US Housing Market Hits 5-Year Low Amid Economic Uncertainty

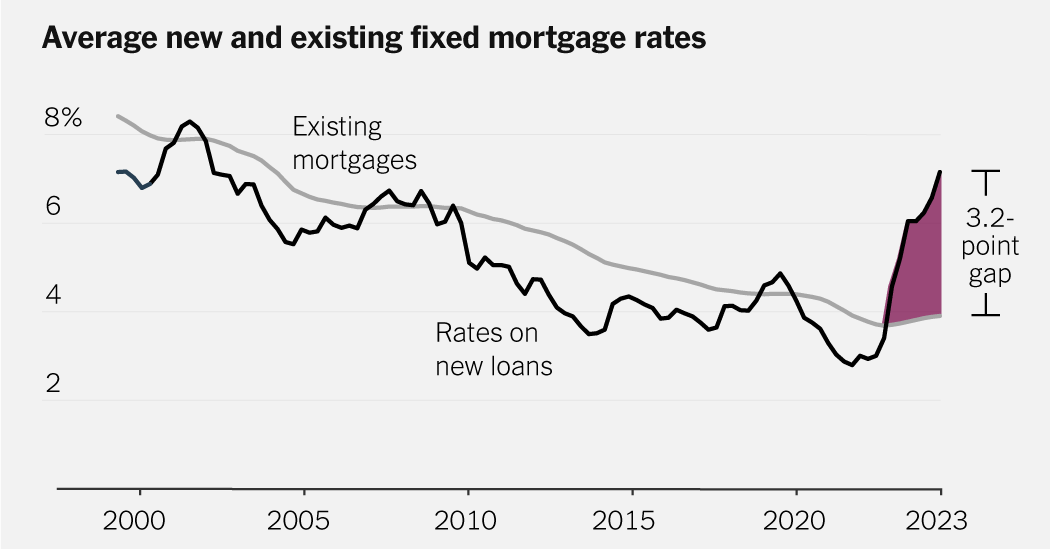

The US housing market remains sluggish despite the peak buying season, due to high mortgage rates, persistent high home prices outpacing wage growth, and a rate lock-in effect where homeowners with low rates are reluctant to sell. This has led to decreased contract activity and a standstill in market momentum, with little expectation of rate reductions soon.