India's Weight-Loss Drug Boom: Risks, Costs, and Cautions

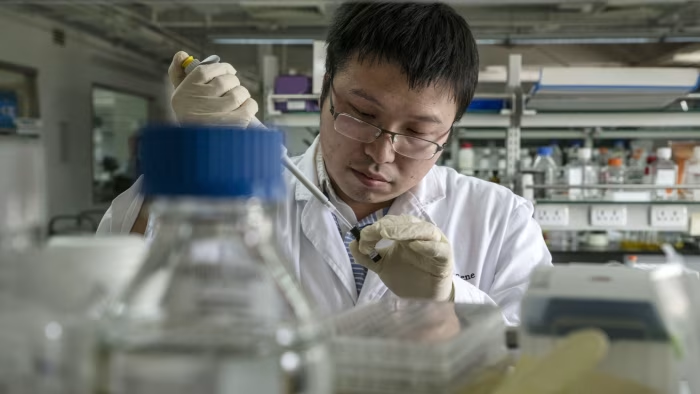

India's anti-obesity drug market has grown significantly, driven by demand for powerful GLP-1 drugs like Rybelsus, Wegovy, and Mounjaro, originally developed for diabetes but now popular for weight loss. While these drugs show promising results, concerns about misuse, side effects, and the importance of lifestyle changes remain. Experts warn against using these medications solely for cosmetic purposes and emphasize that obesity is a chronic disease requiring comprehensive treatment.