"Realty Income: A Top Dividend Stock with Growth Potential and Attractive Valuation"

TL;DR Summary

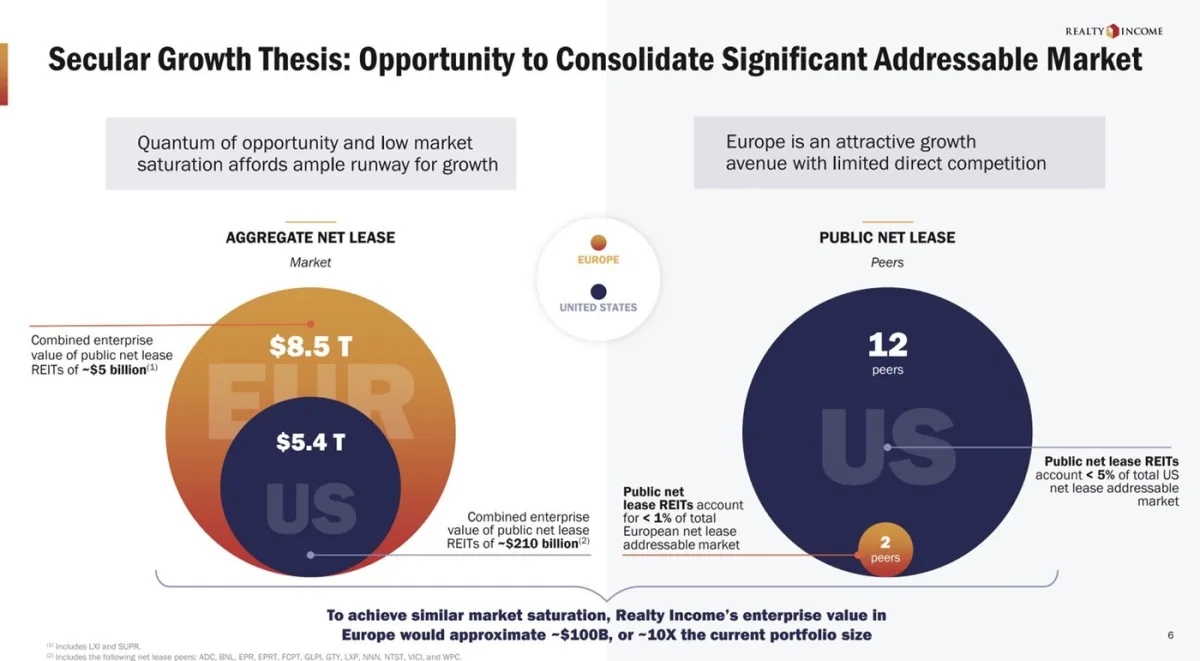

Realty Income, a leading real estate investment trust (REIT), is considered one of the best real estate dividend stocks to buy for several reasons. The company has a vast opportunity to consolidate the fragmented net lease real estate market, demonstrated success in deploying capital, deeper access to capital, increasing diversification of its real estate portfolio, and a differentiated platform leveraging its extensive expertise and data. With a strong track record and the ability to capitalize on a growing investment opportunity, Realty Income is positioned as a top-performing REIT with potential for long-term growth and steadily rising dividends.

- 5 Reasons Why Realty Income Is the Best Real Estate Dividend Stock to Buy Yahoo Finance

- Realty Income: Growth Will Be Tough But Valuation And Dividend Yield Makes Them Attractive Seeking Alpha

- 1 Beaten-Down S&P 500 Dividend Stock to Buy on the Dip and Hold Forever The Motley Fool

- Realty Income Q4: O, O, O, It's Magic, You Know (NYSE:O) Seeking Alpha

- Realty Income: The Wrong And The Right Reasons To De-Emphasize This REIT (NYSE:O) Seeking Alpha

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

5 min

vs 6 min read

Condensed

91%

1,044 → 97 words

Want the full story? Read the original article

Read on Yahoo Finance