Altria Bets on Progressive Dividend Growth After Q4 Slump

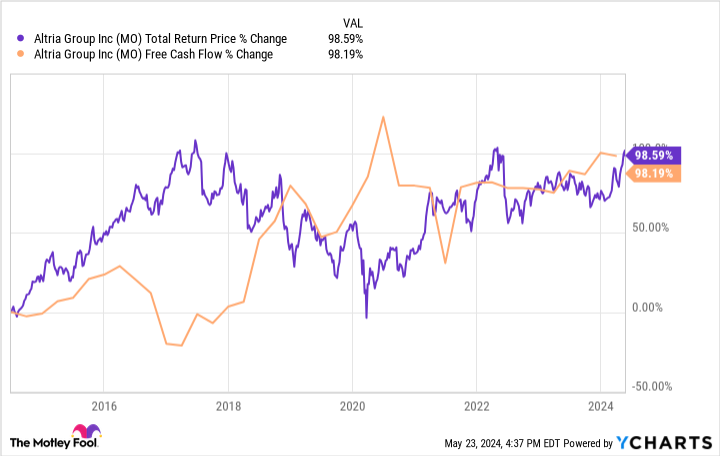

Altria reported a Q4 revenue miss with a 2.1% drop to $5.8B driven by weaker smokeables, though oral tobacco pricing rose. The company guides 2026 EPS growth of 2.5%–5.5% and a mid‑single‑digit CAGR through 2028, with dividend per‑share growth keeping its long track record of regular increases. Risks include declining cigarette shipments and competition from illicit e‑vapor products, amid only modest near‑term EPS growth.