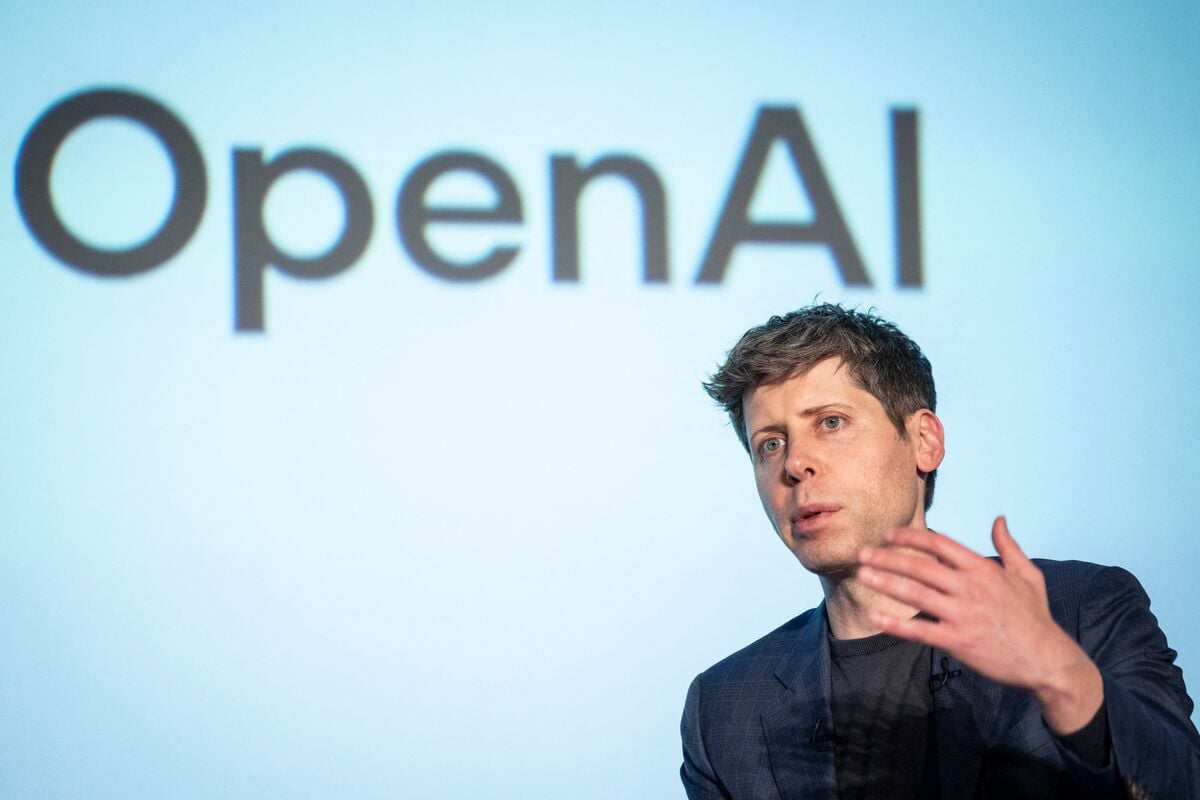

OpenAI Achieves $500B Valuation After Share Sale

OpenAI has completed a secondary share sale valuing the company at $500 billion, making it the world's most valuable startup and surpassing SpaceX, with major investors including SoftBank and others, amid high investor demand for AI technologies.