Paramount Seizes WB Discovery, Redrawing Hollywood Power After Netflix Walks

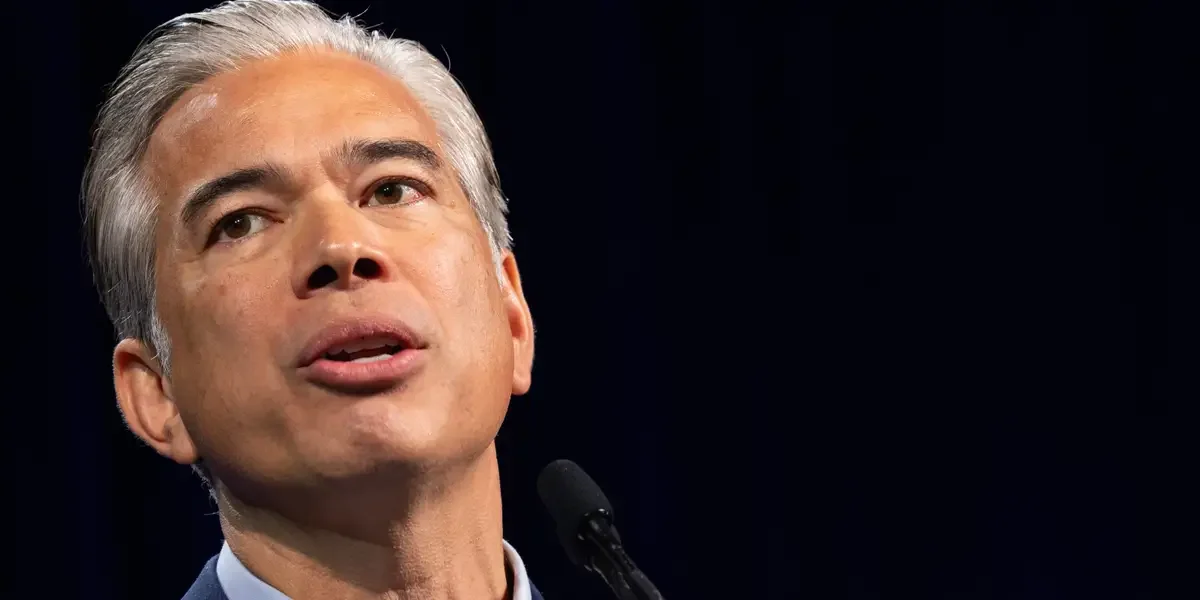

Paramount Skydance’s $31-per-share bid to acquire Warner Bros. Discovery topped Netflix’s $27.75 offer, prompting Netflix to walk away and secure a $2.8 billion breakup fee. The deal, backed by Larry Ellison, hinges on regulatory approval and Paramount’s ability to de-leverage a massive debt load, signaling a dramatic reordering of Hollywood’s studios and streaming landscape.