Hedge Funds Surge with PivotalPath's CTA Recovery and Sector Gains

Market upheavals have led to the biggest gains for macro hedge funds since 2008, highlighting significant shifts and opportunities in financial markets.

All articles tagged with #2008 financial crisis

Market upheavals have led to the biggest gains for macro hedge funds since 2008, highlighting significant shifts and opportunities in financial markets.

The US economy is experiencing a 'cockroach' problem with the rise of private credit firms, which have grown to a $2 trillion market by offering risky loans, raising concerns reminiscent of the 2008 financial crisis.

The Federal Reserve plans to significantly reduce capital requirements for the largest US banks by easing the supplementary leverage ratio, aiming to improve market functioning and align with international standards, despite concerns about increased risk and potential for future financial instability.

The European Union plans to revive securitization practices, which were linked to the 2008 financial crisis, by loosening regulations to boost bank lending and economic growth, despite concerns from regulators and NGOs about potential risks and misuse.

The UK government has sold its final shares in NatWest, marking the end of a 17-year period since its bailout during the 2008 financial crisis, which was aimed at saving the economy from the collapse of major banks like RBS. Despite the bank's troubled history and the long duration of government ownership, experts believe that banking regulations and resilience have improved, reducing the likelihood of future taxpayer-funded bailouts, although new risks like cyberattacks remain significant.

The UK's Financial Conduct Authority has fined Barclays £40 million ($50.9 million) for failing to disclose arrangements with Qatari entities during the 2008 financial crisis. The fine relates to undisclosed fees paid to Qatari funds to avoid a state bailout. Although Barclays initially appealed the fine, it has now withdrawn the appeal, citing the time elapsed and the interests of its stakeholders, while maintaining there is no material financial impact from the penalty.

Bank of America analysts believe that the current housing market is not headed for a crash like the one experienced in 2008. They argue that the market is more reminiscent of the 1980s, with no evidence of overdevelopment or over-leveraging. However, they caution that there may be turbulence ahead due to tight monetary policy and high mortgage rates. The housing market is facing challenges such as limited inventory, high prices, and labor shortages, which are impacting affordability. Bank of America expects rates to rise in November and then be cut in June of next year, but they emphasize that a stable and healthy housing market will require improved affordability through rate cuts.

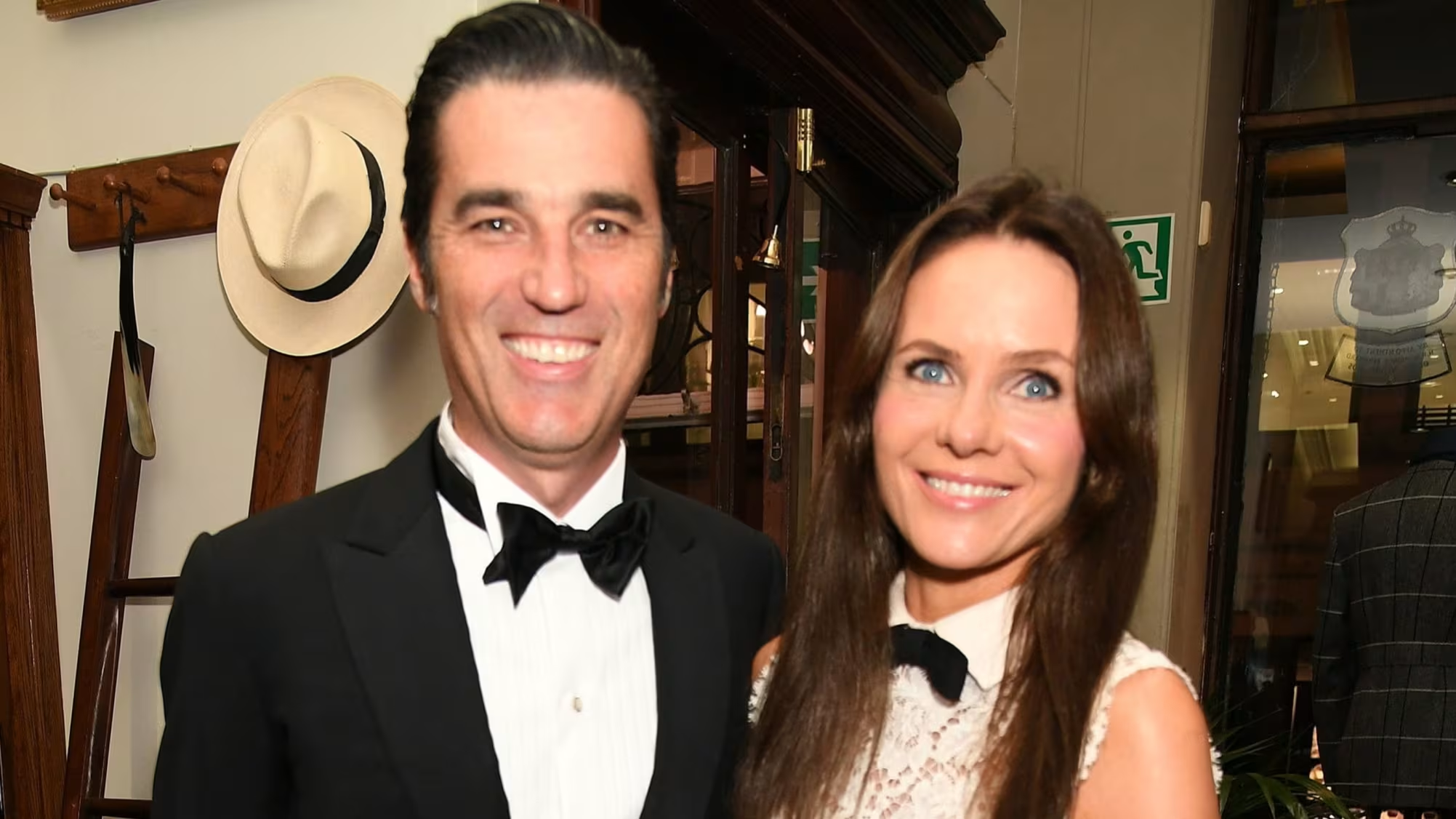

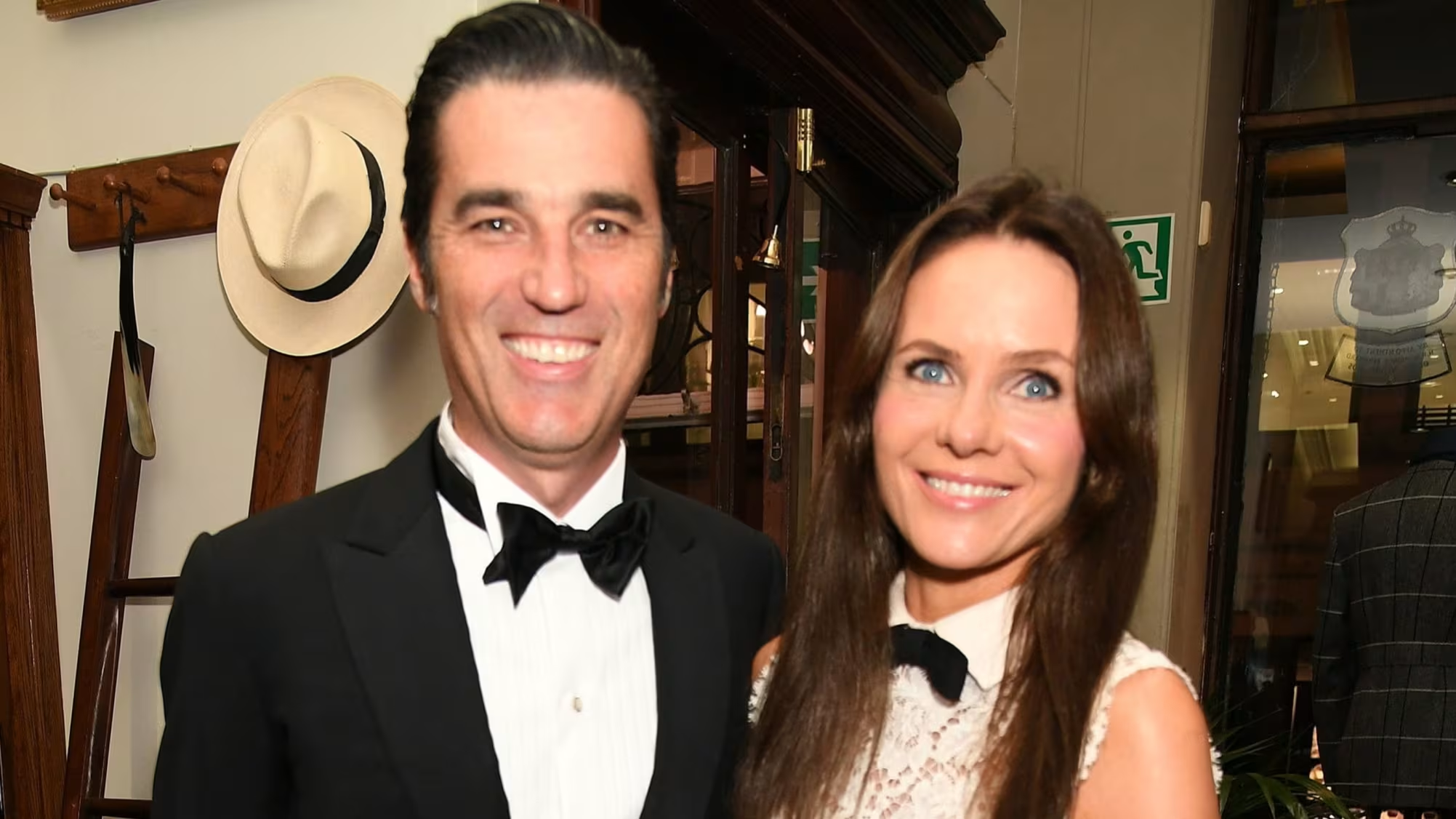

Angelo Mozilo, former CEO of Countrywide Financial and a key figure in the 2008 financial crisis, has passed away at the age of 84. Mozilo and his company were closely associated with the subprime mortgage meltdown that contributed to the crisis. Countrywide, which he co-founded, issued mortgages to borrowers with inadequate credit, leading to high default rates and a wave of foreclosures. The company was eventually acquired by Bank of America for a significantly reduced price, resulting in substantial losses for the bank. Mozilo faced charges of defrauding investors and settled with the SEC for $67.5 million, paying less than originally agreed upon.