Legalfinance News

The latest legalfinance stories, summarized by AI

Featured Legalfinance Stories

"Knight Specialty Insurance Company Defends Trump's Financially Secure $175M Bond in Court"

The firm that posted a $175 million bond for Donald Trump defended the deal in a court filing, asserting that it is adequately secured by the former president's cash. New York Attorney General Letitia James had raised concerns about the arrangement, including the licensing of the bond company. The filing also revealed that the bond is backed by Trump's Charles Schwab brokerage account and argued that the bond company is properly licensed. However, some experts believe that the filing may not have fully addressed all of James's concerns, and a court hearing is set to examine the matter further.

More Top Stories

"Trump's Financial Woes Leave Him Unable to Secure $450 Million Appeal Bond"

The Washington Post•1 year ago

More Legalfinance Stories

"Inheritance Surprise: My Father's Accidental Revocable Trust Leaves Everything to My Stepmom"

A daughter is concerned after discovering that her late father's revocable trust, which was intended to include her and her siblings as beneficiaries, is being changed by her stepmother to exclude them. The daughter may need to contest the trust in court, with the burden of proof on her to show that the trust did not reflect her father's intentions and was a mistake. Obtaining a copy of the trust and seeking legal counsel to review its terms is crucial, and potential implications on capital gains and the stepmother's legal entitlement should be considered.

"Prosecutors Drop Second Trial Plans for FTX Founder Bankman-Fried"

Sam Bankman-Fried, the former CEO of the bankrupt FTX cryptocurrency exchange, will not face a second trial on charges including campaign finance violations, despite being convicted of fraud and conspiracy. Prosecutors have decided that the public interest in a swift resolution and the evidence already presented at the first trial, which can be considered during sentencing, outweigh the need for a second trial. Bankman-Fried, who has been convicted on all seven counts he faced, could spend decades in prison and is expected to appeal his conviction. The sentencing is set for March 28, where issues of forfeiture and restitution for victims will be addressed.

"Prosecutors Drop Second Trial Against Crypto Mogul Sam Bankman-Fried Amid Controversy"

U.S. prosecutors have decided not to pursue a second trial against Sam Bankman-Fried, the founder of the now-bankrupt FTX cryptocurrency exchange, who was convicted on all seven counts of fraud and conspiracy last month. The decision was made in the interest of a prompt resolution and because a second trial would not impact the sentencing, which is set for March 28, 2024. Bankman-Fried, who could face decades in prison, is expected to appeal his conviction. The additional charges, including campaign finance violations and conspiracy to operate an unlicensed money transmitting business, will not be pursued at this time, partly because the evidence was largely presented during the first trial.

Goldman Sachs Takes Legal Action Against Malaysia for 1MDB Settlement

Goldman Sachs has filed a lawsuit against Malaysia over the country's refusal to accept a $2.5 billion settlement in connection with the 1MDB scandal. The investment bank argues that Malaysia's decision to reject the settlement is a breach of an agreement reached last year. Malaysia has accused Goldman Sachs of misleading investors and seeks a higher settlement amount. The lawsuit adds to the legal woes faced by Goldman Sachs in relation to the 1MDB scandal.

The Legacy and Controversies Surrounding Dianne Feinstein

The death of Senator Dianne Feinstein has brought attention to the ongoing legal battle over the assets left by her late husband, Richard C. Blum. The dispute involves trusts created before Blum's death and centers around a Stinson Beach property and a marital trust intended for Feinstein's benefit. Feinstein's daughter, Katherine Feinstein Mariano, has accused the trustees of purposefully withholding payments and has filed a lawsuit alleging financial elder abuse. The trustees argue that the estate lacked liquidity and that Feinstein's own assets were sufficient to cover her expenses. The case is set to be resolved through private mediation. The conflict highlights the challenges faced by blended families in estate planning and serves as a reminder to plan meticulously, set expectations early, and prioritize communication to avoid similar disputes.

Sam Bankman-Fried's Trial: Tweets, Sabotage, and the Complexity of FTX

Sam Bankman-Fried, the founder of cryptocurrency exchange FTX, is facing legal scrutiny as his tweets become central to his trial. Bankman-Fried's tweets, which were seen as promoting risky trading practices and excessive leverage, have drawn attention from regulators. The trial highlights the potential consequences of social media activity in the finance industry.

Prosecution Targets Sam Bankman-Fried's Jets for Forfeiture

The U.S. Department of Justice has filed a document stating that the two luxury jets purchased by former FTX CEO Sam Bankman-Fried are subject to forfeiture due to charges brought against him. The government argues that the aircraft were purchased with fraudulent funds, while FTX claims the loans used for the purchases were not documented. Bankman-Fried is currently standing trial for multiple charges related to the fall of FTX, with the prosecution portraying him as deliberately deceiving customers and investors, while his defense argues he is a young entrepreneur whose plans didn't work out.

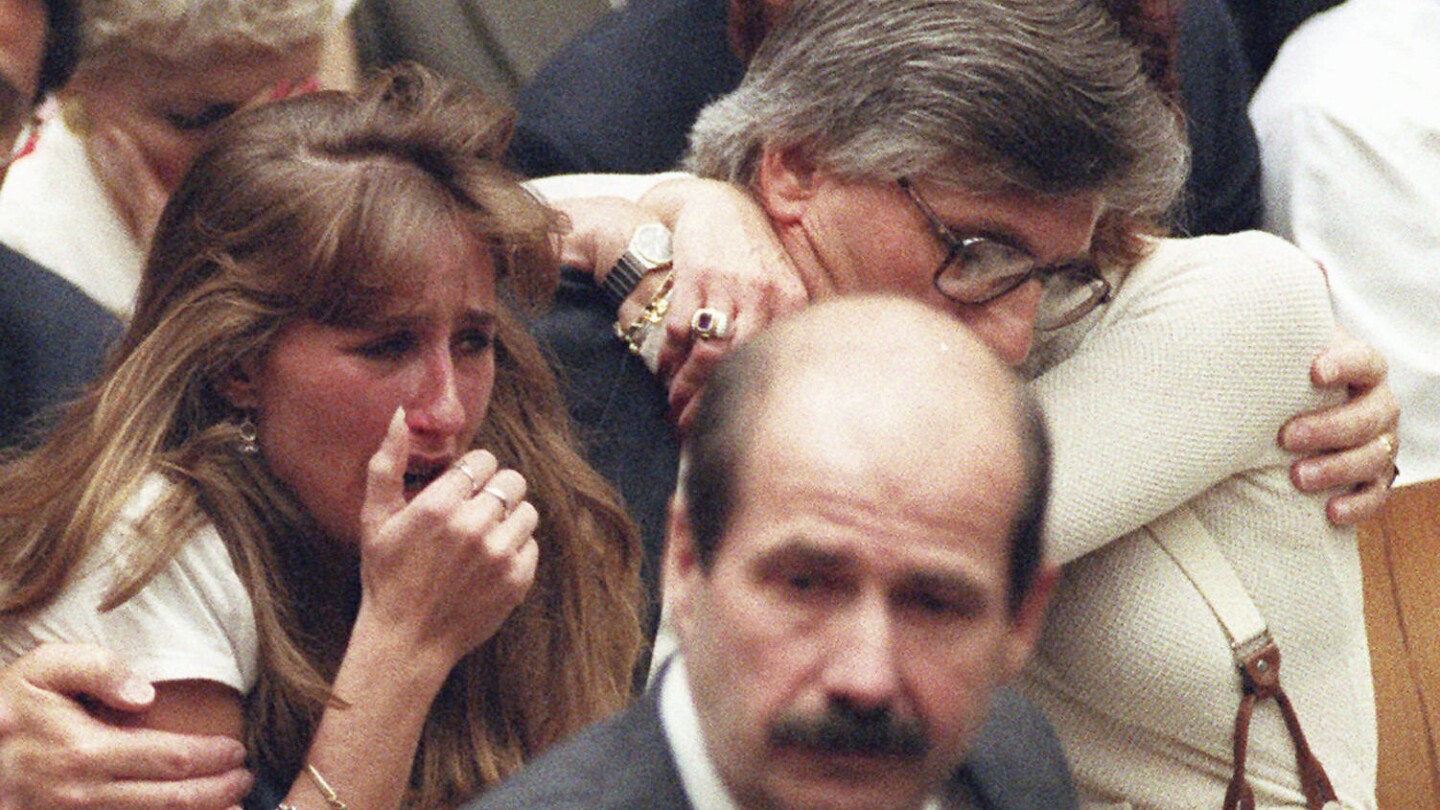

JP Morgan Settles Jeffrey Epstein Sex-Trafficking Lawsuit for $75 Million

JPMorgan Chase has agreed to pay $75 million to settle a lawsuit filed by the U.S. Virgin Islands, accusing the bank of facilitating Jeffrey Epstein's sex-trafficking enterprise for 15 years. The majority of the settlement, $55 million, will go towards local charities and victim assistance, while $20 million will cover legal fees. The settlement does not involve admissions of liability, but the bank expressed regret for any association with Epstein. The U.S. Virgin Islands will use $10 million from the settlement to provide mental health services for Epstein's survivors. JPMorgan Chase was Epstein's banker for 15 years before terminating their relationship in 2013.

"Former Gibson Dunn Attorney Faces Insider Trading Charges"

A former attorney at the top 10 Biglaw firm, Gibson Dunn, has been charged with insider trading. Romero Cabral Da Costa Neto, a visiting attorney from Brazil, allegedly accessed confidential client information from within the firm's internal filing system to make trades ahead of a major pharmaceutical M&A deal. He purchased over 10,000 shares of CTI BioPharma Corp before the deal was publicly announced and reportedly made a profit of over $42,000. Costa also accessed other nonpublic deal information and traded on that information as well. Gibson Dunn is cooperating with authorities and has terminated its relationship with Costa.

CFPB fines Portfolio Recovery Associates $24 million for illegal debt collection practices.

The Consumer Financial Protection Bureau (CFPB) has taken action against Portfolio Recovery Associates, one of the largest debt collectors in the US, for violating a 2015 CFPB order and engaging in other violations of law. The CFPB filed a proposed order that would require Portfolio Recovery Associates to pay more than $12 million to consumers harmed by its illegal debt collection practices, in addition to a $12 million penalty that would be deposited into the CFPB’s victims relief fund. Portfolio Recovery Associates violated the 2015 order by collecting on unsubstantiated debt, collecting on debt without providing required documentation and disclosures to consumers, suing or threatening legal action against consumers without offering or possessing required documentation, and suing to collect on debt outside the statute of limitations.