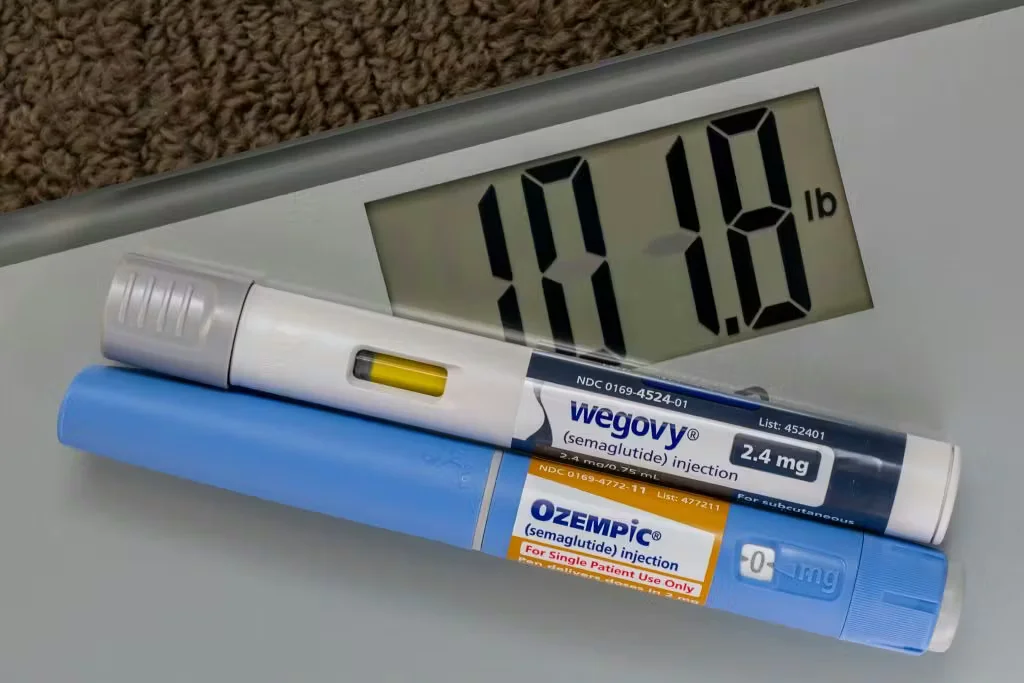

Novo Nordisk targets Hims with lawsuit over cheap Wegovy copycats

Novo Nordisk filed a lawsuit seeking a permanent ban and damages against Hims & Hers for allegedly selling compounded, patent-infringing versions of Wegovy (semaglutide); Hims paused its obesity-pill copycat after regulatory scrutiny as FDA actions loom, underscoring a broader crackdown on compounded GLP-1 drugs used by as many as 1.5 million Americans amid intense obesity-drug competition.