Bitcoin's Record Drop: ETF Enthusiasm Tested as Outflows Hit New High

TL;DR Summary

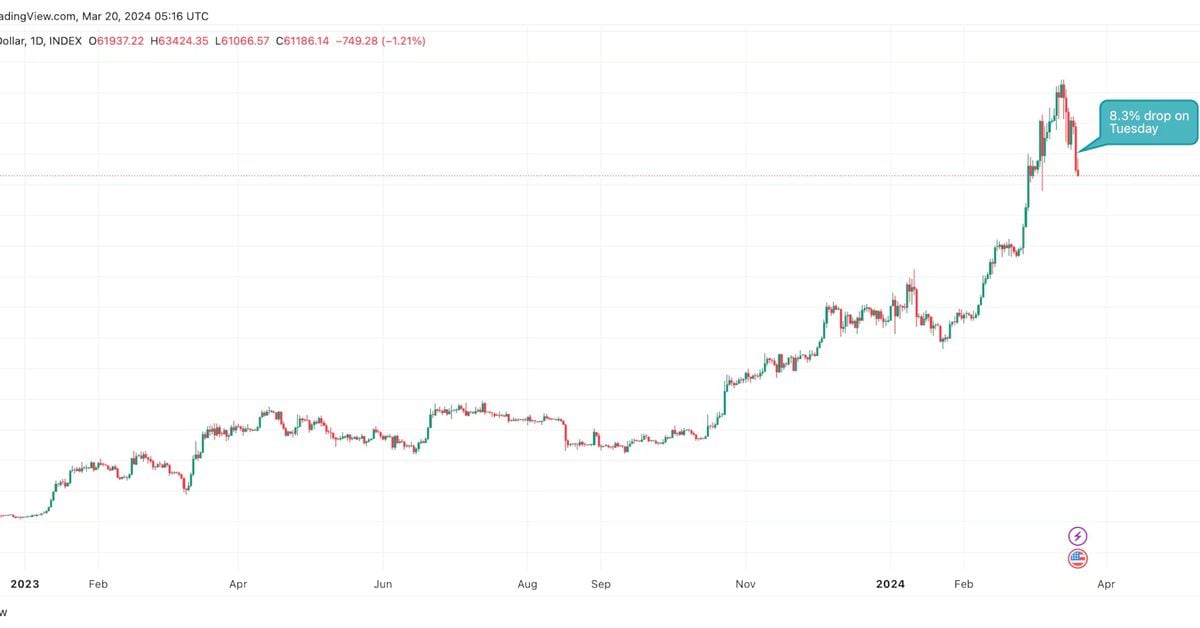

Bitcoin's price dropped over 8% to under $62,000, marking the biggest single-day percentage decline since November 2022, attributed to outflows from U.S.-listed spot exchange-traded funds (ETFs). Web3 gaming developer platform Immutable and venture capital company King River Capital have formed a $100 million "Inevitable Games Fund" to target high-growth opportunities in Web3 gaming. Investment management giant BlackRock has created a fund called the BlackRock USD Institutional Digital Liquidity Fund in partnership with asset tokenization firm Securitize, potentially related to the tokenization of real-world assets.

- First Mover Americas: BTC's Drop Below $62K Is the Biggest Single-Day Loss Since FTX’s Collapse CoinDesk

- Bitcoin's Slump Is the First Test for ETF Enthusiasm, What's Next for Cryptos. And 5 Other Things to Know Before Markets Open. Barron's

- Bitcoin tumbles from record high as Grayscale ETF outflows hit $12bn Financial Times

- Cheatsheet: Grayscale's bitcoin outflows hit a new record Blockworks

- BTC price dip hits 17.5% as week's Bitcoin ETF net outflows near $500M Cointelegraph

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

2 min

vs 3 min read

Condensed

84%

510 → 84 words

Want the full story? Read the original article

Read on CoinDesk