Markets Rise, Speech Represses: Hong Kong’s Delicate Balance

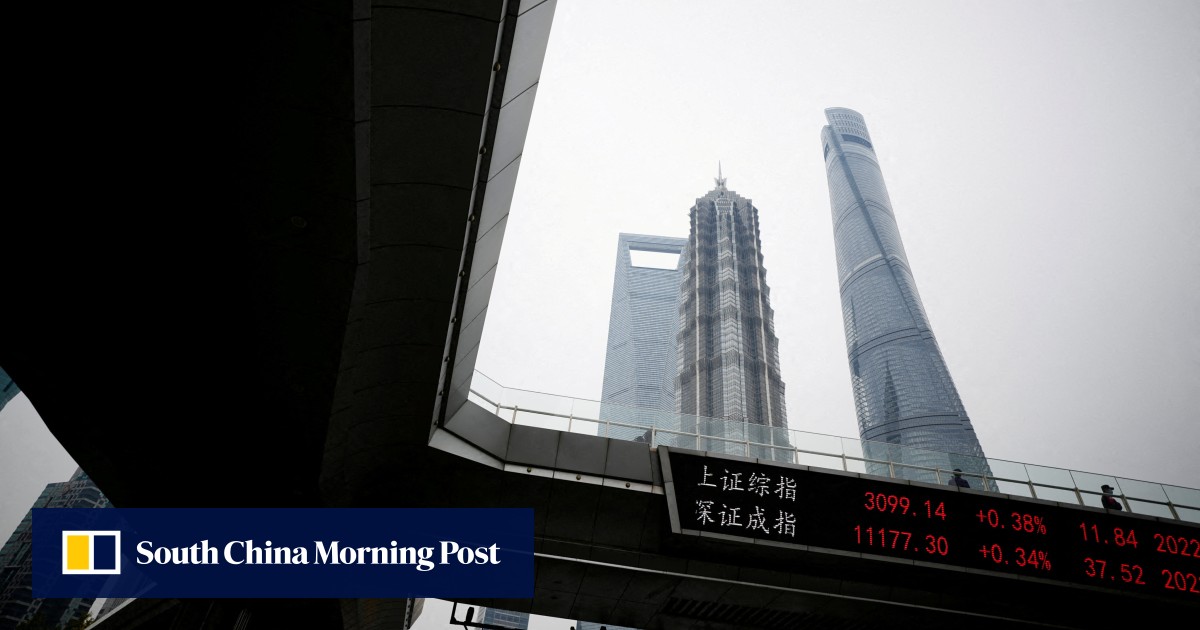

Hong Kong’s stock market remains buoyant even as Beijing tightens control on speech, highlighting a paradox about Friedman’s view that free markets rely on free expression. The 20-year sentence for Jimmy Lai and the National Security Law have chilled reporting and led to self-censorship and restricted access to sensitive topics, while markets benefit in the short term from capital flows; the piece argues that Hong Kong’s long-term prospects depend on whether political freedoms can keep pace with market freedoms, making it a real-world test of Friedman’s thesis.