"Homeowners Clinging to Low Mortgage Rates Impact Housing Markets"

TL;DR Summary

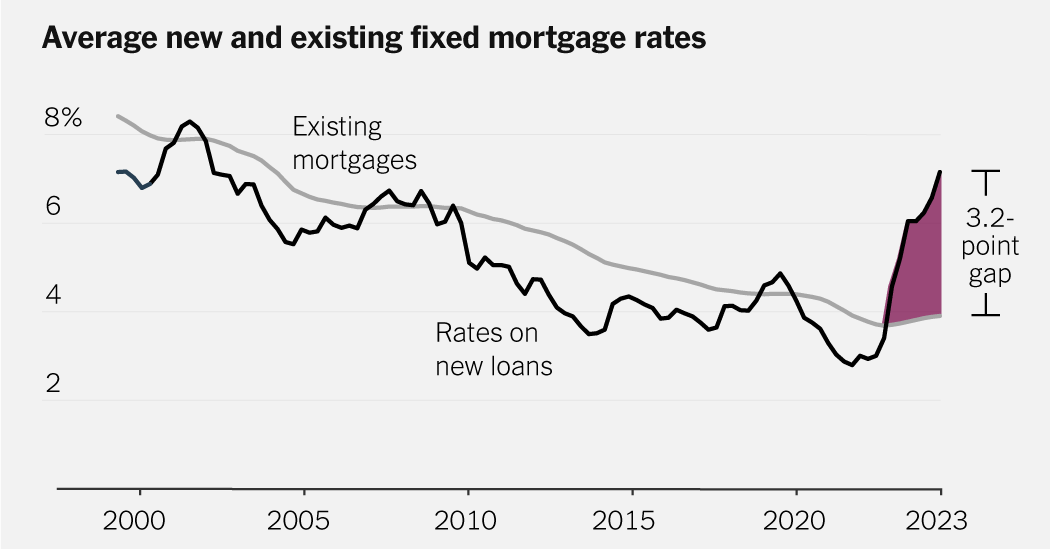

Due to a significant gap between current fixed mortgage rates and the rising market rates, many American homeowners are finding themselves stuck in their homes, unable to move due to the financial implications. This "lock-in effect" has led to approximately 1.3 million fewer home sales in the U.S. and has disrupted the housing market. While those who secured low rates during the pandemic benefit, others are unable to relocate for better opportunities or open up homes for first-time buyers, contributing to market stagnation and rising prices.

Topics:business#federal-housing-finance-agency#homeowners#housing-market#lock-in-effect#mortgage-rates#real-estate

- A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up The New York Times

- The only housing markets with fresh supply are those loaded with baby boomers who are unbothered by higher mortgage rates Yahoo Finance

- The only housing markets getting fresh supply have a 'disproportionately higher' number of homeowners who aren't clinging to low mortgage rates Fortune

- Some Homeowners Can't Bear To Let Go of Low Mortgage Rates, Even When They Move Investopedia

- Boomers in Pittsburgh are least likely to be locked-in by mortgage rates, among major metros By Investing.com Investing.com Nigeria

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

2 min

vs 2 min read

Condensed

78%

388 → 86 words

Want the full story? Read the original article

Read on The New York Times