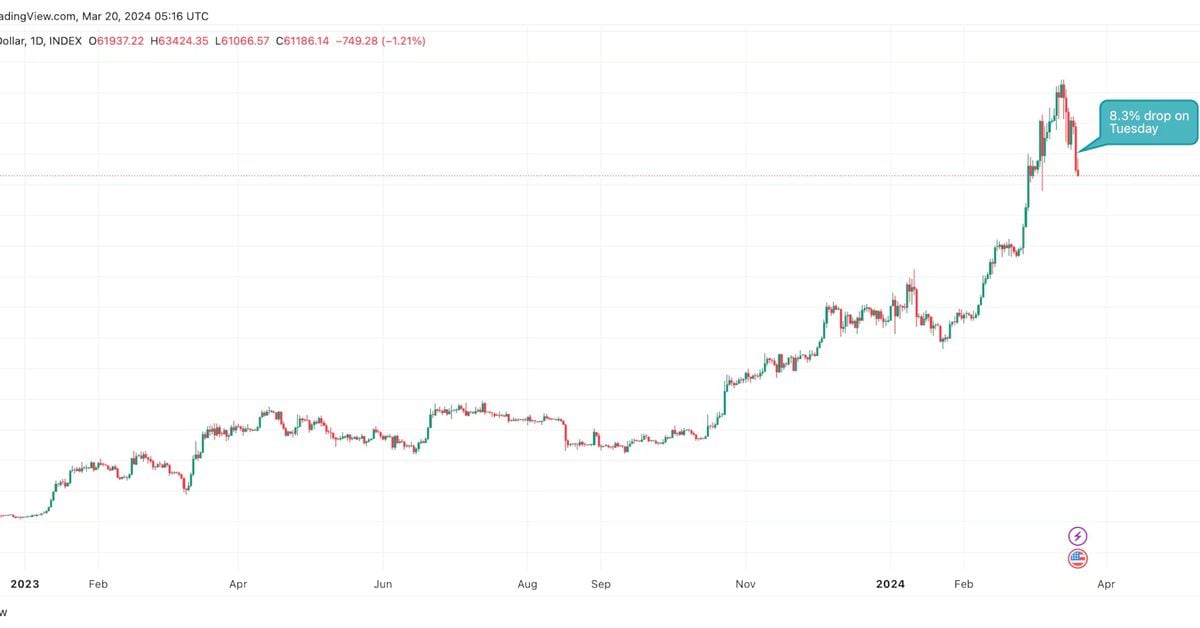

Bitcoin Volatility Surges Amid Hot Inflation Data and Whales' Buying Spree

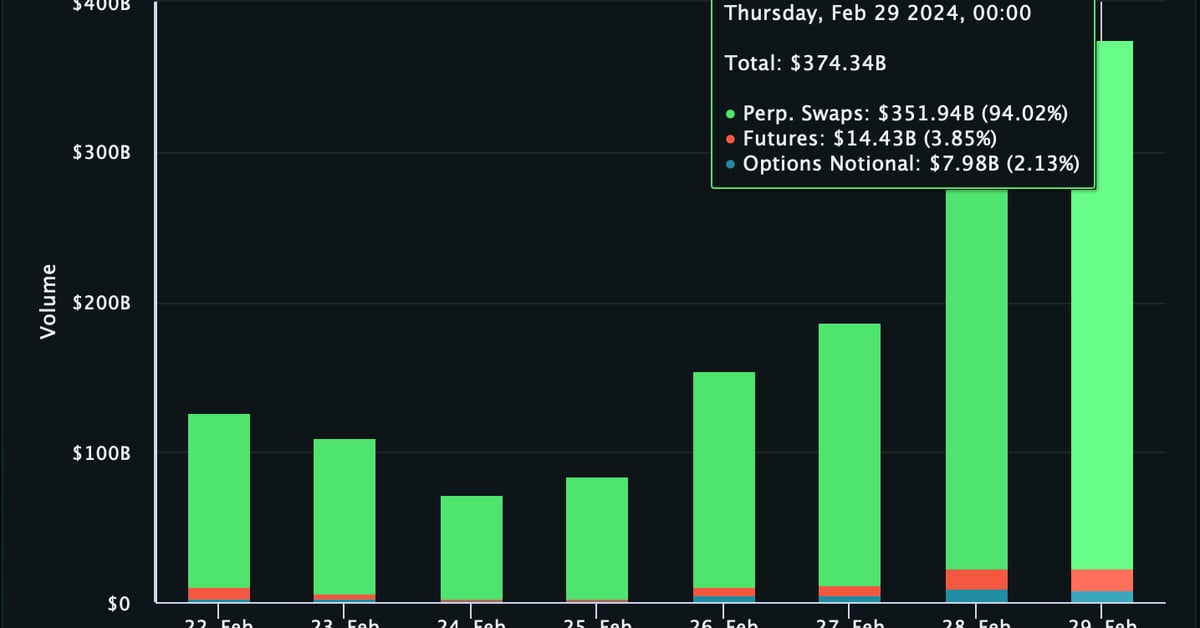

Bitcoin experiences volatility following the release of hot inflation data, leading to expectations of a rate cut in September, as discussed on CNBC Crypto World. Ari Juels, chief scientist at Chainlink Labs, addresses misleading narratives surrounding the convergence of AI and blockchain technology.