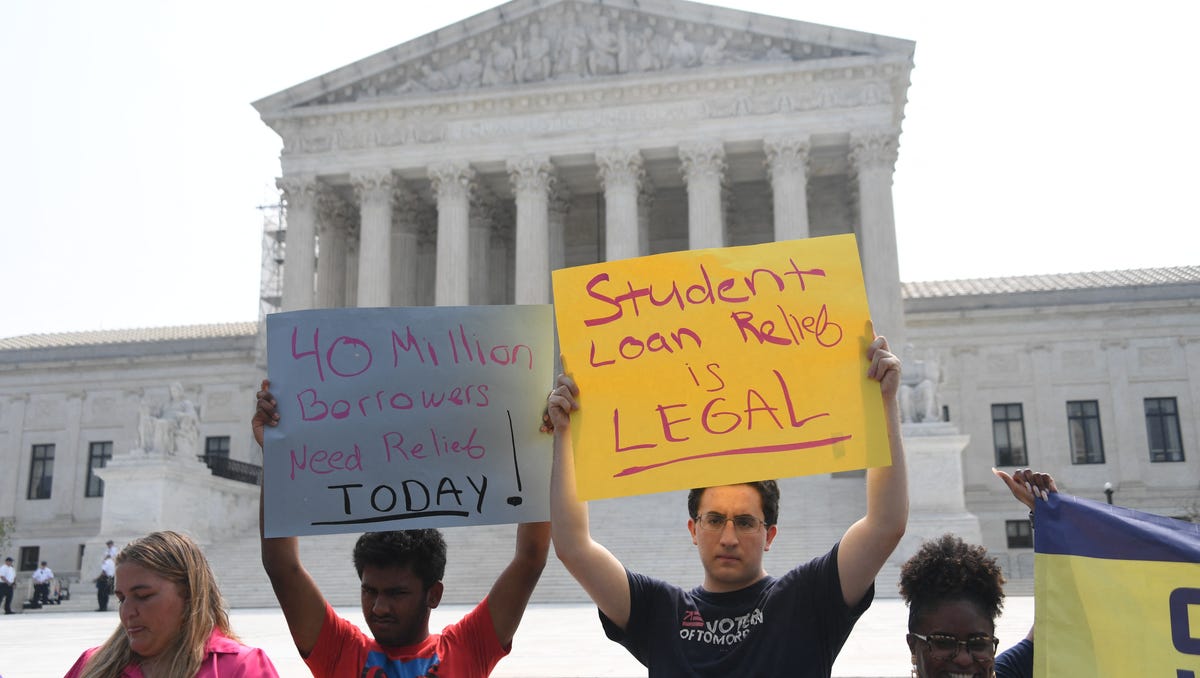

"Republican-Led States Sue to Halt Biden's Student Loan Forgiveness Plan"

Several Republican-led states, including Kansas and 10 others, have filed a lawsuit against the Biden administration over its income-driven SAVE Repayment Plan for student loans, claiming it exceeds presidential authority and unfairly benefits higher-income individuals. The plan, rolled out in August, calculates repayments based on income and family size and provides early debt forgiveness for certain borrowers. The lawsuit argues that the plan is similar to a previous student loan forgiveness plan that was deemed illegal by the Supreme Court. However, research suggests that lower- and middle-income borrowers stand to benefit from loan forgiveness, and it could help address wealth disparities.