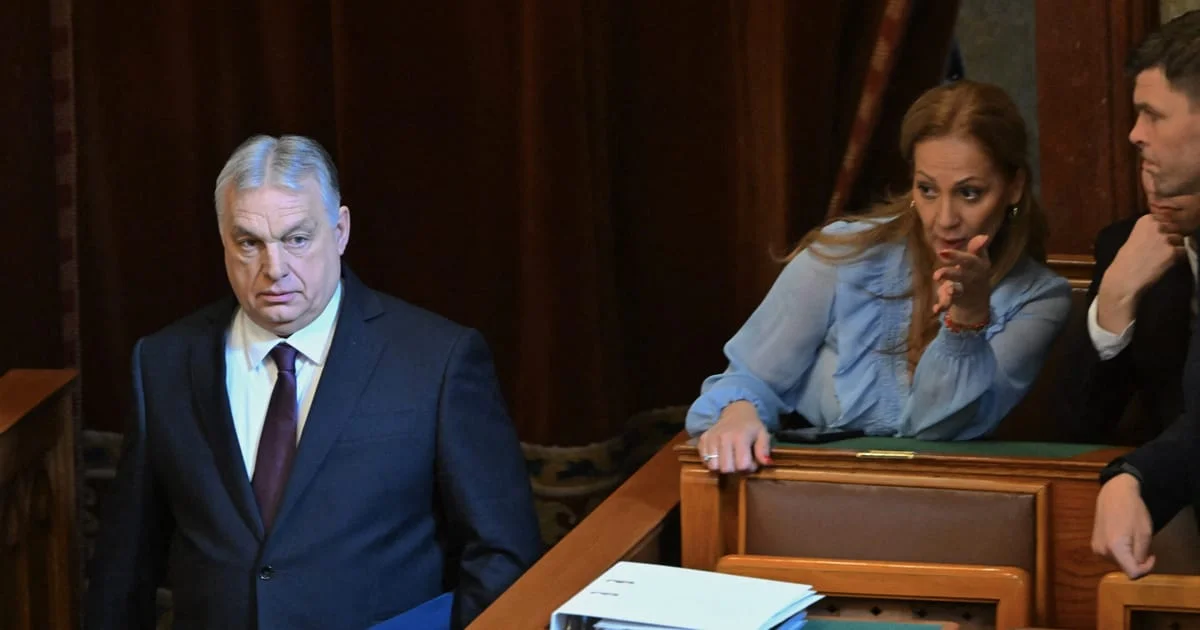

Orbán Deploys Troops to Shield Hungary’s Energy Grid Amid Kyiv Threat

Hungarian Prime Minister Viktor Orbán said Ukraine plans to sabotage Hungary’s energy system and ordered troops and police to guard critical energy facilities, escalating tensions ahead of the April parliamentary elections; he also blocked a €90 billion EU loan to Ukraine and imposed a border flight ban, while Kyiv reports the Druzhba pipeline damaged by a Russian airstrike and under repair.