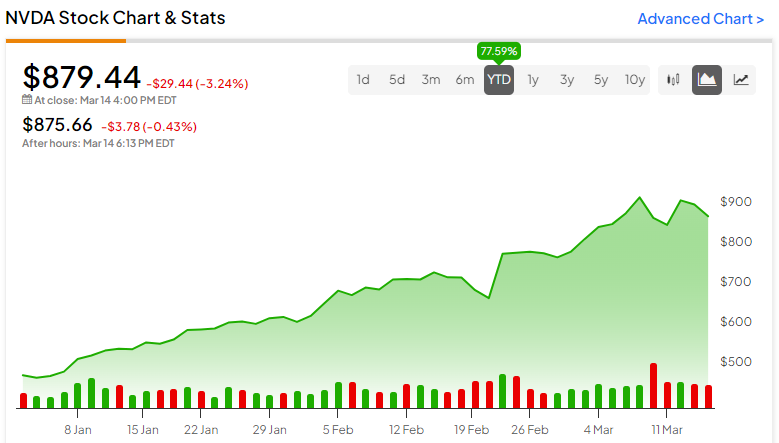

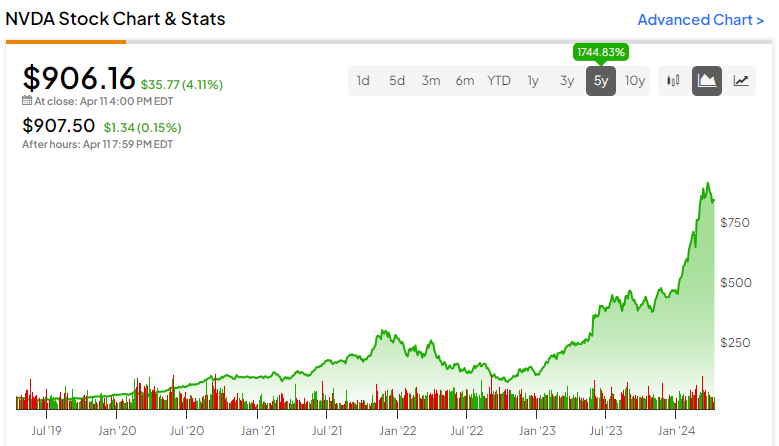

"Nvidia's Cyclical Nature and AI Dominance: Stock Outlook and Potential for $1,000 Share Price"

Nvidia's stock is trading at high multiples despite potential cyclical risks, with the company's rapid profit growth and high margins possibly nearing a peak. Increased competition and potential economic weakness could impact Nvidia's future earnings, while the semiconductor industry's surge in investment and competition pose additional challenges. Analysts remain bullish on the stock, but some caution that Nvidia's position may resemble Intel's during the dot-com bubble, with potential for a similar downturn in the future.