Bitcoin Heist Hacker Sentenced to 5 Years for Crypto Laundering

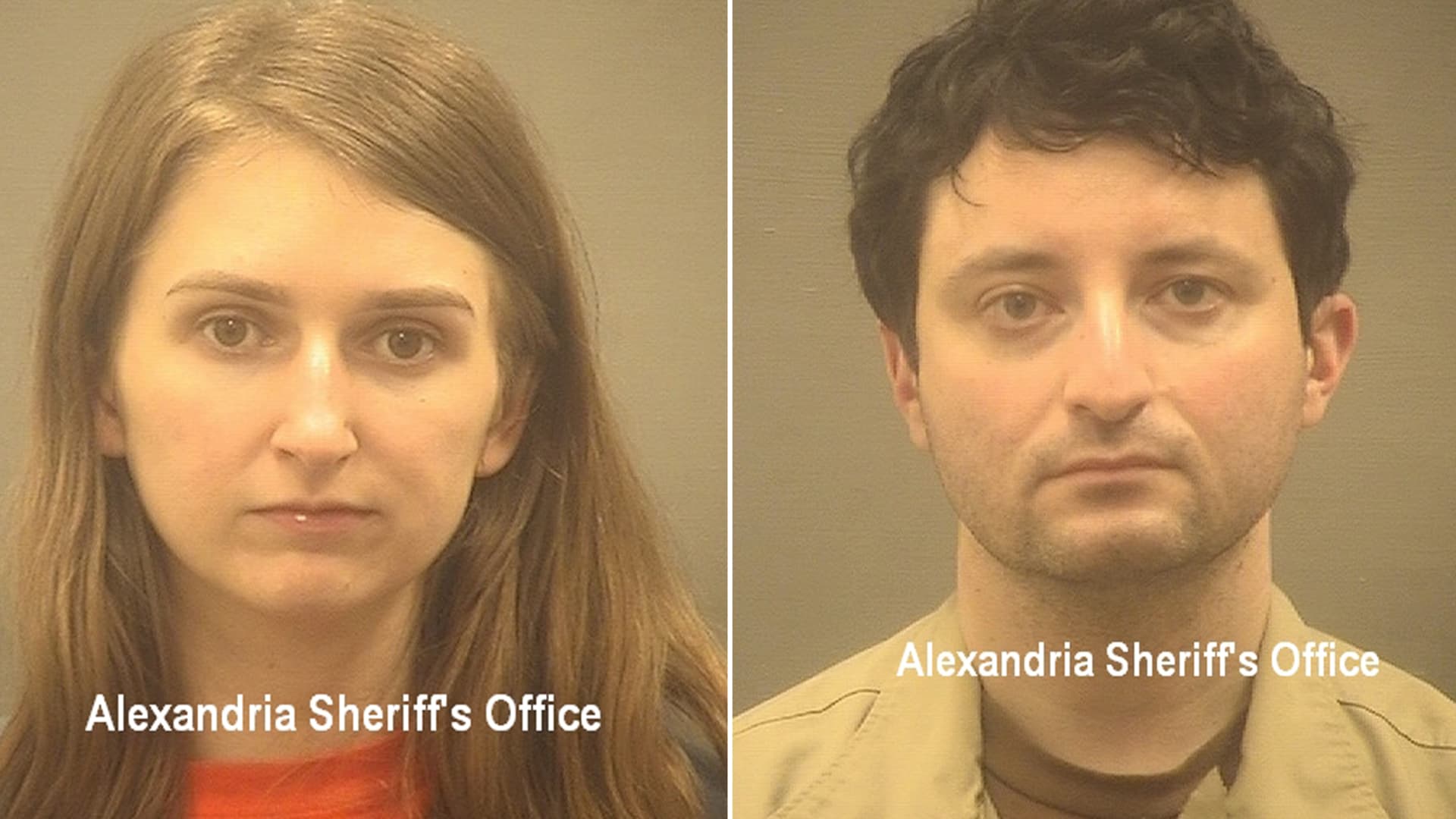

Ilya Lichtenstein has been sentenced to five years in a US prison for laundering proceeds from the 2016 Bitfinex cryptocurrency exchange hack, which involved the theft of nearly 120,000 bitcoin. The stolen bitcoin, initially worth $70 million, had increased to over $4.5 billion by the time of his arrest. Lichtenstein's wife, Heather Morgan, who used the alias Razzlekhan, also pleaded guilty to conspiracy to commit money laundering and is awaiting sentencing. The case resulted in the largest financial seizure in the US Department of Justice's history, recovering $3.6 billion in assets.