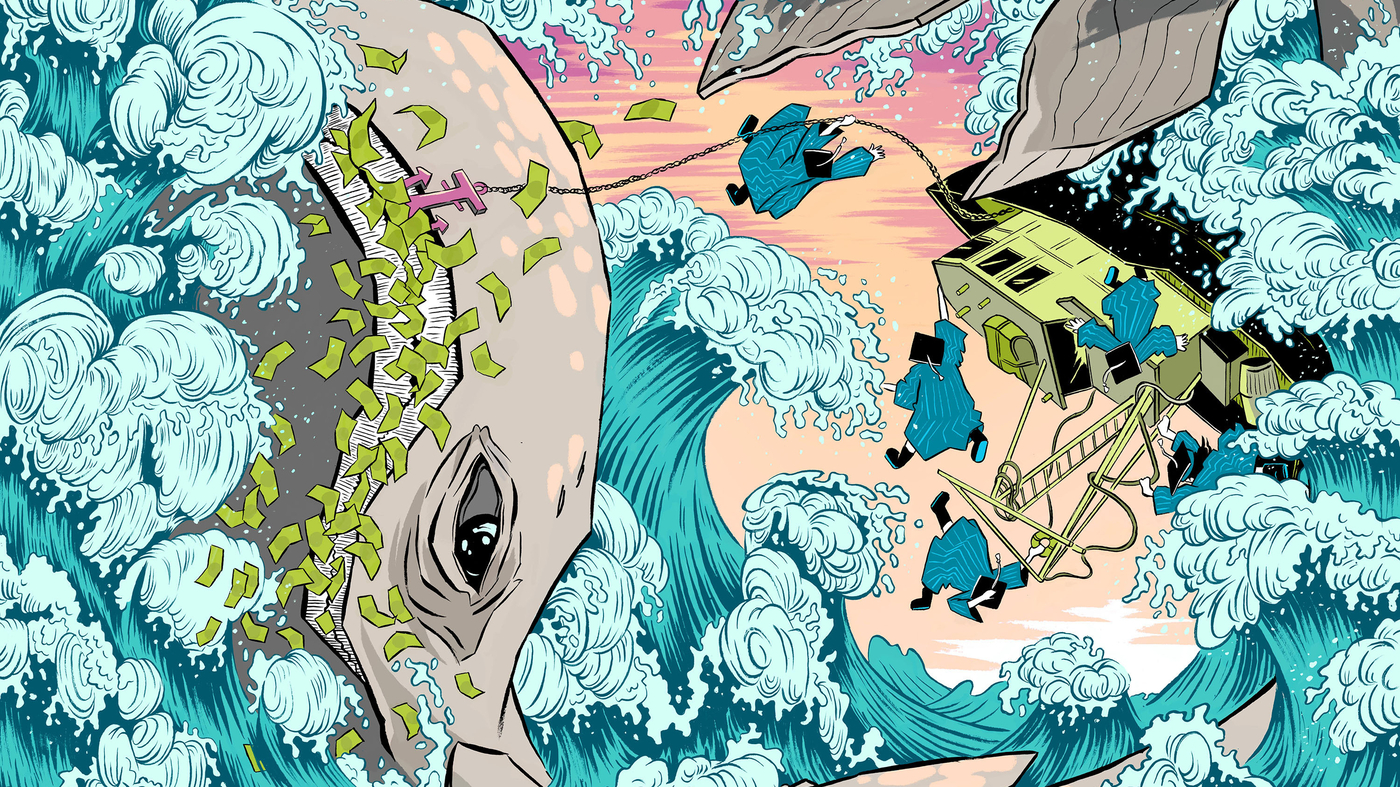

"2023 Reveals Hope for Student Loan Forgiveness and Extended Debt Relief"

Despite the Supreme Court ruling against President Biden's proposal to forgive student loan debt, student loan forgiveness is not entirely dead. The U.S. Education Department is exploring other legal avenues to cancel student debts, albeit on a smaller scale. Additionally, the Biden administration has introduced new repayment plans, such as the Saving on a Valuable Education (SAVE) program, which offers more generous terms and multiple windows for loan forgiveness. However, the implementation of these changes is hindered by budget cuts and a lack of funding, leading to challenges in assisting borrowers and implementing other initiatives, such as overhauling the Free Application for Federal Student Aid (FAFSA).