ASML's AI-driven growth amid mixed China outlooks

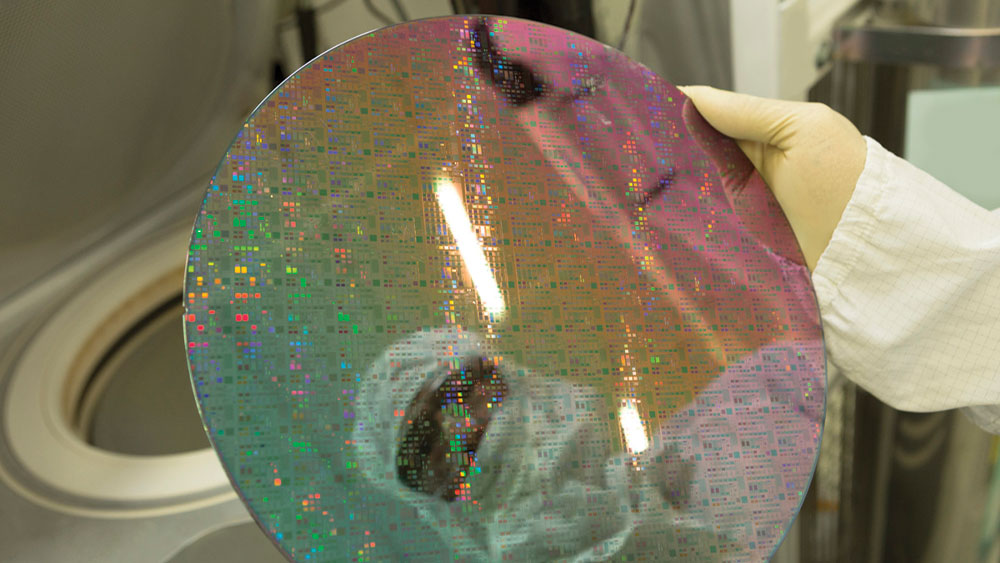

Despite missing revenue expectations, ASML remains a favored stock in the AI sector due to its critical role in semiconductor manufacturing, which is essential for AI development.

All articles tagged with #semiconductor equipment

Despite missing revenue expectations, ASML remains a favored stock in the AI sector due to its critical role in semiconductor manufacturing, which is essential for AI development.

The US is tightening restrictions on SK Hynix and Samsung by revoking their exemptions to buy US semiconductor equipment for China, requiring new licenses for future purchases, which may impact their operations and the global semiconductor supply chain, while potentially benefiting Chinese and US competitors like Micron.

Applied Materials shares surged 13% in premarket trading after the semiconductor equipment supplier issued an optimistic second-quarter forecast, driven by strong demand for AI-enabled chips and improvements in electronics end-markets. The company expects second-quarter revenue of $6.5 billion, plus or minus $400 million, and adjusted profit per share of $1.79 to $2.15, surpassing market expectations. Analysts highlighted the company's diversified portfolio and potential for further gains, leading to a rise in stock price and positive outlook.

Lam Research's stock has reached new all-time highs due to its strong performance in the semiconductor equipment sector, particularly in etch, deposition, and packaging techniques essential for AI chipmaking. The company's forecasted recovery is driven by the continued growth of new AI applications, which require its expertise. Additionally, Lam's focus on R&D investments and AI-powered services positions it well for the AI era, making its recent share price spike well-deserved and potentially sustainable.

Nvidia investors received positive news about the company's AI chips for 2024, as discussed in a recent video by The Motley Fool. While the stock wasn't included in the top 10 stock picks by The Motley Fool's Stock Advisor team, the video provides insights for potential investors and offers a special offer link for further information.

The demand for AI hardware is expected to outstrip supply in 2024, impacting companies like Nvidia. A video discussing this news and its effects on semiconductor equipment companies was published on Jan. 18, 2024, with after-market stock prices used. Additionally, it's noted that Randi Zuckerberg, a former Facebook director, is a member of The Motley Fool's board of directors, and Jose Najarro, who has positions in several tech companies, is affiliated with The Motley Fool.

Semiconductor equipment vendor Applied Materials beat analyst estimates for its fiscal fourth quarter and provided a positive outlook for the current period. However, the company's stock fell after reports emerged of a U.S. criminal investigation into its exports to China's top chipmaker, SMIC. Applied Materials is being probed for potentially evading export restrictions by sending equipment to SMIC without proper licenses. The U.S. has restricted shipments of advanced semiconductors and chipmaking gear to China for national security reasons.

ACM Research, a semiconductor equipment supplier, exceeded Wall Street's earnings expectations for the third quarter but provided a lower sales outlook, causing its stock to fall. The company reported adjusted earnings of 57 cents per share on sales of $168.6 million, beating analysts' estimates. However, ACM Research's revenue guidance for the full year was narrowed to a range of $520 million to $540 million, down from the previous range of $515 million to $585 million. The stock fell 3.5% in morning trades.

Japan's export restrictions on advanced chip-manufacturing equipment, in line with U.S.-led efforts to hinder China's development of high-end semiconductors for military purposes, have taken effect. The move has triggered a backlash from China, which plans to curb exports of gallium and germanium, two rare earth metals crucial for chip production, next month. The United States had previously implemented export controls on high-end chips, urging Japan and the Netherlands to follow suit. Japan's list of restricted items now includes equipment for cleaning, checkups, and lithography, while the impact on domestic companies is expected to be limited.

Dutch semiconductor equipment maker ASML reported better-than-expected second-quarter earnings and raised its full-year sales forecast to 30% growth, citing strong demand from Chinese customers. The company's net profit rose 35% to 1.9 billion euros, while sales increased 28% to 6.9 billion euros. ASML dominates the market for lithography systems and is expanding production to meet customer demand. CEO Peter Wennink noted that chip makers using ASML's most advanced EUV systems are slowing down equipment delivery, while customers using slightly older DUV product line are still demanding every tool they can get. Despite export control rules and licensing requirements, ASML does not expect these regulations to impact its long-term financial forecasts.