GM's 2025 Stock Surge Outpaces Rivals Amid Strong Performance and Market Shifts

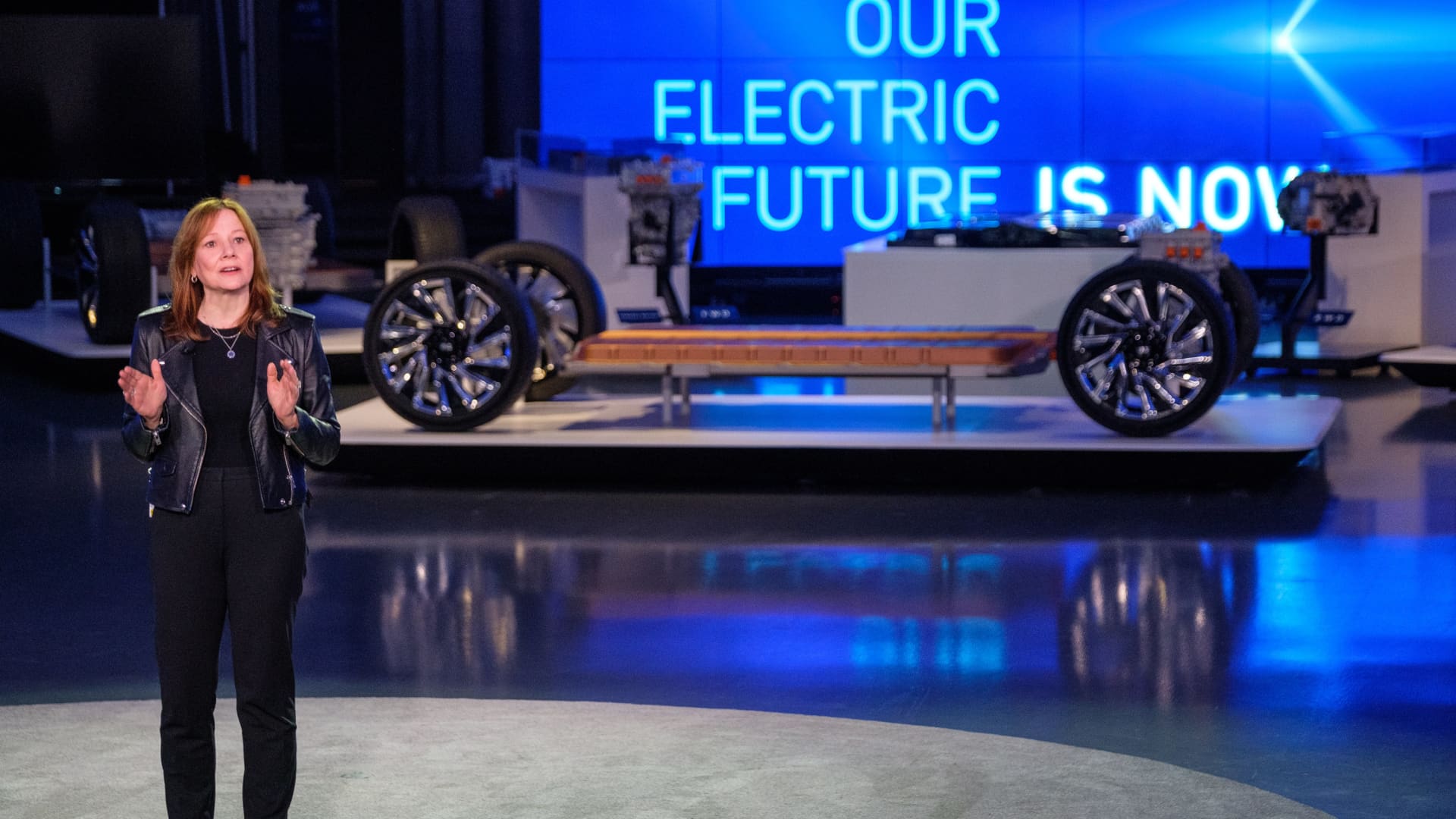

General Motors' stock has surged over 55% in 2025, making it the top-performing U.S.-traded automaker stock of the year, driven by strong earnings, strategic stock buybacks, and favorable regulatory changes, outperforming Tesla, Ford, and others.