Cryptocurrency Markets News

The latest cryptocurrency markets stories, summarized by AI

Featured Cryptocurrency Markets Stories

"Crypto Rebound: Bitcoin Hits $66K as SOL and DOGE Lead the Way"

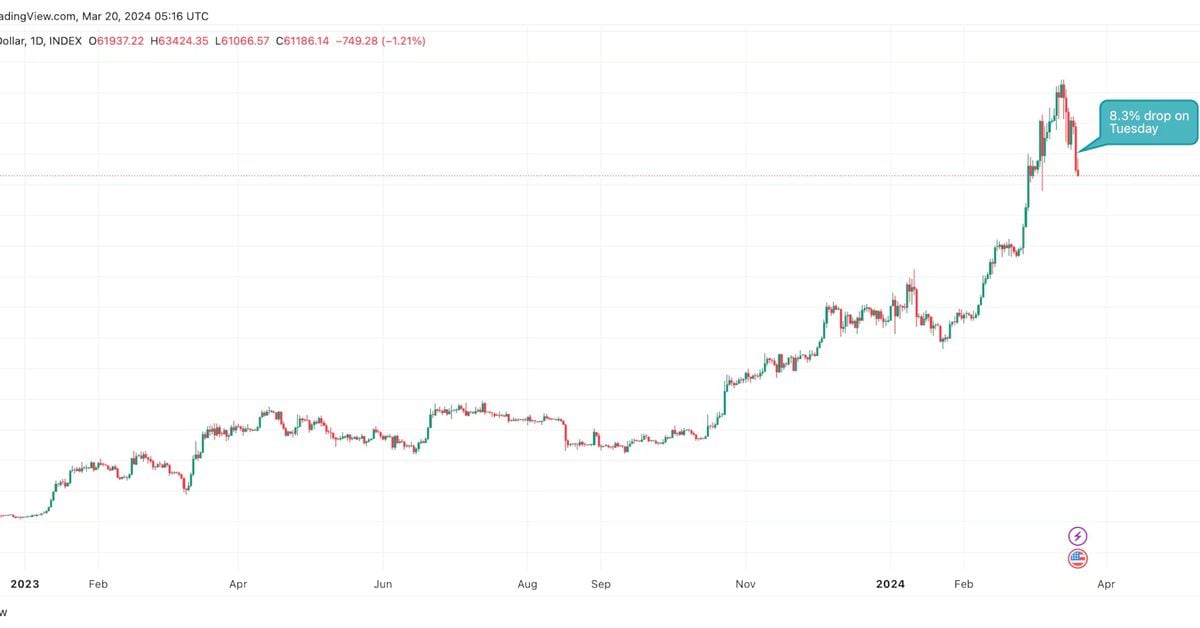

Bitcoin surged past $67,000 following dovish remarks from the Federal Reserve, while Ether rebounded from SEC-related fears and Dogecoin soared on news of Coinbase's plan to list futures contracts. The crypto markets bounced sharply higher, with Bitcoin targeting $67,000 after the Fed maintained its outlook for three rate cuts this year despite hotter-than-expected inflation figures. Traditional markets also climbed higher, with the S&P 500 index jumping nearly 1% to a fresh all-time high, and the tech-heavy Nasdaq-100 gaining 1.3%.

More Top Stories

Bitcoin Hits Record High Above $66,000 Amid Crypto Surge

CoinDesk•2 years ago

Bitcoin Volatility Surges as Price Nears All-Time High

CoinDesk•2 years ago

More Cryptocurrency Markets Stories

Bitcoin's Surge: Crossing $57,000 and Fueling Crypto Rally

Bitcoin surged 11.5% to near $57,000, led by Bitfinex traders and boosted by spot buying on Binance, with Pantera founder Dan Morehead attributing the rally to institutional capital inflows and the impending BTC reward halving. OKX launched a platform in Turkey to cater to the growing crypto adoption and transaction volume in the country, while Uniswap's UNI token surged 60% after proposing to distribute protocol fees to token stakers, leading to a whale address liquidating 90,000 tokens.

Bitcoin's Future Amidst Capital Rotation and Price Struggles

Bitcoin's price remained stable, but a trader predicts a potential drop to $47,000, while the CD20 broad market gauge fell 0.4%. Oanda is launching a UK cryptocurrency trading platform, and the Frax Finance team is considering distributing protocol fees to stakers of its native token, FXS. The market for most coins appears overheated, with excess bullish leverage potentially leading to mass liquidations and rapid price corrections.

"Bitcoin ETF Inflows Drive Crypto Market Rally and Surge"

The cryptocurrency market has seen a rally, with Bitcoin approaching a trillion-dollar market cap and Ether trading at $2,500. Eight of the top 10 tokens have posted gains, with Bitcoin and Ethereum up 10.7% and 9% respectively. Spot Bitcoin ETFs attracted $400 million in daily inflows, driving short-term gains, with demand for Bitcoin from ETF providers reaching 9,000 BTC. Fidelity's FBTC has surpassed $3 billion in AUM, while Grayscale's GBTC saw a $101 million outflow streak.

Bitcoin Volatility Soars Near Two-Year High Amid ETF Excitement

Bitcoin is nearing a two-year high, with increased activity in derivatives markets and a changing macroeconomic backdrop potentially leading to heightened volatility. Fidelity Digital Assets's Chris Kuiper notes that despite low volatility, some participants are becoming bullish, with metrics in Bitcoin derivatives approaching levels last seen in late 2021. The US Federal Reserve's potential policy changes and the expectation of Bitcoin exchange-traded funds also contribute to the evolving landscape. As Bitcoin trades around $46,800, market participants should brace for increased volatility ahead.