"Market Anticipation Builds as Bond Traders Await Crucial Jobs Report"

TL;DR Summary

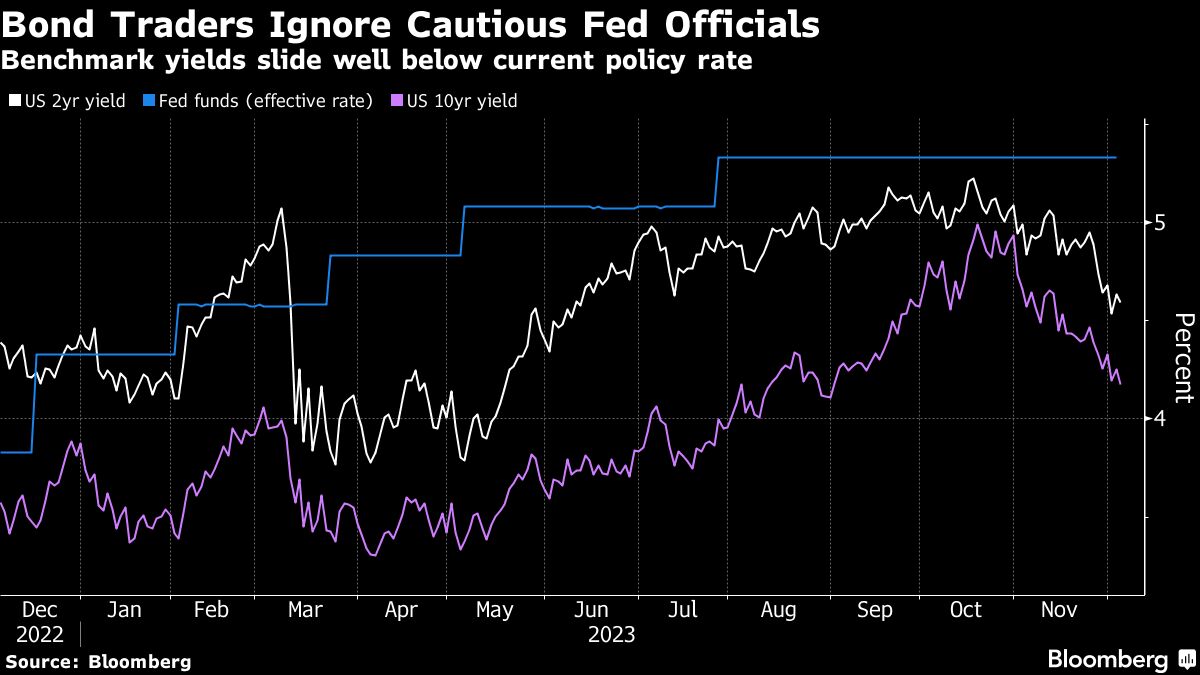

Bond traders in the US Treasury market, who have fueled a significant rally in recent months, are awaiting Friday's jobs report to determine if their optimism is justified. Softening inflation and employment data have led investors to believe that the Federal Reserve will cut interest rates by at least 1.25 percentage points over the next year. However, the Fed has cautioned against premature talk of rate cuts. The report is expected to show moderate employment and wage growth in November, but any surprises challenging the bullish narrative could lead to a market reversal.

Reading Insights

Total Reads

0

Unique Readers

4

Time Saved

4 min

vs 5 min read

Condensed

90%

962 → 93 words

Want the full story? Read the original article

Read on Yahoo Finance