Tesla Challenges DMV Over Autopilot Advertising Decision

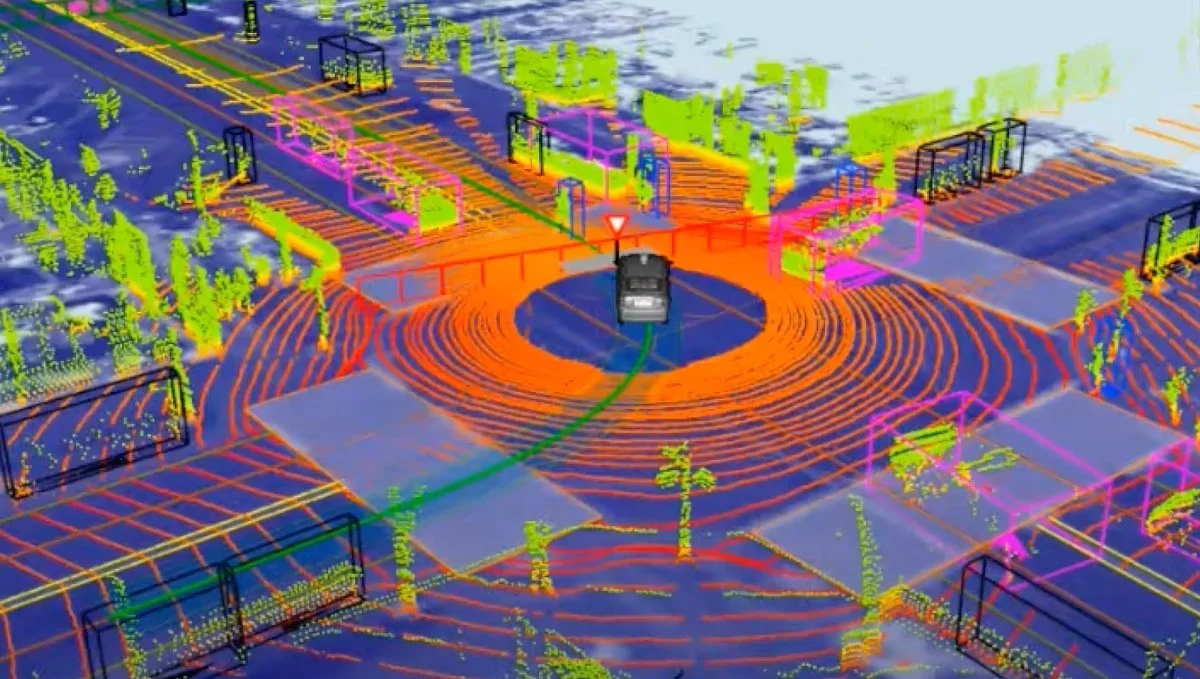

Tesla has filed a California lawsuit to overturn a DMV ruling that labeled its Autopilot and Full Self-Driving labels as false advertising. The company had already adjusted branding—removing Autopilot from some listings and converting FSD to a subscription—while contending the names aren’t unambiguously false and that consumers understand their meaning. The DMV said it did not suspend Tesla’s license after the changes, but Tesla argues it didn’t receive due process in the hearings, highlighting the broader debate over how ADAS features are marketed in California.