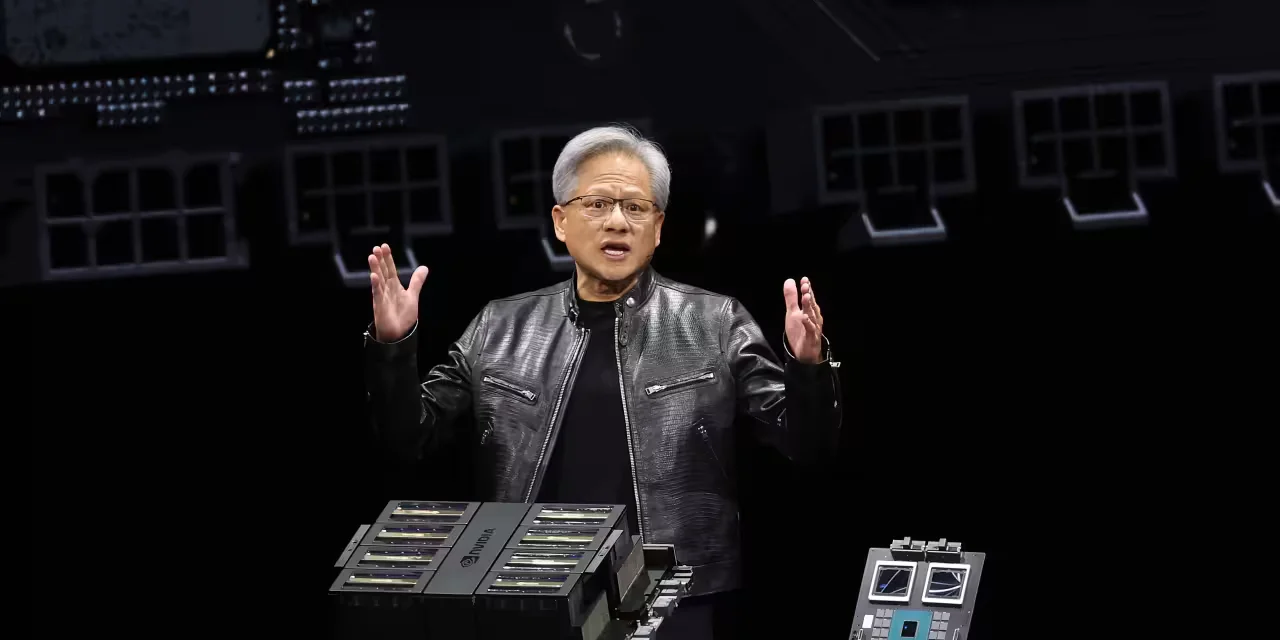

Nvidia's $65B Forecast Highlights AI Industry Surge

Nvidia forecasts $65 billion in revenue for Q4 2026, highlighting the rapid growth and strong demand in the AI industry, and suggesting that the sector's expansion is driven by major technological shifts rather than a bubble.