"Nvidia's Stock Price: Analyzing the Future Amid Market Gains and AI Chip Shifts"

TL;DR Summary

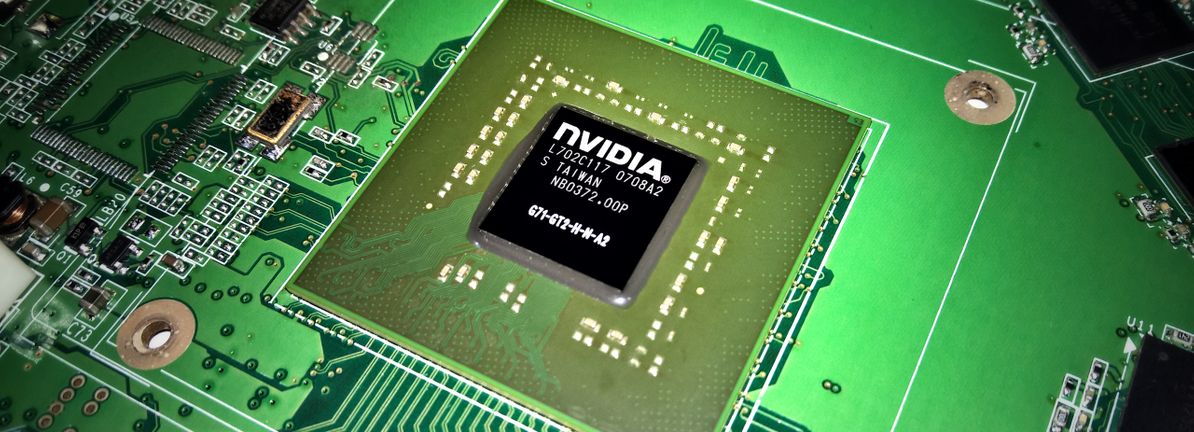

NVIDIA Corporation's stock price has surged, trading close to its 52-week high, leading to questions about whether it's still a bargain. Analysis suggests that the stock is currently expensive based on its price-to-earnings ratio compared to the industry average, indicating potential overvaluation. While the company's future earnings are expected to double, shareholders may consider selling if they believe the stock should trade below its current price, while potential investors may want to wait for a price drop. It's important to consider the risks and other factors before making any investment decisions.

- What Does NVIDIA Corporation's (NASDAQ:NVDA) Share Price Indicate? Yahoo Finance

- Can Nvidia's stock price keep soaring beyond $788? One top analyst sees a bubble Fortune

- Nvidia Stock Gains as $2 Trillion Market Value Remains in Sight Barron's

- How a Shifting AI Chip Market Will Shape Nvidia's Future The Wall Street Journal

- Nvidia Earnings Valuation Stock Market Performance Charts Morningstar

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

3 min

vs 4 min read

Condensed

87%

688 → 91 words

Want the full story? Read the original article

Read on Yahoo Finance