Five Dividend Stocks to Buy for Steady Income Right Now

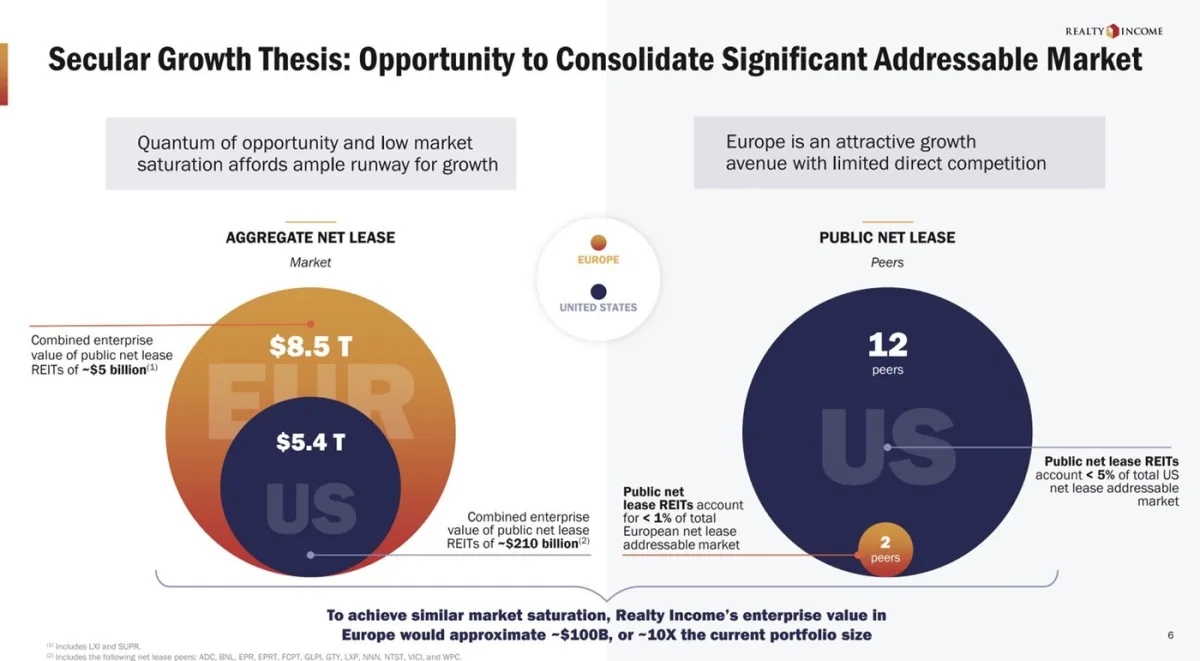

The piece highlights five dividend-oriented picks for income and defensiveness: PepsiCo (~3.5% yield) as a strong consumer-staples play; Pfizer (~6.3% forward yield) with a renewed pipeline and growth trajectory; Realty Income (REIT) with a ~5% yield and a monthly dividend backed by high occupancy; Verizon (~5.8% yield) for reliable income amid modest growth; and IBM (~2.6% yield) with a long dividend-raising streak and rising high-margin, recurring software/services revenue. The theme is income-focused, defensive exposure in a market wary of overvalued growth.