Retirement Planning News

The latest retirement planning stories, summarized by AI

Featured Retirement Planning Stories

"The Optimal Age for Social Security Benefits and Average Retiree Payout"

Social Security is crucial for many retirees, with the age at which benefits are claimed having a significant impact on the monthly amount received. While there's no single correct age to file, data from the Social Security Administration shows that around 28% of men and 27% of women file at their full retirement age (FRA), with age 62 being a popular choice as well. Delaying benefits until age 70 can result in significantly larger monthly payments. The average monthly benefit among retired workers varies by age, with those who wait until age 70 receiving around $740 more per month compared to claiming at age 62. Ultimately, the decision on when to take Social Security depends on individual circumstances and financial goals.

More Top Stories

"The $1.46 Million Retirement Myth: Americans' Struggle to Save"

Fox Business•1 year ago

More Retirement Planning Stories

"Understanding the Impact of Social Security Benefits at Different Ages"

Social Security benefits are a crucial income source for retirees, with 22.7 million people aged 65 and over lifted above the federal poverty line annually. The benefits are calculated using a formula based on work history, earnings, full retirement age, and claiming age, with claiming age having the most significant impact on monthly payouts. While claiming at 62 offers immediate access to benefits, waiting until 70 can increase monthly payouts by 24% to 32%. Research suggests that waiting to claim benefits, ideally until age 70, can result in the highest lifetime benefit for most retirees, although individual circumstances should also be considered.

"The Optimal Social Security Benefit Age for Retirees"

The Nationwide Retirement Institute reports that only 8% of surveyed adults can identify all the factors that determine the maximum Social Security benefit, which is problematic as it is often the largest source of income in retirement. Social Security benefits for retired workers are calculated based on work history, lifetime earnings, and claiming age, with the maximum benefit being earned by those who have at least 35 years of work history, earnings up to the maximum taxable limit, and claim at age 70. Claiming at age 66 rather than 62 can result in up to $942 more per month, and delaying until age 70 can yield up to $2,163 more per month. While very few Americans will qualify for the maximum benefit, working for at least 35 years and delaying claiming can help increase the payout.

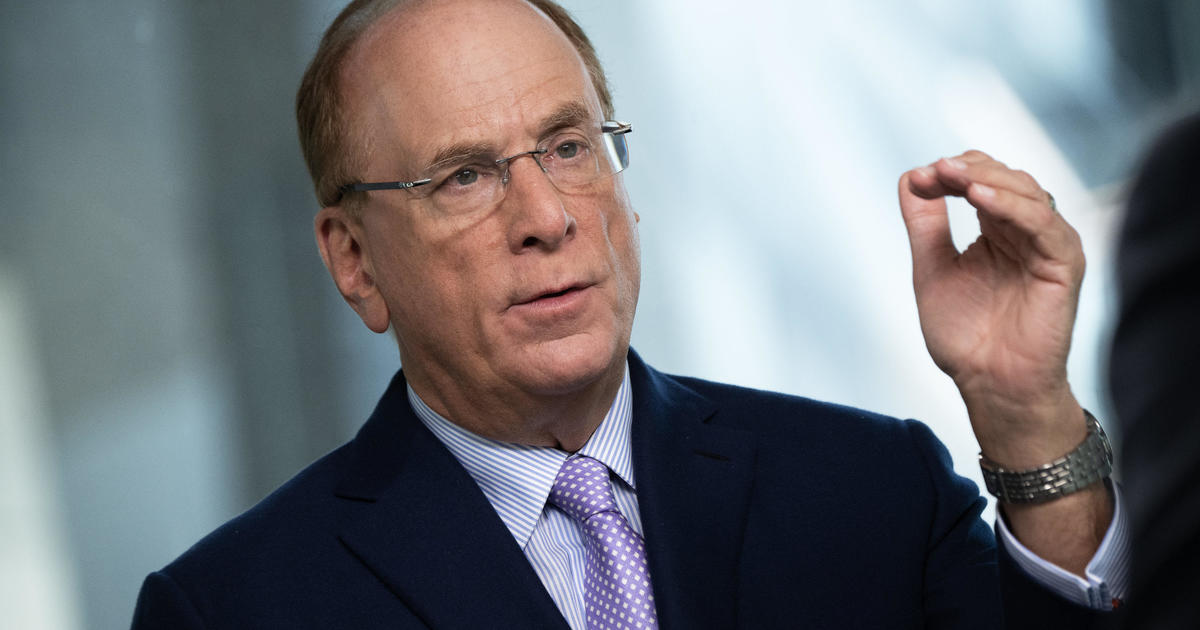

"BlackRock CEO Larry Fink Urges Longer Working Years to Tackle Retirement Crisis"

BlackRock CEO Larry Fink suggests that Americans should work longer before retiring to address the strain on the U.S. retirement system caused by changing demographics and longer life expectancies. This comes amid a debate about the future of Social Security, with some proposing to raise the retirement age. However, experts argue that aging in the workplace and health issues often lead to earlier-than-planned retirements. Fink's comments are notable given his firm's vested interest in retirement accounts, and he also promotes a new target-date fund. He emphasizes the need for public policy changes to make retirement investing more automatic for workers and calls on his generation to help fix the nation's retirement problems.

"Maximizing Social Security Benefits for Early Retirement"

If you're considering early retirement, it's important to understand how your Social Security benefits could be affected. Claiming benefits early results in lower payouts and forgoing delayed retirement credits, while not working for 35 years or earning low wages during that time could shrink your benefits. Additionally, going back to work after claiming benefits may lead to a reduction in your Social Security income. It's crucial to carefully consider these factors before making a decision about early retirement.

"Essential Social Security Facts for Early Retirees: What You Need to Know"

Early retirees need to consider three key facts about Social Security benefits before making a decision. Claiming benefits before full retirement age results in a lower benefit and limits the chance to earn delayed retirement credits. Additionally, not having 35 years of work history or working exactly 35 years could shrink benefits. Finally, going back to work after claiming benefits may result in a reduction of Social Security income, with earnings limits in place until full retirement age.

"Understanding the Average Social Security Retired-Worker Benefit Across Age Groups"

The average Social Security retirement benefit varies significantly by age, with claiming age being a key factor. Retirees can start receiving benefits as early as age 62, but waiting until age 70 can increase monthly payouts by up to 32%. Women tend to receive lower benefits due to historical disparities in pay and time spent in the labor force. Research suggests that waiting until age 70 to claim benefits can maximize lifetime income, and there's a do-over clause for those who regret claiming early, allowing benefits to continue growing.

Maximizing Your Social Security Benefits: Expert Insights and Average Checks

While delaying Social Security benefits until age 70 can lead to higher monthly checks and potentially maximize lifetime benefits, it's not without risks. Delaying benefits may temporarily reduce spousal benefits and leave less for heirs, and there's no way to predict if it's the best strategy for everyone. Coordinating claiming strategies with a spouse and considering the impact on retirement accounts are crucial, as collecting early to out-invest the growth in benefits comes with substantial risk.

"Maximizing Social Security Benefits: A Comprehensive Guide"

Social Security benefits are a crucial income source for retirees, with factors like work history, earnings, full retirement age, and claiming age influencing monthly payouts. Claiming benefits as early as age 62 can reduce monthly benefits by up to 30%, while waiting until age 70 can increase payouts by 24-32%. Despite popular choices being ages 62 and 66, a study suggests that waiting until age 70 may maximize lifetime benefits for most retirees, emphasizing the power of patience in making Social Security claiming decisions.

"Controversial Proposal: Limiting Retirement Tax Breaks to Strengthen Social Security"

A controversial proposal by economists Andrew Biggs and Alicia Munnell suggests limiting tax perks for retirement savings plans to bolster Social Security's funding gap, sparking opposition from critics who argue that removing tax benefits would discourage saving. The proposal aims to redirect funds from retirement plans to shore up Social Security, providing immediate funding while allowing time for lawmakers to consider other changes. Despite pushback, both economists stand by their stance, emphasizing the need to reevaluate the impact of tax preferences on retirement saving behavior.

"Key Considerations for Aging in Place During Retirement"

As 77% of adults ages 50 and up aim to stay in their homes long term, experts emphasize the importance of making necessary improvements and upgrades to support aging in place. These upgrades, such as an aging-friendly bathroom and accessible entryways, can range from $30,000 to $80,000, but are a one-time cost compared to the annual median cost of a nursing home. It's advised to start planning for aging in place early, consider function over design, enlist professional help, and have a financial and contingency plan in place.