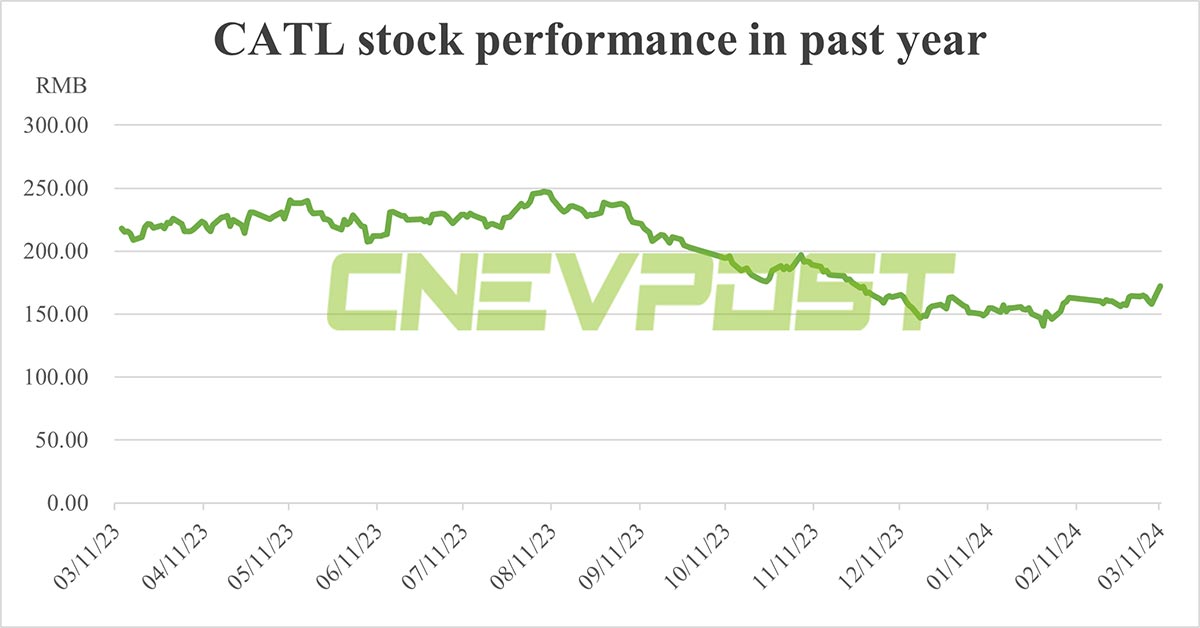

CATL Shares Rise on China's Energy Storage Expansion and Policy Support

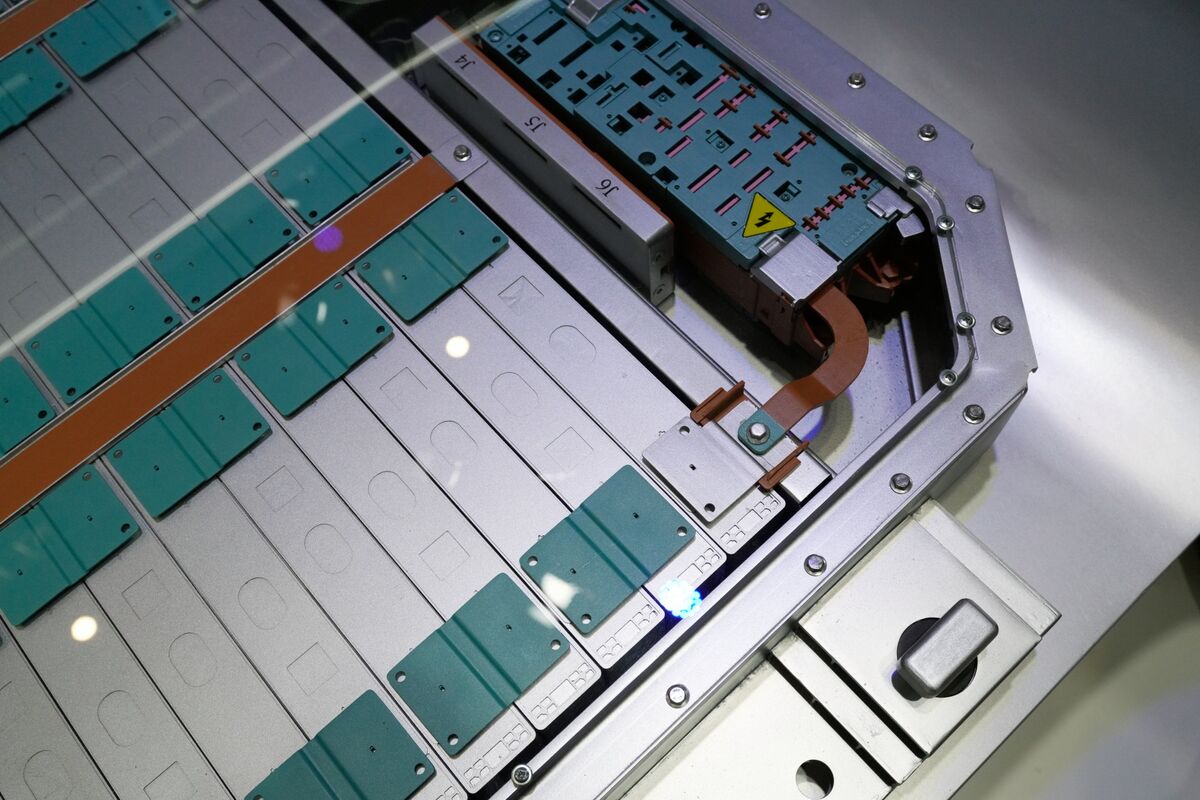

CATL's shares surged to record highs following China's announcement of a plan to install over 180 million kW of new energy storage capacity by 2027, backed by a $35 billion investment, boosting investor optimism and expanding CATL's market share in the EV battery sector.