Navigating Uncertainty: Portfolio Strategies and Unexpected Events in 2026

UBS provides strategies for investors to prepare their portfolios for potential shocks and growth opportunities in 2026, emphasizing diversification and risk management.

All articles tagged with #growth opportunities

UBS provides strategies for investors to prepare their portfolios for potential shocks and growth opportunities in 2026, emphasizing diversification and risk management.

Alphabet faces increasing regulatory pressures and other risks that threaten its business model and growth prospects, leading to a recommendation to sell its stock.

Energy Transfer, an integrated midstream company, has been increasing its distribution every quarter since the start of 2022, with approximately 90% of its 2024 earnings projected to come from fee-based activities. The company's growth opportunities include spending on growth capex and a strong backlog of projects, positioning it to continue growing its distribution over the next several years. Despite past challenges, Energy Transfer's distribution is well covered by its cash flow, and it is considered one of the cheapest large-cap stocks in the midstream sector, with potential for price upside.

The Motley Fool discusses the potential for Intel's stock price to soar due to numerous growth opportunities and catalysts, recommending it as a semiconductor stock to consider. The video was published on Feb. 19, 2024, and includes updates impacting Intel's stock.

JPMorgan Chase & Co. plans to increase its workforce this year, citing growth opportunities in dealmaking, US wealth management, international retail banking, and its payments division, according to President Daniel Pinto at the World Economic Forum in Davos. This move contrasts with recent job cuts by other Wall Street firms.

Microsoft, one of the top-performing tech stocks in the Dow Jones Industrial Average this year, is poised to continue its success in 2024. The company's focus on integrating artificial intelligence (AI) into its existing solutions has proven to be effective, with AI tools like Copilots increasing developer productivity by up to 55%. Microsoft's diverse range of products and services allows it to monetize AI across various markets and cater to different audiences. With strong cash flow, the ability to absorb mistakes, and a deep understanding of consumer needs, Microsoft is positioned as a medium-risk/high-potential reward AI stock that could outperform the market in the coming years.

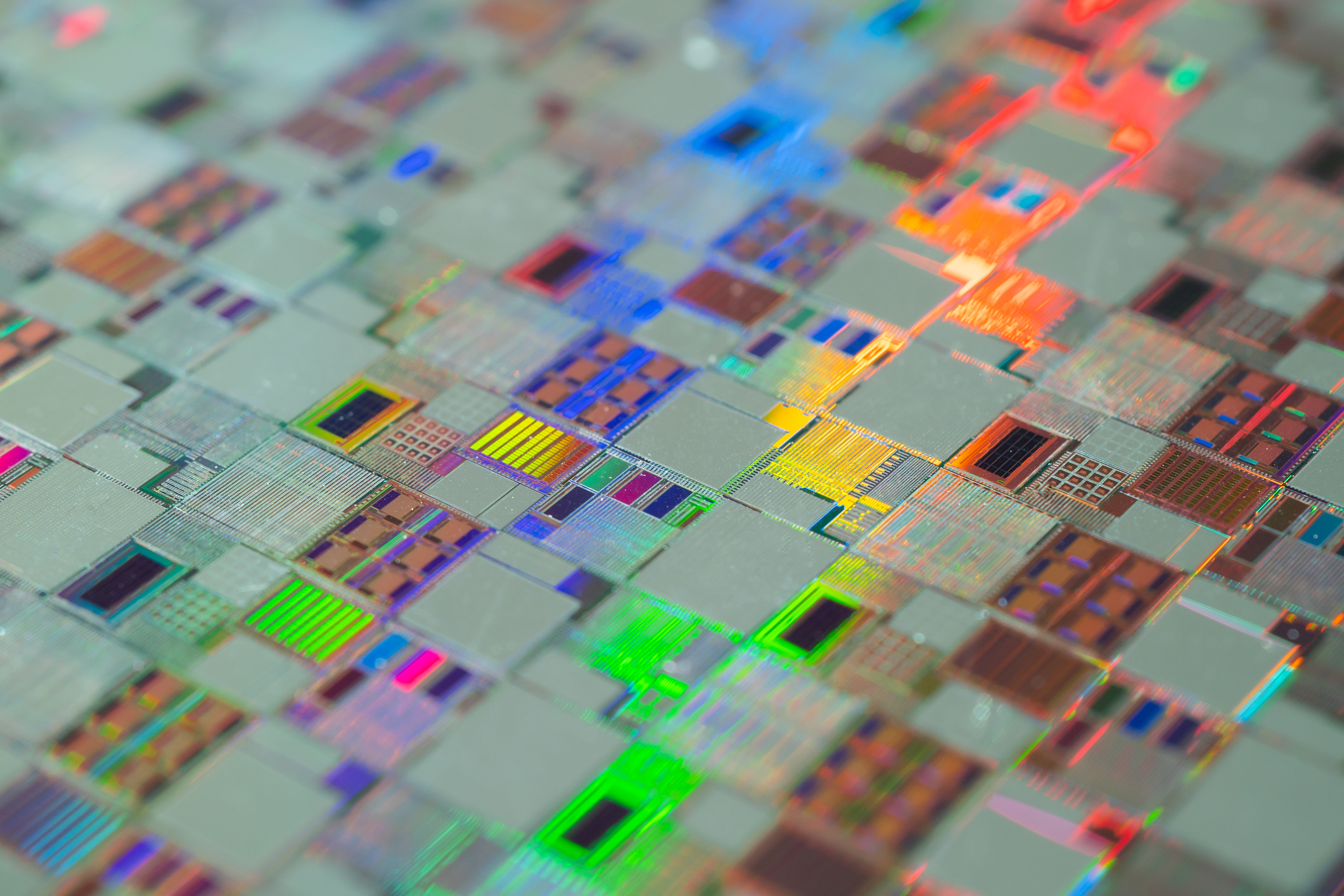

Investors looking for growth opportunities in the stock market beyond this year's "Magnificent Seven" may find potential in four sectors for 2024. These sectors include real estate, where a decline in interest rates and a slowdown in construction could benefit rental housing companies like Invitation Homes and MidAmerica Communities. Basic materials companies, such as FMC, are also poised for growth as they have already gone through the de-stocking process. In the healthcare space, companies like Thermo Fisher Scientific and Zoetis, which provide equipment and treatments, respectively, are expected to benefit from a return in funding. Lastly, traditional players in the semiconductor industry, like Texas Instruments, could see strong demand as they recover from inventory corrections.

Target has recently closed nine stores, including its first store in Manhattan's Harlem neighborhood, citing high levels of theft and safety risks. The closures come as the retailer faces stagnant sales and a series of setbacks. However, Target's Chief Operating Officer, John Mulligan, remains optimistic about the company's growth potential, pointing to previous closures and openings in other markets as evidence that closing stores does not mean the company has run out of room to grow. Target will update investors on its sales trends and efforts to overcome challenges as it reports fiscal third-quarter earnings this week. The company is dealing with softer sales, inventory issues, and losses from theft and organized retail crime. Target's stock performance has also been rocky, and it has struggled to win back shoppers and achieve growth.

Tiffanie Boyd, McDonald's senior vice president and chief people officer for the U.S., advises people to ignore the common career advice of only pursuing jobs they love. She suggests that taking a job offer, even if it's not your dream job, can open doors for your career by providing opportunities to learn new skills, explore new cities, and meet valuable mentors. Boyd recommends making a pros and cons list to evaluate job offers based on the potential for personal growth and alignment with long-term career goals. However, if a job offer poses significant risks to finances, relationships, or mental health, it's not worth pursuing.

Arm Holdings and Nvidia, two chip stocks with strong competitive advantages, have seen their stock prices soar. However, both stocks are currently overvalued and do not justify their high valuations. Arm Holdings, despite its dominance in the smartphone market, is not experiencing significant growth and is facing challenges due to the downturn in the smartphone market. While it has growth opportunities in server CPUs and artificial intelligence, these prospects are not compelling enough to justify its current valuation. Nvidia, on the other hand, is benefiting from the demand for AI accelerators, but this boom may not last as the AI market becomes more competitive and the profitability of AI-powered services remains uncertain. With increasing competition and the potential for falling profit margins, Nvidia's current valuation is also questionable.

Kellogg Co. announced that its planned split into two companies, WK Kellogg Co. and Kellanova, is set to be finalized in Q4 2023. WK Kellogg Co. will focus on cereals in North America, while Kellanova will focus on snack foods and growth opportunities in foreign markets. Kellogg's snack food business, including brands like Pringles and Pop-Tarts, generates the majority of the company's revenue. The company aims to increase its global market for its snack business, particularly in emerging markets. Kellogg will keep its plant-based food business, MorningStar Farms, and expects flat sales growth for WK Kellogg Co. due to the decline in cereal consumption in the US. The plant-based meat industry is expected to consolidate, and Kellogg anticipates better days for MorningStar Farms. Food packaging industries may face pressure to improve volume sales as food price inflation levels off in 2024.

Blackstone Inc, a manager of alternative investments, has become the first firm in its industry to reach $1 trillion in assets, achieving its goal three years ahead of schedule. However, the company's second-quarter distributable earnings dropped 39% due to a slump in asset sales. Blackstone's CEO, Stephen Schwarzman, remains optimistic about growth opportunities in private credit, insurance, infrastructure, the energy transition, life sciences, Asia, and wealth management. Despite its growth, Blackstone's size is dwarfed by BlackRock Inc, the world's largest asset manager. Blackstone's focus on alternative assets limits its customer base, but these investments are typically more lucrative. The company is also partnering with banks to expand lending areas.

Apple CEO Tim Cook is betting on emerging markets like India to provide more opportunities for growth, with their youthful populations and relatively few iPhones. Apple recently opened its first two retail stores in India and set a quarterly record with strong double-digit year-over-year growth. Selling an iPhone in an emerging market represents the chance to get consumers hooked on Apple devices and services over time. Cook sees opportunities for Apple in India in services but said that average revenue per user would take time to catch up to Apple's other markets.

Visa reported better-than-expected Q2 earnings, with payment volumes rising 10% and cross-border volume (excluding Europe) increasing 32%. CEO Ryan McInerney expressed confidence in sustained growth for Visa's payments business, despite a decline in growth rates from a year ago. The company's shares rose 2.4% in after-hours trading.