IQM eyes US SPAC listing at $1.8B to accelerate Europe’s quantum push

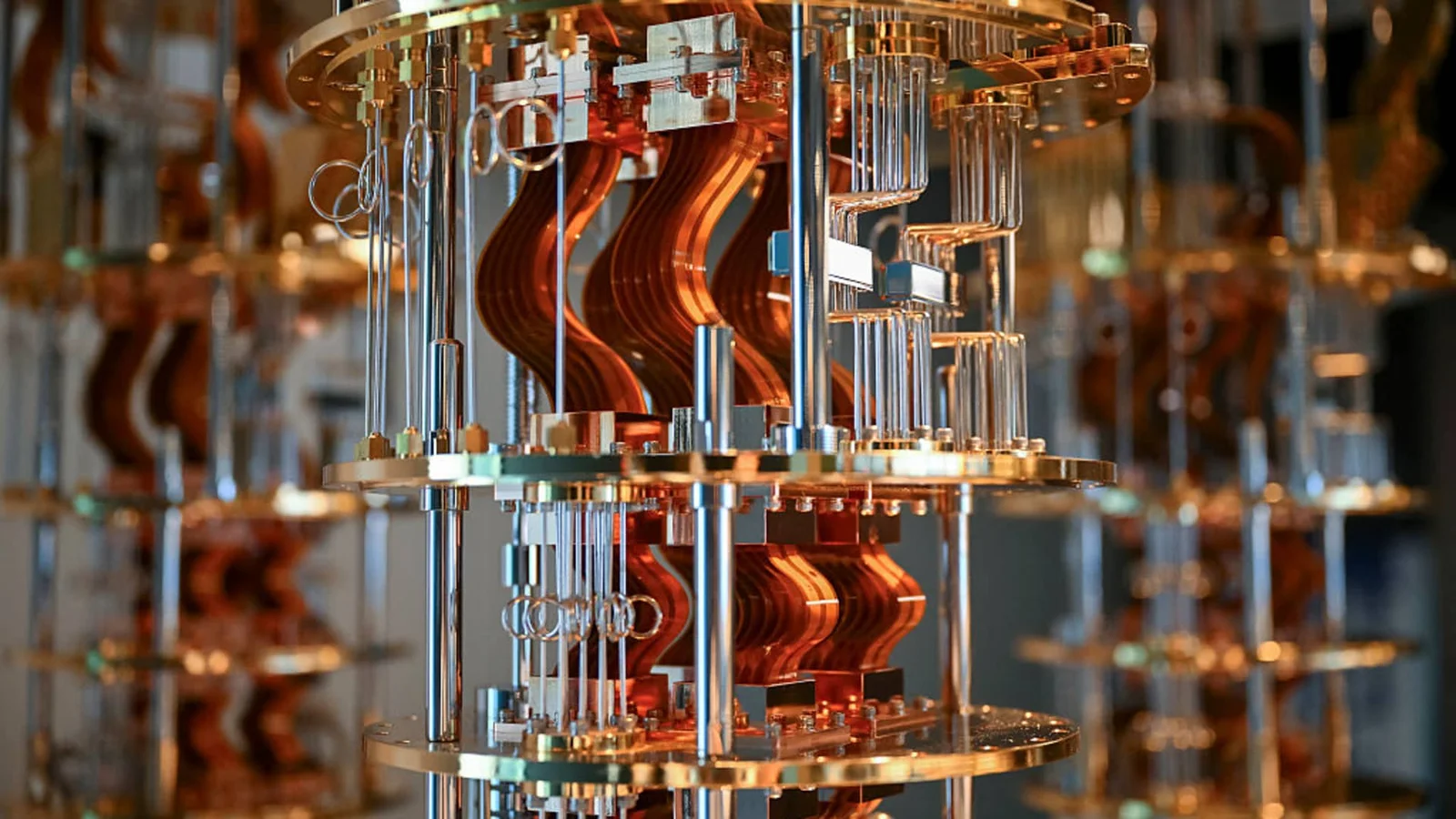

Finland’s IQM unveiled plans to become one of Europe’s first publicly listed quantum companies by merging with Real Asset Acquisition Corp in a US SPAC deal that values IQM at about $1.8 billion, with a potential June close and a dual Helsinki listing on the table. The transaction could bring more than $300 million in funding as IQM scales its open-architecture quantum systems, after selling 21 quantum units to 13 customers and reporting at least $35 million in unaudited revenue for 2025.