"Ark CEO Cathie Wood's Strategy for Avoiding Overheated Chip Stocks and the Arm IPO Frenzy"

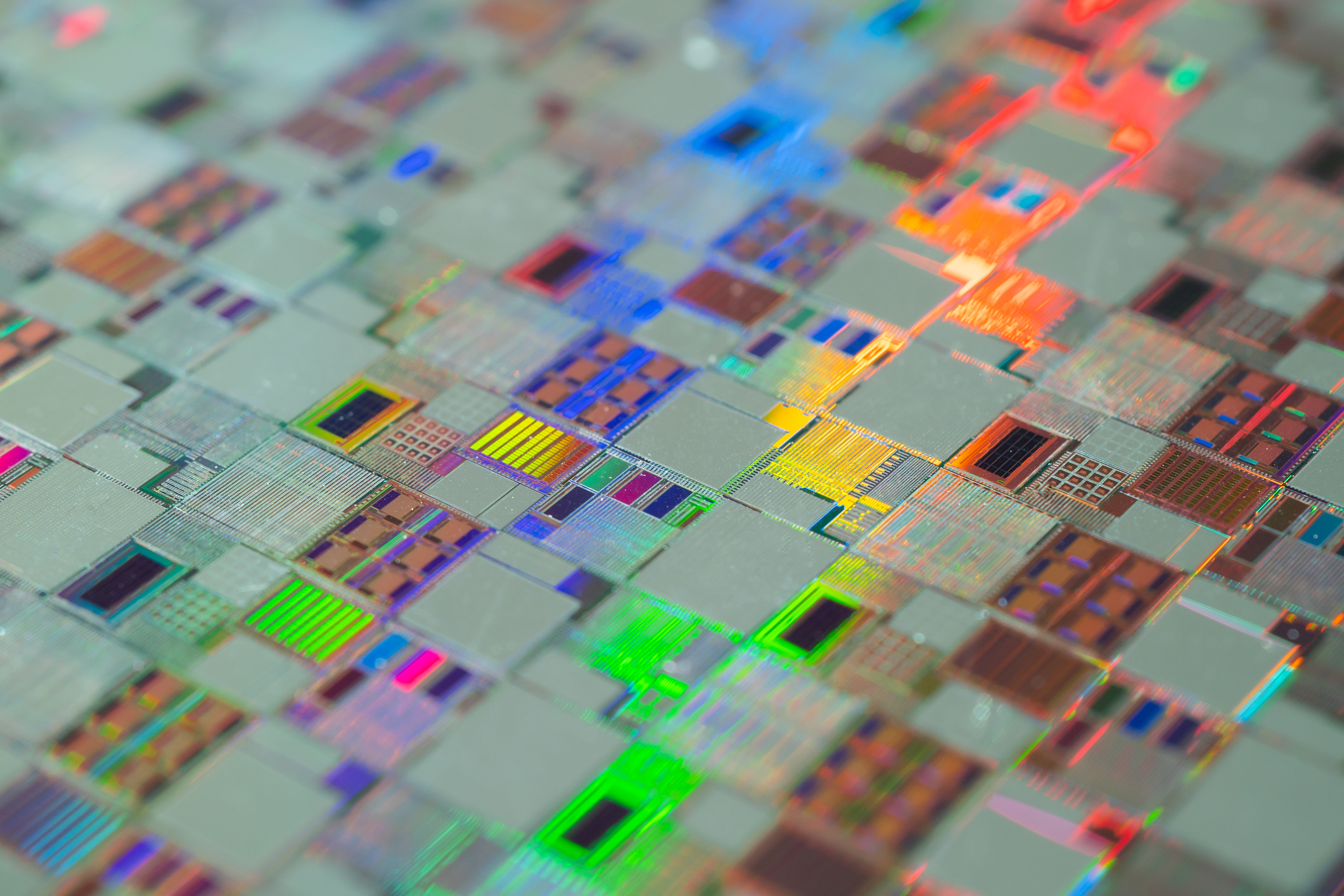

Arm Holdings and Nvidia, two chip stocks with strong competitive advantages, have seen their stock prices soar. However, both stocks are currently overvalued and do not justify their high valuations. Arm Holdings, despite its dominance in the smartphone market, is not experiencing significant growth and is facing challenges due to the downturn in the smartphone market. While it has growth opportunities in server CPUs and artificial intelligence, these prospects are not compelling enough to justify its current valuation. Nvidia, on the other hand, is benefiting from the demand for AI accelerators, but this boom may not last as the AI market becomes more competitive and the profitability of AI-powered services remains uncertain. With increasing competition and the potential for falling profit margins, Nvidia's current valuation is also questionable.

- 2 Overheated Chip Stocks to Avoid at All Costs The Motley Fool

- Ark CEO Cathie Wood says she avoided the Arm IPO frenzy. Here's why CNBC

- Arm Holdings shares extend declines, down fourth session in a row Reuters.com

- Chip Designer Arm Committed to China, CEO Says Caixin Global

- ARM: The Biggest IPO of 2023 GuruFocus.com

Reading Insights

0

2

4 min

vs 5 min read

85%

840 → 128 words

Want the full story? Read the original article

Read on The Motley Fool