Mortgage Rates Fluctuate, Prompting House-Buying Controversy

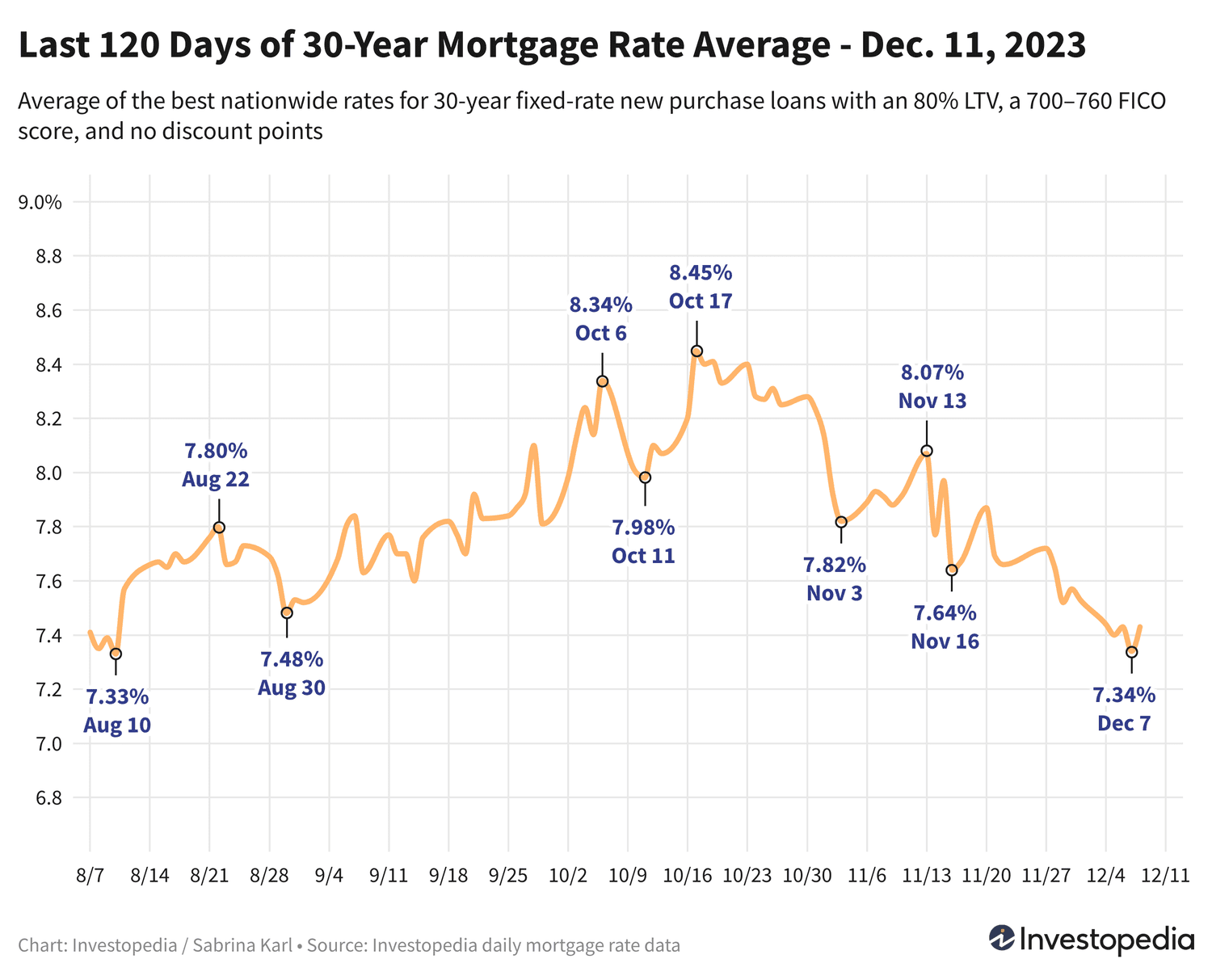

30-year mortgage rates rose moderately on Friday but remain near their lowest level in four months, with an average of 7.43%. Rates for other loan types also increased. Freddie Mac's weekly mortgage data showed rates climbing to a 7.79% average in October, the highest since 2000, but have since fallen. The lowest mortgage rates vary by state, with Vermont, Mississippi, Delaware, Louisiana, and North Dakota having the lowest averages, while Oregon, Nevada, Arizona, Minnesota, and Washington have the most expensive averages. Mortgage rates are influenced by factors such as bond market performance, the Federal Reserve's monetary policy, and competition among lenders.

- 30-Year Mortgage Rates Bobbing in Lowest Range Since August Investopedia

- Mortgage rates are dropping. Is this a good time to buy a house? USA TODAY

- Mortgage Rates Barely Budge, But Volatility Potential is Much Higher Tomorrow Mortgage News Daily

- Today’s mortgage rates for December 11, 2023 NJ.com

- Dave Ramsey has blunt words on the big house-buying controversy now TheStreet

Reading Insights

0

0

5 min

vs 6 min read

91%

1,145 → 101 words

Want the full story? Read the original article

Read on Investopedia