Scaramucci bags Trump’s credit-card cap as a hard-left pivot sparked by texts with Mamdani

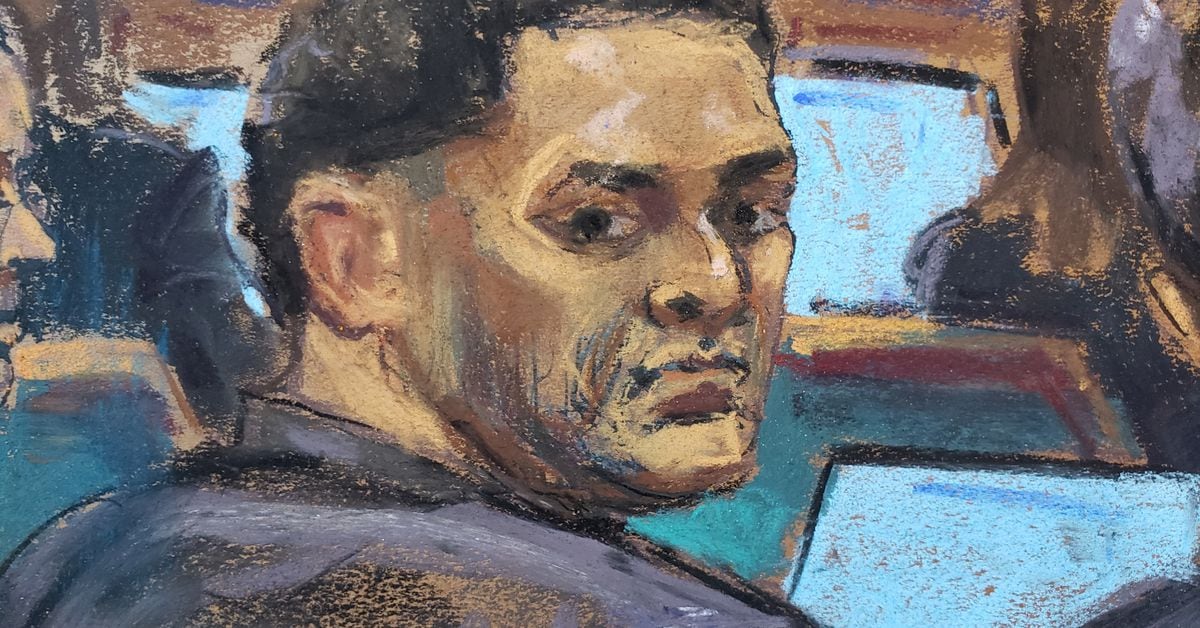

Former White House communications director Anthony Scaramucci says Trump’s proposal to cap credit-card interest at 10% is a hard-left populist move, more aligned with Democratic policy than GOP orthodoxy, though it would require congressional approval. He ties the stance to Trump’s reported text exchanges with New York City mayor Zohran Mamdani and notes bankers’ objections, while colleagues debate the GOP’s identity amid broader consumer debt strain.