Rural Towns Struggle with Healthcare Access After Clinic Closures

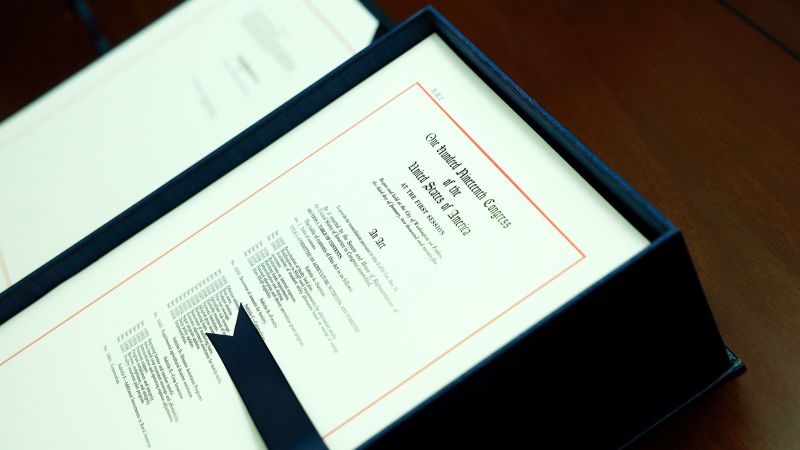

The rural town of Churchville, Virginia, lost its local health clinic due to healthcare provisions in Trump's legislation, highlighting challenges in rural healthcare access and political divides, with residents and local leaders discussing the impact and potential solutions.